Top Rental Property Markets 2024 for Long-Term Wealth

Category: Real Estate Investing

Discover the Best Rental Property Markets for 2024

If you're an aspiring or seasoned real estate investor searching for the best rental property markets in 2024, you've landed in the right place. Navigating the ever-changing landscape of residential and commercial real estate can be daunting, especially with so many market variables influencing cash flow, appreciation, and tenant demand. Whether you're focused on maximizing rental yields or building a diversified portfolio for sustained long-term wealth, identifying the right market is critical to your success.

This guide is crafted precisely for investors like you who want more than just generic lists or outdated data. You'll find actionable insights on emerging cities with economic growth, demographic trends, and market dynamics designed to help you make confident investment decisions. Our clear, practical approach evaluates markets not just by headline affordability but by real metrics such as rent-to-price ratios, vacancy rates, and job growth.

By the end, you’ll understand which markets stand out in 2024, why they matter for both residential and commercial rental investments, and how to align market selection with your financial goals. Keep reading to pinpoint your next smart investment location, optimize your property strategy, and build lasting wealth through real estate.

- Discover the Best Rental Property Markets for 2024

- Understanding Key Metrics for Evaluating Rental Property Markets in 2024

- Top Residential Rental Markets of 2024

- Emerging Commercial Rental Markets: Where to Find Strong Cash Flow and Growth Potential

- Impact of Demographics and Migration Trends on Rental Market Opportunities

- Evaluating Economic Indicators that Predict Rental Market Performance

- Balancing Cash Flow vs. Appreciation: Tailoring Market Choices to Your Investment Strategy and Risk Tolerance

- Legal and Regulatory Considerations in Top Rental Property Markets for 2024

- Tips for Due Diligence and Local Market Research: Leveraging Data, Agents, and Online Tools to Validate Market Potential

- How Technology and Remote Work Trends Influence 2024 Rental Property Markets

- Building a Diversified Rental Portfolio Across Multiple Markets: Geographic Spread Benefits and Risk Management Strategies

Understanding Key Metrics for Evaluating Rental Property Markets in 2024

To confidently identify the best rental property markets in 2024, mastering the key metrics that drive investment performance is essential. These metrics reveal not just where prices are today, but where rents, values, and tenant demand are headed—critical factors for sustained cash flow and long-term wealth building. Here’s what every real estate investor must analyze before committing capital:

-

Rent Yield (Cap Rate): This metric measures the annual rental income relative to the property’s purchase price. A higher rent yield indicates stronger cash flow potential and quicker return on investment. In 2024, look for markets with healthy rent-to-price ratios that outperform national averages, reflecting both affordability and rental demand.

-

Appreciation Potential: While cash flow is vital, property value growth drives wealth accumulation over time. Evaluate historical price trends alongside economic forecasts to identify markets with sustainable appreciation fueled by population growth, infrastructure development, and urban revitalization.

-

Vacancy Rates: Low vacancy rates signify robust tenant demand and market stability. High or rising vacancies can erode rental income, increase maintenance costs, and signal oversupply or economic weakness. Target markets with tightening rental inventories and consistent occupancy above 90%.

-

Employment Growth: Job creation is a leading indicator of rental demand and market resilience. Strong employment growth, particularly in sectors like technology, healthcare, and manufacturing, attracts renters and supports rising wages, which boosts rent affordability and increases investor confidence.

-

Tenant Demand and Demographics: Understanding renter profiles—whether millennials, families, or commercial tenants—helps tailor your investment strategy. Markets with growing populations, increasing home rental preferences, and favorable income levels typically offer stronger, more stable rental demand.

By systematically evaluating these five critical metrics, investors can pinpoint rental property markets poised for superior performance in 2024 and beyond. Combining quantitative data with qualitative insights ensures your investment decisions align with both current realities and future trends, maximizing returns while minimizing risk.

Image courtesy of Jakub Zerdzicki

Top Residential Rental Markets of 2024

Choosing the best residential rental markets in 2024 means balancing affordability, strong rental income, and healthy economic conditions—all of which are critical for maximizing cash flow and long-term property appreciation. Based on these essential investment criteria, several cities and states consistently rise to the top as ideal locations for residential rental property investors. These markets demonstrate compelling rent-to-price ratios, robust job growth, and population influxes that drive sustained tenant demand.

