Top Benefits of Hiring a Property Manager for Real Estate Wealth

Category: Real Estate Investing

Why Hiring a Property Manager Can Transform Your Rental Investment

If you're a real estate investor—whether just starting out or expanding an established rental portfolio—understanding the true value of hiring a property manager is crucial. You’re likely juggling the challenges of managing tenants, maintenance, legal compliance, and maximizing cash flow—all while trying to build long-term wealth through residential or commercial properties. You came here searching for clarity: what specific benefits does a property manager bring that justify their cost? This post dives beyond generic advice to give you clear, actionable insights tailored to your investor journey. We break down how professional management cuts down your workload, mitigates risks, improves tenant satisfaction, and optimizes your returns. You’ll learn which tasks are best delegated and how this strategic partnership can elevate your asset's performance. Unlike other guides that skim the surface, this article addresses your pain points and growth goals with practical details proven in today’s competitive rental markets. Stick around for a deep yet digestible look at how property management isn’t just a convenience—it can be a game changer for your wealth-building strategy.

- Why Hiring a Property Manager Can Transform Your Rental Investment

- Understanding the Role of a Property Manager

- Time Savings and Stress Reduction

- Expert Tenant Screening and Retention

- Handling Maintenance and Repairs Efficiently

- Navigating Legal Compliance and Risk Mitigation

- Optimizing Rent Collection and Financial Management

- Enhancing Property Marketing to Minimize Vacancy

- Scaling Your Portfolio with Professional Support

- Access to Industry Networks and Technology

- Cost-Benefit Analysis: When Hiring a Property Manager Makes Financial Sense

Understanding the Role of a Property Manager

A property manager acts as the vital link between landlords and tenants, expertly handling the day-to-day operations that keep rental properties running smoothly. Their core responsibilities span a broad range of tasks critical to both residential and commercial real estate investments, ensuring legal compliance, maximizing occupancy, and maintaining property value. For landlords, this means freeing up time and reducing direct involvement in often-complex landlord-tenant dynamics, while for tenants, it translates into consistent communication and swift issue resolution.

Key property management functions include:

- Tenant Screening and Leasing: Property managers perform thorough background checks, verify creditworthiness, and draft lease agreements that comply with current laws—minimizing vacancy risks and tenant turnover.

- Rent Collection and Financial Reporting: They ensure timely rent payments, handle late fees, and provide transparent monthly financial statements that help landlords track ROI efficiently.

- Maintenance and Repairs: Coordinating routine upkeep and emergency repairs through a network of trusted vendors protects the property’s condition and prevents costly damages.

- Legal Compliance and Evictions: Staying updated on landlord-tenant laws, property managers manage lease enforcement and legal processes, including evictions if necessary, mitigating potential liabilities.

- Tenant Relations: Serving as the primary contact, they facilitate prompt communication, foster tenant satisfaction, and improve retention rates—vital for consistent rental income.

In commercial rentals, property managers often handle additional responsibilities such as coordinating with multiple tenants, managing larger maintenance projects, and enforcing complex lease provisions. Their expertise ensures properties operate smoothly, compliance is maintained across diverse regulations, and landlords can focus confidently on expanding their portfolio rather than daily crises. Ultimately, understanding these multi-faceted roles clarifies why hiring a professional property manager is a strategic move for serious investors aiming to grow wealth sustainably.

Image courtesy of Pavel Danilyuk

Time Savings and Stress Reduction

One of the most immediate and tangible benefits of hiring a property manager is the significant time savings and stress reduction that come from offloading day-to-day management responsibilities. Managing rental properties involves constant communication with tenants, handling maintenance requests, navigating legal requirements, and addressing emergencies—tasks that can quickly consume hours each week. By entrusting these operational duties to a professional property manager, investors free themselves from the relentless demands of property oversight and gain valuable time to focus on scaling their portfolio or pursuing personal priorities.

