Top Property Management Tips for Landlords to Build Wealth

Category: Real Estate Investing

Master Property Management to Grow Your Rental Wealth

As an aspiring or current real estate investor, you already know that smart property management is crucial to maximizing your rental income and preserving your long-term wealth. You’ve searched for practical, actionable property management tips for landlords because juggling tenants, maintenance, and legal responsibilities can be overwhelming and time-consuming. Without a proven system, costly mistakes and stress can eat into your returns.

This guide cuts through the noise with clear, expert strategies tailored to both residential and commercial property owners aiming for consistent profitability and hassle reduction. Unlike generic advice, this post dives deep into optimizing tenant screening, maintenance plans, rent collection, legal compliance, and technology integration—the exact pain points you face daily.

Whether you’re self-managing your first duplex or overseeing a commercial portfolio, these tips offer a step-by-step roadmap to streamline operations, protect your investment, and build sustainable cash flow. We'll also highlight modern tools and best practices proven to save time and boost tenant satisfaction. Read on for the essential tactics that separate successful landlords from those stuck in costly pitfalls.

- Master Property Management to Grow Your Rental Wealth

- Understanding Your Legal Responsibilities as a Landlord

- Effective Tenant Screening and Selection

- Creating Clear, Comprehensive Lease Agreements

- Efficient Rent Collection and Financial Tracking

- Proactive Maintenance and Property Inspections: Preserving Value and Preventing Costly Repairs

- Leveraging Property Management Software and Tools

- Setting Up a Reliable Vendor and Contractor Network

- Handling Tenant Communication and Conflict Resolution

- Optimizing Marketing and Vacancy Management

- Planning for Long-Term Financial Success: Monitoring Cash Flow, Capital Expenditures, Tax Strategies, and Portfolio Diversification

Understanding Your Legal Responsibilities as a Landlord

Navigating the complex legal landscape is essential to safeguarding your rental business and avoiding costly disputes. As a landlord, you must stay informed about key compliance areas, including tenant rights, eviction laws, and safety regulations. Familiarizing yourself with these not only protects your investment but also fosters positive tenant relationships, which directly impacts tenant retention and your long-term cash flow.

Tenant Rights: Respect and Compliance

Every jurisdiction enforces specific tenant protections that landlords must honor. These often include:

- Fair housing laws that prohibit discrimination based on race, gender, disability, or family status.

- Privacy rights, limiting landlords’ entry into the property without proper notice.

- Proper handling of security deposits, including clear documentation and timely returns.

Failing to uphold tenant rights can lead to legal action and penalties. Make it a priority to review local landlord-tenant laws regularly and incorporate clear clauses in your lease agreements.

Eviction Laws: Following the Proper Process

Evictions are a last resort, but when necessary, must be conducted strictly according to state and local regulations. Key legal steps include:

- Providing written notice specifying the reason for eviction and the time to remedy or vacate.

- Filing eviction proceedings through the court system.

- Avoiding illegal eviction tactics such as lockouts or utility shutoffs.

Missteps in eviction procedures can result in dismissed cases and potential liability, so understanding the process in your area is critical.

Safety Regulations: Protecting Tenants and Your Property

Compliance with safety standards is not optional. You need to ensure your property meets all relevant codes, such as:

- Functioning smoke and carbon monoxide detectors.

- Safe electrical and gas systems.

- Accessibility standards as applicable.

- Regular fire safety inspections.

Ignoring these can lead to fines, tenant harm, and legal exposure. Maintaining a checklist and scheduling routine inspections helps you stay compliant and ensures tenant well-being.

Mastering these legal obligations is foundational in building a professional, trustworthy rental portfolio. When combined with strategic property management, it solidifies your path toward consistent rental income and growing real estate wealth.

Image courtesy of Artful Homes

Effective Tenant Screening and Selection

One of the most critical factors in successful property management is selecting reliable tenants who pay rent on time and respect your property. Effective tenant screening minimizes vacancy rates and reduces costly payment issues, ensuring steady cash flow and protecting your investment from damage or legal troubles. Implementing a thorough tenant screening process is not just good practice—it’s essential for long-term rental success.

Strategies for Thorough Background Checks and Credit Assessments

Start with a comprehensive background check, which should include:

- Credit Reports: Evaluate the prospective tenant’s financial responsibility by reviewing their credit score and history. A strong credit score typically indicates timely bill payment habits and lower financial risk.

- Criminal Background Checks: Screen for any past convictions that could compromise the safety or security of your property and existing tenants. Tailor your policies to comply with fair housing laws while protecting your investment.

- Employment and Income Verification: Confirm stable employment and sufficient income to cover rent. As a general guideline, monthly rent should not exceed 30-35% of the tenant’s monthly gross income.

- Rental History: Contact previous landlords to assess the tenant’s behavior, including rent payment punctuality, property upkeep, and any eviction history.