Leading Cities to Watch in 2024

-

Atlanta, Georgia

Atlanta remains a powerhouse with its affordable housing prices paired with rising rents. The city’s diverse economy—spanning technology, film production, and logistics—supports steady employment growth and a growing millennial population seeking rental homes. Atlanta’s vacancy rates hover around a healthy 6%, while average rent yields range between 6-8%, making it a prime target for both cash flow and appreciation-focused investors. -

Phoenix, Arizona

Phoenix continues its rapid expansion fueled by an influx of new residents from higher-cost states like California. Its strong job market in healthcare and tech sectors, combined with relatively affordable home prices, pushes rental income upward. Investors can expect rent-to-price ratios near or above 7%, with vacancy rates consistently under 5%. These fundamentals signal lucrative opportunities for buy-and-hold strategies. -

Raleigh-Durham, North Carolina

This area benefits from a robust knowledge economy powered by universities and research institutions, attracting young professionals and families alike. Residential properties here feature solid appreciation potential due to ongoing infrastructure projects and an expanding labor force. Rent yields average 5-7%, with particularly strong demand for single-family rentals and townhomes. -

Tampa Bay, Florida

Tampa offers a combination of attractive affordability and surging tenant demand propelled by tourism, healthcare, and finance industries. Its favorable tax environment and steady population growth keep vacancy rates low—often below 5%—while rents have increased by approximately 5% year-over-year. This market is well-suited for investors seeking a mix of stability and growth.

States with Promising Rental Property Conditions

- Texas continues to dominate as a top investment state, boasting multiple cities like Austin, Dallas, and San Antonio with high rent-to-price ratios, flourishing job markets, and expanding populations.

- Florida’s warm climate and no state income tax keep attracting renters and investors alike, especially in cities beyond Tampa including Orlando and Jacksonville.

- Nevada, led by Las Vegas’ recovery and growth in entertainment and tech sectors, presents higher-than-average rental yields and vacancy rates under control.

Investing in these top residential rental markets aligns with data-backed metrics and current economic trends, helping you establish a reliable rental income stream while capturing potential property appreciation in 2024. Prioritizing markets that marry affordability with strong economic fundamentals ensures your portfolio thrives amid evolving market conditions.

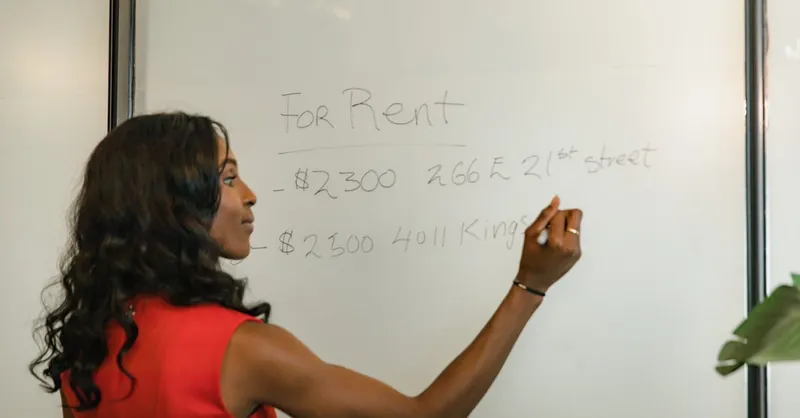

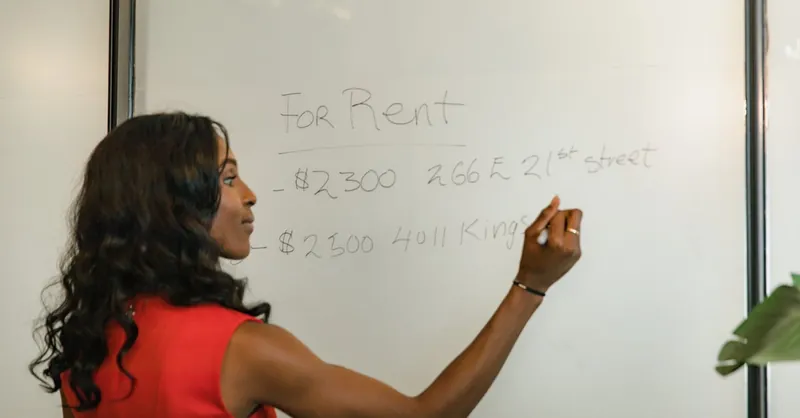

Image courtesy of Andreea Ch

Emerging Commercial Rental Markets: Where to Find Strong Cash Flow and Growth Potential