Beyond just saving time, a property manager alleviates the emotional and administrative burden that often comes with landlord duties. Dealing with difficult tenants, late payments, or unexpected repairs can create ongoing stress and distractions. Property managers act as a buffer, professionally resolving conflicts, ensuring prompt rent collection, and coordinating maintenance through reliable vendors. This proactive management fosters tenant satisfaction and prevents small problems from escalating into costly legal or financial headaches. For investors serious about building long-term wealth, delegating daily tasks not only enhances operational efficiency but also supports better decision-making and a healthier work-life balance—key ingredients for sustained success in both residential and commercial real estate investing.

Image courtesy of Timur Weber

Expert Tenant Screening and Retention

One of the most critical ways a professional property manager adds value to your rental investment is through their expert tenant screening and retention strategies. Utilizing robust, multi-layered screening processes, property managers effectively identify quality tenants who are financially responsible, respectful of property rules, and likely to fulfill lease terms long-term. This reduces the risk of costly evictions, late rent payments, and property damage—common pitfalls that can severely impact your cash flow and property condition.

A comprehensive tenant screening typically includes:

- Credit Checks: Assessing financial history to gauge the tenant’s ability to pay rent consistently.

- Background Checks: Verifying criminal history and prior evictions to minimize risk.

- Employment Verification: Confirming stable income sources to ensure sustained rent payments.

- Rental History: Contacting previous landlords to evaluate tenant behavior, lease compliance, and care for property.

Beyond initial screening, professional property managers excel in tenant retention—a key factor in maintaining steady rental income and reducing turnover costs. By fostering good tenant relationships through timely communication, responsive maintenance, and proactive lease renewals, they cultivate tenant satisfaction and loyalty. Lower vacancy rates and decreased turnover mean fewer periods without rental income and reduced expenses on advertising, cleaning, and repairs.

In competitive residential and commercial rental markets, this combination of thorough screening and retention expertise empowers investors to optimize occupancy, protect their investment, and enhance long-term profitability. Hiring a seasoned property manager ensures your property attracts responsible tenants who contribute to building sustainable wealth through reliable, hassle-free rental income.

Image courtesy of Jakub Zerdzicki

Handling Maintenance and Repairs Efficiently

A key advantage of hiring a professional property manager is their ability to handle maintenance and repairs efficiently, which is essential for preserving the long-term value of your rental property. Property managers maintain a proactive approach to upkeep, scheduling routine inspections and preventative maintenance that catch issues before they escalate into costly problems. This strategy not only extends the lifespan of critical building components—such as HVAC systems, plumbing, roofing, and electrical infrastructure—but also safeguards your investment from unexpected deterioration.

Moreover, property managers leverage established relationships with a network of trusted vendors, contractors, and service providers to coordinate timely repairs and maintenance. This vendor management ensures competitive pricing, reliable workmanship, and prompt response times, which are crucial for minimizing downtime and tenant disruption. When emergency repairs arise, a property manager acts as the first responder, organizing immediate solutions that protect the property and tenant safety while minimizing legal and financial risks for landlords. Ultimately, this hands-on, systematized approach to maintenance and repairs not only enhances tenant satisfaction by providing a well-maintained living or working environment but also preserves and enhances your asset’s value—an essential factor in building sustainable, long-term wealth through residential and commercial real estate investment.

Why Proactive Maintenance Matters for Wealth Building

- Prevents small issues from becoming major expenses

- Improves tenant retention by maintaining property appeal

- Keeps properties compliant with safety regulations

- Protects against depreciation and preserves market value

By entrusting these responsibilities to a skilled property manager, landlords avoid costly delays and reduce the risks of property damage, vacancies, and legal complications, all of which can erode your rental income and wealth-building potential. Efficient maintenance management is not just routine work—it’s a strategic investment in your property’s profitability and longevity.

Image courtesy of Andrea Piacquadio

Navigating Legal Compliance and Risk Mitigation

One of the most valuable yet often overlooked benefits of hiring a professional property manager is their expertise in navigating the complex landscape of legal compliance and risk mitigation. Rental property investors face an ever-changing array of landlord-tenant laws, fair housing regulations, lease agreement requirements, and eviction procedures that can vary widely by jurisdiction. A seasoned property manager ensures your investment remains fully compliant with all relevant laws, reducing the risk of costly lawsuits, fines, and delayed evictions that could diminish your rental income and damage your reputation as a landlord.

Expertise in Landlord-Tenant Laws and Lease Agreements

Property managers possess in-depth knowledge of federal, state, and local landlord-tenant laws. This enables them to draft and enforce legally sound lease agreements tailored to protect your interests while maintaining fairness and transparency with tenants. Proper lease formulation includes clear terms related to rent payment, maintenance responsibilities, security deposits, and tenant conduct, which help avoid misunderstandings and disputes down the line.

Streamlined and Fair Eviction Processes

When problematic tenants arise, handling evictions improperly can lead to lengthy legal battles and lost rental income. Experienced property managers streamline the eviction process by:

- Ensuring all breach notices comply with statutory requirements

- Filing eviction paperwork with precision and timeliness

- Coordinating court appearances and enforcement actions professionally

Their thorough approach minimizes legal exposure while expediting tenant removal when necessary, protecting your cash flow and property condition.

Risk Mitigation Beyond Legalities

In addition to compliance, property managers proactively mitigate risks by implementing policies for tenant screening, property inspections, and maintenance schedules—all of which reduce the likelihood of liability claims related to unsafe living conditions or negligent management. This comprehensive risk management strategy not only secures your assets but also fosters tenant confidence, vital for attracting and retaining reliable renters.

By entrusting legal compliance and risk management to a knowledgeable property manager, rental investors safeguard their investments against regulatory pitfalls and operational hazards—paving the way for stable, long-term wealth building in both residential and commercial real estate markets.

Image courtesy of Artful Homes

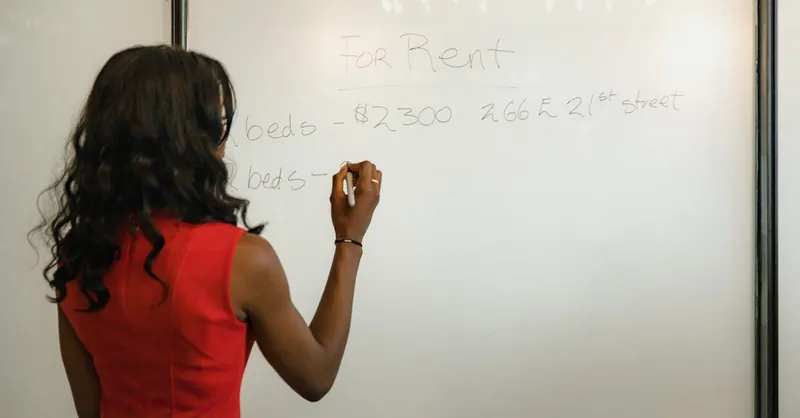

Optimizing Rent Collection and Financial Management

A cornerstone benefit of hiring a professional property manager is the significant improvement in rent collection consistency and the streamlining of financial management—both critical factors for maintaining healthy cash flow and maximizing your rental property's profitability. Property managers implement proven systems for timely rent collection, reducing late payments and minimizing rent arrears. Their expertise ensures that rent is collected in accordance with lease terms and local laws, handling all payment processing with accuracy and security, which enhances your income reliability and reduces financial stress.

In addition to rent collection, property managers provide comprehensive accounting and financial reporting services that give landlords clear insights into their rental portfolio’s performance. Monthly statements typically include detailed breakdowns of income, expenses, maintenance costs, and reserve funds, allowing investors to track their return on investment (ROI) effectively. This level of financial transparency and organization simplifies tax preparation and budgeting, and supports informed decision-making for future property acquisitions or improvements.

Key Financial Benefits of Professional Property Management:

- Consistent and Timely Rent Collection: Automated reminders and follow-ups help reduce late payments.

- Accurate Expense Tracking: All property-related expenses—from repairs to utilities—are documented systematically.

- Clear Financial Reporting: Landlords receive regular, easy-to-understand reports detailing cash flow and net income.

- Budget Management: Property managers assist with forecasting and controlling operating costs to optimize profit margins.

- Tax Preparation Support: Organized financial records streamline annual tax filings and potential audits.