As the commercial real estate sector evolves in 2024, savvy investors are increasingly drawn to emerging commercial rental markets that offer a rare blend of healthy cash flow and appreciation upside. Unlike traditional gateway cities where prices have surged, these emerging markets provide greater entry affordability combined with promising economic drivers, making them ideal for both new and seasoned investors seeking to diversify their portfolios beyond residential assets.

Key factors distinguishing these high-potential commercial markets include:

- Robust local job growth in key industries such as tech hubs, healthcare services, logistics, and renewable energy, which fuel demand for office, industrial, and retail space.

- Supply-constrained environments where new commercial developments lag behind tenant absorption rates, pushing rents upward and limiting vacancy rates.

- Favorable demographic shifts, including population influxes of millennials and remote workers who contribute to demand for flexible office environments and mixed-use commercial properties.

- Emerging infrastructure and transit projects that improve accessibility and enhance long-term asset value.

Markets worth watching for commercial rental investors in 2024 include secondary metros and Sun Belt cities such as Nashville, Tennessee; Raleigh, North Carolina; Austin, Texas; and Salt Lake City, Utah. These metros typically report industrial and office cap rates several percentage points higher than mature markets, offering strong initial yields with upside driven by continued economic expansion and urban revitalization.

Investors focusing on commercial rental properties in these emerging markets should prioritize:

- Industrial warehouses and distribution centers benefiting from ecommerce growth and supply chain re-shoring.

- Creative office spaces and coworking hubs catering to startups and remote professionals.

- Neighborhood retail and mixed-use developments anchored by local services and experiential businesses.

By targeting emerging commercial rental markets with the right fundamentals—employment growth, vacancy compression, and tenant diversity—investors can position themselves to capture sustained cash flow alongside long-term appreciation, fueling portfolio growth well beyond typical residential income streams. This strategic approach complements residential holdings, balancing risk while expanding wealth-building opportunities in 2024’s dynamic real estate landscape.

Image courtesy of Andy Coffie

Impact of Demographics and Migration Trends on Rental Market Opportunities

Understanding how population shifts and demographic changes influence rental market demand is crucial for identifying the best rental property markets in 2024. Migration trends—both domestic and international—along with generational housing preferences, directly shape tenant pools, rental rates, and vacancy dynamics. Savvy investors who anticipate these patterns position themselves to capitalize on sustained rental demand and market resilience.

The Role of Migration in Shaping Rental Demand

In 2024, interstate migration continues to drive rental housing needs in key Sun Belt and emerging metro areas. Factors such as affordability, climate, job availability, and quality of life motivate renters to relocate from high-cost urban centers to more affordable, opportunity-rich cities. This influx results in:

- Increased renter population growth, particularly in cities like Austin, Phoenix, and Tampa, where new residents often choose rentals for flexibility and affordability.

- Rising rental rates and compressed vacancy, reflecting heightened competition for limited housing stock.

- Expansion of suburban and exurban rental markets, as millennials and remote workers seek larger, more affordable living spaces outside traditional urban cores.

Simultaneously, international immigration contributes to rental demand in gateway cities with diverse economies such as Atlanta and Dallas. These populations often prefer multi-family and mixed-use developments, supporting sustained growth in those sectors.

Demographic Shifts: Millennials, Gen Z, and Aging Populations

Rental market opportunities also hinge on generational housing trends:

- Millennials and Gen Z renters prioritize walkability, access to jobs, and modern amenities, fueling demand for urban apartments, townhomes, and mixed-use communities. Their growing presence ensures strong tenant turnover and opportunity for rent escalations in dynamic markets.

- Aging populations in many parts of the country are down-sizing or relocating to warmer climates, boosting demand for single-story homes and rental communities with senior-friendly features.