By entrusting your rent collection and financial oversight to a skilled property manager, you gain not only peace of mind but also a powerful tool for sustaining positive cash flow, reducing accounting errors, and maximizing rental income stability—all essential components in building long-term wealth through residential and commercial real estate investments.

Image courtesy of Jakub Zerdzicki

Enhancing Property Marketing to Minimize Vacancy

One of the most powerful ways a professional property manager adds value to your rental investment is through aggressive, targeted marketing strategies designed to minimize vacancy periods and maintain consistently high occupancy rates. Property managers understand that every day a unit sits empty translates into lost rental income, so they deploy a combination of proven marketing tactics and industry expertise to attract qualified tenants quickly and efficiently.

Key Marketing Strategies Used by Property Managers

-

Multi-Channel Advertising: Property managers list vacancies across multiple online platforms including popular rental websites, social media channels, and local listing services, maximizing visibility to diverse tenant pools. This multi-faceted approach ensures properties stand out in competitive markets for both residential and commercial rentals.

-

Professional Photography and Virtual Tours: High-quality photos and virtual walk-throughs showcase your property’s best features, making listings more appealing and engaging to prospective tenants. These visual assets significantly increase inquiry rates and lead to faster tenant placement.

-

Compelling Listing Descriptions: Crafting clear, SEO-optimized, and benefit-focused property descriptions helps attract tenants who are searching for specific amenities, location benefits, or lease terms. Skilled property managers know how to highlight unique selling points that resonate with target markets.

-

Prompt and Professional Lead Follow-Up: Maintaining quick response times to inquiries and scheduling viewings efficiently prevents potential renters from moving on to competing properties. Property managers often have dedicated leasing teams that nurture leads professionally and maintain tenant interest throughout the application process.

-

Pricing Strategy Optimization: Experienced property managers conduct comprehensive market analyses and use dynamic pricing techniques to set competitive yet profitable rent rates. This strategy balances attracting tenants without leaving rental income unrealized due to underpricing.

By employing these strategic marketing methods, property managers reduce vacancy durations, increase tenant demand, and ensure your rental property remains a desirable choice in the marketplace. This aggressive approach not only stabilizes cash flow but also contributes directly to building long-term wealth by maximizing rental income potential over time.

Image courtesy of Kampus Production

Scaling Your Portfolio with Professional Support

As you expand your real estate holdings, managing multiple rental properties simultaneously can become overwhelming without dedicated support. This is where hiring a professional property manager proves invaluable—investors leverage their expertise and systems to handle numerous properties seamlessly, enabling efficient and scalable portfolio growth. With a property manager in place, you avoid the pitfalls of fragmented management, inconsistent tenant communications, and missed maintenance issues that frequently accompany multi-property ownership.

Key ways property managers empower investors to scale include:

-

Centralized Operations: Property managers consolidate tenant screening, rent collection, maintenance coordination, and legal compliance across all properties, streamlining workflows and reducing administrative complexity. This centralization enables investors to oversee their entire portfolio without becoming bogged down in each property's unique demands.

-

Technology and Reporting: Professional property management firms utilize advanced software platforms that automate rent processing, track maintenance tickets, and generate comprehensive financial reports. This transparency and efficiency provide investors with real-time insights necessary for strategic decision-making and portfolio optimization.

-

Consistent Tenant Experience: By applying standardized tenant screening, leasing, and communication protocols across all properties, property managers enhance tenant satisfaction and retention rates portfolio-wide. High occupancy and reduced turnover amplify rental income stability, which is critical as your investment scale increases.

-

Vendor Network Leverage: Managing multiple properties requires timely and cost-effective maintenance solutions. Property managers capitalize on bulk service agreements and established relationships with contractors, delivering reliable repairs at competitive prices while minimizing downtime.

-

Compliance Across Jurisdictions: For investors operating in multiple locations, navigating varying legal requirements can be daunting. Experienced property managers ensure each property remains compliant with local landlord-tenant laws, safety codes, and taxation rules, mitigating risks associated with multi-market management.