Key Takeaways for Investors

To harness demographic and migration-driven growth, focus on markets exhibiting:

- Net positive migration rates, especially from high-cost, high-tax states to more affordable Sun Belt or tech-driven metros.

- Diverse renter profiles supporting a mix of residential and commercial rental product types.

- Infrastructure and amenities development aligned with evolving tenant expectations.

Being attuned to how population dynamics influence rental demand empowers investors to anticipate market trends, maintain low vacancy rates, and maximize cash flow — fundamental elements for building lasting wealth through rental property investing in 2024 and beyond.

Image courtesy of RDNE Stock project

Evaluating Economic Indicators that Predict Rental Market Performance

Understanding the underlying economic indicators that drive rental market performance is vital for identifying the best opportunities in 2024. Three critical factors—job growth, industry sector diversification, and infrastructure investments—serve as powerful predictors of sustained rental demand and property value appreciation.

1. Job Growth as a Leading Indicator

Strong and consistent job growth fuels demand for rental properties by attracting new residents who need housing. Markets with expanding employment, especially in well-paying sectors, usually see lower vacancy rates and climbing rents. In 2024, focus on cities and metro areas where:

- Employment growth outpaces the national average, signaling economic vitality.

- Key industries such as technology, healthcare, manufacturing, and logistics are expanding.

- The unemployment rate is declining or stable, reflecting resilient local economies.

These indicators often correlate directly with rising rental incomes and lower risk of market downturns, making job growth one of the most reliable metrics for rental market strength.

2. Industry Sector Diversification Reduces Risk

Markets dependent on a single industry are vulnerable to economic shocks, which can abruptly reduce rental demand and lead to vacancy spikes. Conversely, diversified economies benefit from multiple thriving sectors providing employment stability. Look for rental markets where diverse industries—such as finance, tech, healthcare, education, and manufacturing—coexist and collectively drive population growth and income levels. This diversification:

- Stabilizes tenant demand across economic cycles.

- Supports varied renter demographics, including professionals, families, and commercial tenants.

- Enhances potential for long-term rental income growth and property appreciation.

3. Infrastructure Investments Boost Long-Term Market Appeal

Infrastructure projects—including transportation improvements, airport expansions, road upgrades, and public transit development—enhance a city's accessibility and livability, making it more attractive to both renters and businesses. Markets receiving significant infrastructure investment often experience:

- Increased population and employment due to improved connectivity.

- Revitalization of neighborhoods attracting higher-income tenants.

- Appreciation in property values fueled by enhanced amenities and economic activity.

Investors tracking announced or ongoing infrastructure initiatives can identify emerging rental hotspots poised for growth before prices escalate, capturing greater returns over time.

By thoroughly analyzing these economic indicators, rental property investors can predict market trajectory with greater accuracy, align acquisitions with sustained demand, and ultimately maximize cash flow and portfolio value in 2024’s competitive landscape. Prioritize markets where robust job growth intersects with diverse economies and proactive infrastructure development to build resilient rental holdings capable of delivering long-term wealth.

Image courtesy of RDNE Stock project

Balancing Cash Flow vs. Appreciation: Tailoring Market Choices to Your Investment Strategy and Risk Tolerance

When selecting the best rental property markets in 2024, one of the most crucial decisions investors face is how to balance cash flow and property appreciation based on their individual investment goals and risk tolerance. These two core outcomes often require different market characteristics, and understanding the trade-offs will help you tailor your strategy for sustained long-term wealth building.

Cash Flow-Focused Markets: Steady Income and Lower Risk

Investors prioritizing immediate, consistent rental income should target markets with:

- High rent-to-price ratios ensuring strong monthly cash flow relative to purchase cost.

- Stable or falling vacancy rates that minimize income disruptions.

- Affordable entry prices, often found in secondary or emerging markets.

- Local economies with steady but moderate employment growth, limiting extreme price volatility.

These markets typically offer lower appreciation rates but provide a safer, more predictable income stream ideal for investors who depend on rental cash flow for reinvestment, mortgage coverage, or passive income. Examples include traditionally affordable Sun Belt cities or mid-tier metros where demand remains solid but price growth has already moderated.

Appreciation-Centric Markets: Growth Potential with Elevated Risk

Alternatively, investors with higher risk tolerance and longer time horizons may focus on markets exhibiting:

- Rapid property value growth driven by booming job creation, urban revitalization, or limited housing supply.

- Strong population influx that fuels both rental demand and future price appreciation.

- Typically lower initial rent yields, as higher purchase prices pressure immediate cash flow.

These markets are attractive for investors aiming to build significant equity through appreciation, possibly leveraging value-add strategies or redevelopment opportunities. However, they often come with greater risks including market bubbles, rising vacancy during corrections, and fluctuating rents. Examples include gateway cities experiencing renaissance or dynamic tech hubs expanding rapidly.

Aligning Your Investment Approach

To optimize your rental property investment in 2024:

- Assess your financial goals—is your priority steady cash flow to cover expenses, or long-term capital gains through property appreciation?

- Evaluate your risk tolerance—can you weather market cycles and vacancy risks for higher returns, or do you prefer more predictable income streams?

- Select markets that match your strategy:

- For cash flow, prioritize affordable areas with solid rent yields and stable tenant demand.

- For appreciation, target fast-growing metros with dynamic economies and limited inventory.

Balancing these factors ensures that your choice of rental property markets aligns with your personal investment profile, helping you build a resilient portfolio capable of generating wealth through both income and asset growth in 2024 and beyond.

Image courtesy of Jakub Zerdzicki

Legal and Regulatory Considerations in Top Rental Property Markets for 2024

When evaluating the best rental property markets in 2024, understanding the legal and regulatory landscape is just as crucial as analyzing economic and demographic factors. Local laws—ranging from landlord-tenant regulations to zoning codes—can significantly impact your investment's profitability, operational ease, and long-term value. Likewise, tax incentives and rent control measures vary widely across markets, influencing both cash flow and exit strategies. Here are the key legal and regulatory considerations every rental property investor should master:

1. Landlord-Tenant Laws

Each state and city has its own set of landlord-tenant laws that govern lease agreements, security deposits, eviction procedures, and tenant protections. Markets with investor-friendly policies often feature streamlined eviction processes and flexible lease terms, which reduce risks related to non-paying tenants and prolonged vacancies. Conversely, some regions impose stringent tenant rights that can increase landlord liability and operational complexity. Key points to evaluate include:

- Limits on security deposit amounts and timeframes for returns.

- Restrictions on eviction notices and grounds for eviction.

- Regulations around lease renewals, rent increases, and tenant maintenance responsibilities.

Understanding these laws upfront helps you avoid costly legal disputes and maintain steady cash flow.

2. Rent Control and Rent Stabilization

Rent control policies restrict how much landlords can raise rents annually. While these rules aim to protect tenants from rapid rent hikes, they can severely cap upside potential for investors. Some cities like San Francisco and New York enforce strict rent control, limiting profitability, while many fast-growing Sun Belt markets currently have minimal or no rent control, enhancing growth potential. When selecting markets, consider:

- Whether rent control or rent stabilization laws exist.

- The scope of rent caps and allowable exceptions.

- How rent control policies affect tenant turnover and investment returns.

Opting for markets with balanced tenant protections and landlord flexibility generally optimizes rental income sustainability.

3. Tax Incentives and Property Taxes

Local and state governments may offer tax incentives designed to attract real estate investment or stimulate development, which can improve your property's net yield and long-term value. These include:

- Property tax abatements or freezes for new developments or renovations.

- Tax credits for energy-efficient upgrades or affordable housing projects.

- Favorable depreciation rules and deductions impacting your annual tax filings.

Conversely, markets with excessively high property taxes can erode cash flow. Evaluate effective property tax rates alongside incentives to identify destinations where the tax environment supports rather than hinders rental profitability.

4. Zoning and Land Use Regulations

Zoning codes dictate how land can be utilized, influencing what types of rental properties can be developed or converted in a given area. Understanding zoning restrictions is vital for both residential and commercial investors because:

- Some neighborhoods impose strict limits on property uses—such as prohibiting short-term rentals, multi-family conversions, or mixed-use developments.

- Zoning impacts the feasibility of value-add projects, expansions, or redevelopment.

- Local comprehensive plans and upcoming zoning changes may signal future growth areas or regulatory tightening.

In markets with investor-friendly zoning, you have more flexibility to adapt properties to shifting demand, maximize revenue streams, and enhance property values over time.