By outsourcing operational responsibilities to a seasoned property manager, investors free up valuable time and mental bandwidth to focus on sourcing new acquisitions, analyzing market opportunities, and refining their long-term wealth-building strategy. Ultimately, professional property management is not just a support function—it is a strategic enabler that transforms a collection of rental units into a cohesive, scalable investment portfolio delivering sustainable cash flow and appreciation over time.

Image courtesy of RDNE Stock project

Access to Industry Networks and Technology

One of the often underappreciated but highly impactful benefits of hiring a professional property manager is their access to extensive industry networks and cutting-edge technology platforms. Experienced managers maintain strong relationships with a reliable pool of vendors, contractors, inspectors, and service providers—connections that individual landlords typically take years to build. This network enables property managers to source trusted professionals who provide quality work at competitive rates, ensuring maintenance and repairs are completed efficiently without compromising standards. Leveraging these relationships also means faster response times and priority scheduling, which directly improves tenant satisfaction and reduces property downtime.

In addition to vendor networks, property managers use modern property management software and technology tools that streamline operations, automate routine tasks, and enhance communication. These platforms facilitate:

- Online rent collection and payment processing to improve timeliness and convenience.

- Automated maintenance request tracking that connects tenants directly with approved service providers.

- Digital lease signing and document storage for compliance and ease of access.

- Real-time financial reporting and analytics that give investors instant insight into property performance.

- Marketing automation tools that expedite tenant placement and vacancy reduction.

By integrating robust technology solutions with their professional networks, property managers optimize every facet of rental property operations—delivering higher efficiency, cost savings, and enhanced tenant experiences. For rental property investors, this means leveraging resources and tools that support sustainable growth and long-term wealth, all without the steep learning curve or operational headaches of managing these relationships and technologies independently.

Image courtesy of panumas nikhomkhai

Cost-Benefit Analysis: When Hiring a Property Manager Makes Financial Sense

For rental property investors aiming to build long-term wealth, the decision to hire a property manager hinges on a clear cost-benefit analysis that balances management fees against the financial and operational advantages gained. While property management typically costs between 8% to 12% of monthly rental income, there are specific scenarios where investing in professional management delivers a strong return on investment (ROI) by increasing revenue, reducing expenses, and protecting asset value.

When the Benefits Outweigh Management Fees

-

Multiple Properties or Larger Portfolios

Managing several units or commercial spaces intensifies the workload and complexity, making it impractical to handle operations solo. Hiring a property manager becomes cost-effective as their systems and vendor networks generate economies of scale, minimizing vacancies and maximizing overall cash flow. -

Investor Time Constraints

If your schedule limits direct involvement—due to a full-time job, family commitments, or geographic distance—outsourcing daily management tasks reduces costly mistakes, tenant churn, and delayed maintenance that can erode profitability. -

High Vacancy or Poor Tenant Quality

Properties struggling with frequent vacancies or problem tenants benefit from a professional’s tenant screening and aggressive marketing capabilities, turning units faster and maintaining steady rental income despite management fees. -

Complex or Commercial Properties

Commercial leases involve sophisticated negotiations, maintenance obligations, and regulatory compliance. Professional management protects assets from legal risks and maximizes rent through expert lease enforcement and tenant relations. -

Need for Financial and Legal Protection

Property managers mitigate risks associated with legal compliance, eviction processes, and financial management—areas where inexperience can lead to costly penalties or lost income, justifying the marginal cost of professional oversight.

Quantifying ROI from Property Management

- Increased Rental Income: Experienced managers optimize rent pricing and reduce vacancy, often offsetting fees with higher net rents.

- Reduced Expenses: Established vendor relationships and preventative maintenance programs lower repair costs and emergency expenses.

- Minimized Legal and Financial Risks: Avoiding fines, lawsuits, and evictions protects rental income and property value from erosion.

- Time Reclamation: Freed time enables investors to focus on scaling profits or acquiring new assets, delivering indirect financial benefits.

By carefully evaluating your investment goals, property characteristics, and personal bandwidth, you can identify the tipping points where hiring a property manager not only covers their fees but drives greater profitability and long-term wealth growth in your rental real estate portfolio. In many cases, the incremental cost translates into smoother operations and higher net returns—key elements in mastering rental property investing.

Image courtesy of Jakub Zerdzicki