Navigating these legal and regulatory factors alongside economic and demographic insights empowers you to invest confidently in rental property markets where operational risks are manageable and growth potential is maximized. By prioritizing markets with clear, balanced landlord-tenant frameworks, competitive tax incentives, minimal rent control constraints, and flexible zoning, you build a foundation for sustainable rental income and long-term wealth generation in 2024 and beyond.

Image courtesy of Ivan Samkov

Tips for Due Diligence and Local Market Research: Leveraging Data, Agents, and Online Tools to Validate Market Potential

Conducting thorough due diligence and comprehensive local market research is non-negotiable when selecting the best rental property markets in 2024. Accurately validating market potential goes beyond headline numbers; it requires integrating multiple information sources and analytical tools to uncover nuanced insights on rental dynamics, economic conditions, and neighborhood trends.

Leverage Local Data Sources for Deeper Market Insights

Start by tapping into granular local data to understand micro-market trends that often dictate rental success. Key data points include:

- Neighborhood-level rent and vacancy statistics — These reveal where tenant demand is strongest and which areas may face oversupply or stagnation.

- Historical and projected employment and population growth — Look beyond citywide averages to specific ZIP codes or districts that are attracting new jobs and residents.

- Rental yield and price appreciation trends over 3-5 years — Identifying consistent patterns helps differentiate sustainable markets from speculative bubbles.

- Local housing supply trends and new construction activity — Monitoring residential and commercial development pipelines signals future inventory pressures or opportunities.

Municipal planning departments, regional housing authorities, and economic development organizations often publish valuable reports and dashboards. Additionally, census data, Bureau of Labor Statistics (BLS), and local MLS platforms provide foundational statistics indispensable for informed analysis.

Collaborate with Experienced Local Real Estate Agents and Property Managers

Establishing partnerships with local real estate professionals is crucial in validating market assumptions and uncovering qualitative factors that data alone may miss. Skilled agents and property managers offer:

- On-the-ground knowledge about tenant demand shifts, rental rate sensitivity, and vacancies.

- Insights into evolving neighborhood desirability driven by schools, retail, transit access, and safety.

- Awareness of upcoming community developments or zoning changes not yet widely publicized.

- Real-time feedback on comparable property performance and tenant screening trends.

Engaging with multiple agents and property management companies across specific submarkets sharpens your competitive edge and fills in research blind spots that internet data and reports cannot fully address.

Utilize Advanced Online Tools and Platforms for Market Validation

In the digital age, a wealth of online real estate analytics platforms and tools complement traditional research methods to enhance market validation:

- Rentometer, Zillow Rental Manager, and Realtor.com: Provide rental comps and vacancy insights tailored to neighborhoods and property types.

- Mashvisor and Roofstock Analytics: Offer detailed investment property metrics including cap rates, cash flow estimates, and neighborhood heatmaps.

- CoStar and LoopNet (for commercial properties): Deliver leasing activity, tenant mix, and market absorption trends critical to commercial rental decisions.

- Google Trends and Social Media Sentiment Analysis: Track local market buzz, migration interest, and community sentiment that may precede market movement.

Combining algorithm-driven data analytics with hands-on local expertise ensures you evaluate rental property markets with precision, confidence, and actionable insight.

In sum, mastering due diligence and local market research in 2024 demands an integrated approach that blends robust local data, professional on-the-ground perspectives, and cutting-edge digital tools. This layered strategy empowers real estate investors to validate true market potential—minimizing risk, maximizing rental income, and capitalizing on appreciation opportunities for successful, long-term wealth creation.

Image courtesy of RDNE Stock project

How Technology and Remote Work Trends Influence 2024 Rental Property Markets

The surge of technology adoption and the continuing evolution of remote work are reshaping rental property markets in 2024, profoundly influencing both buyer and renter preferences as well as unlocking emerging hotspot areas. As more employers embrace flexible work arrangements, tenants are no longer confined to traditional metropolitan job centers, leading to a decentralized demand pattern that investors must recognize to capitalize on growth opportunities.

Shifting Renter Preferences Fuel Market Transformation

Remote work has broadened renter priorities beyond proximity to urban office hubs to focus on livability factors such as affordability, larger living spaces, reliable high-speed internet, and access to outdoor amenities. Key renter preferences driving market shifts include:

- Suburban and exurban demand growth: Many remote workers seek spacious homes with dedicated office areas in suburbs or smaller cities, causing a surge in single-family rental markets outside major metros.

- Preference for tech infrastructure: Reliable broadband connectivity and smart-home features are increasingly important, elevating demand in communities investing in digital infrastructure.

- Desire for mixed-use neighborhoods: Renters want walkable areas with easy access to shops, restaurants, and green spaces, leading to rising interest in emerging urban villages and satellite cities.

Emerging Hotspot Areas Powered by Remote Work Trends

These tech and lifestyle shifts have triggered new rental hotspots outside the traditional “gateway” cities. Investors should watch for markets combining:

- Strong digital infrastructure and innovation ecosystems, even if distant from core tech hubs.

- Affordable housing stock with upgrade potential tailored for remote professionals and families.

- Robust local economies boosting ancillary services supporting a newer remote workforce, such as coworking spaces, fitness centers, and delivery services.

Notable emerging regions benefiting from these trends include smaller metro areas like Boise, Idaho; Chattanooga, Tennessee; and Greenville, South Carolina—all offering attractive rent-to-price ratios, growing populations, and technology-friendly community initiatives. Investing early in these markets allows rental property investors to capture outsized appreciation and rental growth driven by workforce decentralization.

Understanding the interplay between technology adoption, remote work flexibility, and shifting renter behaviors is essential for identifying the best rental property markets in 2024. By targeting markets aligned with these evolving trends, investors can anticipate accelerated demand, optimize rental income streams, and position their portfolios for resilient long-term growth in a rapidly changing real estate landscape.

Image courtesy of Vlada Karpovich

Building a Diversified Rental Portfolio Across Multiple Markets: Geographic Spread Benefits and Risk Management Strategies

In 2024, one of the most effective ways to mitigate risk and maximize long-term wealth through rental property investing is by building a diversified portfolio across multiple geographic markets. Concentrating all your investments in a single city or region can expose you to local economic downturns, regulatory shifts, or natural disasters that disproportionately impact cash flow and asset value. By strategically spreading your rental properties across various markets—in different states or metro areas—you reduce portfolio volatility and enhance overall resilience.

Benefits of Geographic Diversification

- Risk Mitigation: Economic cycles rarely affect all regions simultaneously or equally. When one market faces employment contraction or rising vacancies, others may be stable or expanding, ensuring your rental income remains steady.

- Capitalizing on Varied Market Cycles: Markets differ in their stages of growth or recovery. Diversifying enables you to capture appreciation in booming metros while also securing strong cash flow in affordable secondary cities.

- Access to Multiple Tenant Pools: Different markets attract distinct renter demographics—from young professionals in tech hubs to families in suburban areas—which broadens your tenant diversification and reduces vacancy risks.

- Regulatory and Tax Flexibility: Local landlord-tenant laws, tax structures, and incentives vary widely, so investing beyond a single jurisdiction can optimize your operational efficiency and tax advantages.

Strategic Risk Management Approaches

To successfully manage a geographically diversified rental portfolio, investors should implement key strategies:

- Comprehensive Market Research: Apply consistent due diligence using the key metrics discussed earlier—rent yields, vacancy rates, job growth—to identify complementary markets that align with your investment goals.

- Leverage Local Expertise: Partner with knowledgeable brokers, property managers, and contractors in each location to maintain effective oversight and address unique market conditions quickly.

- Standardized Investment Criteria and Processes: Develop scalable, replicable acquisition, management, and exit strategies to streamline operations across different regions.

- Financial Cushioning and Cash Reserves: Maintain sufficient liquidity to absorb unexpected vacancies, maintenance, or market downturns that may arise asynchronously across markets.

- Use of Technology and Remote Management Tools: Employ property management software and communication platforms to efficiently monitor performance and tenant relations in out-of-area properties.

Embracing geographic diversification in your rental property investments not only spreads risk but also positions your portfolio to benefit from a broader spectrum of economic trends, demographic shifts, and real estate cycles. This multi-market approach is a cornerstone strategy for building sustainable, long-term wealth through real estate in 2024 and beyond.

Image courtesy of Jakub Zerdzicki