Choosing Reliable Tenants to Minimize Vacancy and Payment Issues

Beyond the numbers, red flags such as frequent moves, inconsistent employment, or negative landlord references should prompt caution. In addition to detailed screening:

- Require a completed rental application with all relevant personal and financial information.

- Conduct an in-person or virtual interview to gauge tenant communication and responsibility.

- Use leasing agreements that clearly outline tenant obligations, payment terms, and consequences for breaches.

By investing time upfront in careful tenant selection, you significantly decrease the risk of late payments, property damage, and lengthy vacancies—protecting your rental income and enhancing your portfolio’s overall profitability. Integrating these best practices into your property management routine helps build a stable, trustworthy tenant base that supports long-term wealth building in residential and commercial real estate.

Image courtesy of Ivan Samkov

Creating Clear, Comprehensive Lease Agreements

A well-crafted lease agreement is the cornerstone of effective property management and tenant relations. It sets clear expectations, defines the rights and responsibilities of both parties, and provides a legal framework to address issues before they escalate into costly disputes. For landlords focused on building long-term wealth, investing time in detailed, tailored lease agreements is essential to protect your rental income and property value.

Must-Have Lease Clauses to Protect Your Investment

To create a lease agreement that withstands scrutiny and prevents misunderstandings, it must include several critical clauses:

- Term and Rent Details: Specify lease duration, rent amount, due date, acceptable payment methods, late fees, and any grace periods.

- Security Deposit Terms: Outline the amount, purpose, conditions for withholding, and timeline for return in compliance with local laws.

- Maintenance and Repairs: Clearly describe tenant responsibilities versus landlord obligations for upkeep and damage repairs.

- Occupancy Limits: Define maximum number of occupants to avoid overcrowding and potential code violations.

- Use of Property and Restrictions: Address permitted uses (residential or commercial), pet policies, smoking rules, and noise restrictions.

- Entry and Inspection Rights: Establish how and when the landlord can access the property, respecting tenant privacy.

- Renewal and Termination: Detail procedures for lease renewal, notice periods for termination, and conditions for eviction.

- Dispute Resolution: Include arbitration or mediation clauses as alternatives to costly court disputes.

- Legal Compliance: Incorporate acknowledgment that tenants must comply with all applicable laws, regulations, and community rules.

Customization Tips for Different Property Types and Markets

Generic lease templates may save time initially but often miss nuances relevant to your specific property type or local market. Consider the following customization strategies:

- Residential vs. Commercial Leases: Commercial leases often require more detailed provisions around tenant improvements, liability, and operating expenses; tailor clauses accordingly.

- Local Law Adaptations: State and municipal regulations vary widely—ensure your lease reflects current landlord-tenant laws and any rent control ordinances.

- Market-Driven Terms: In competitive rental markets, flexibility on renewal options or pet policies might attract high-quality tenants, while in slower markets, stricter policies help protect your investment.

- Technology Integration: Specify digital payment platforms, electronic communication, and virtual inspection protocols if you use proptech solutions.

The Importance of Detailed Agreements to Avoid Disputes

Disputes often arise from vague or missing lease terms. A comprehensive and clear lease agreement reduces ambiguity, minimizes tenant-landlord conflicts, and simplifies enforcement. When tenants understand their obligations and consequences upfront, compliance improves and enforcement becomes less contentious.

Moreover, a solid lease equips landlords with a legally enforceable document should eviction or legal action become necessary. It also speeds resolution by serving as an authoritative reference during disagreements, making detailed documentation one of the best property management defenses you can employ.

Focusing on creating and regularly updating your lease agreements to reflect evolving laws, market conditions, and property-specific specifics will save you time, money, and stress—ultimately supporting your goal to build lasting real estate wealth with confidence.

Image courtesy of Artful Homes

Efficient Rent Collection and Financial Tracking

Maintaining efficient rent collection processes and meticulous financial tracking systems is essential for landlords aiming to maximize cash flow and reduce administrative headaches. Implementing structured, reliable methods to ensure on-time rent payments helps prevent income interruptions and supports the smooth operation of your rental business.

Best Practices for On-Time Rent Payment Systems

To encourage punctual rent payments, establish clear and consistent policies in your lease agreement, including:

- Defined Due Dates and Grace Periods: Set specific rent due dates with reasonable grace periods to accommodate minor delays without confusion.

- Late Payment Penalties: Clearly outline late fees and consequences to incentivize timely payments and protect your revenue.

- Multiple Payment Options: Offer tenants convenience through various payment methods such as online portals, automatic bank transfers, mobile apps, or traditional checks. This flexibility significantly reduces barriers to timely payment.

Leveraging technology can transform rent collection into a seamless, automated process.

Utilizing Technology for Streamlined Collection and Tracking

Modern property management software and payment platforms offer landlords tools to automate rent collection, send timely reminders, and provide tenants with easy payment access. Benefits include:

- Automatic Payment Reminders: Scheduled notifications reduce forgetfulness and late payments.

- Recurring Payment Setup: Enables tenants to schedule monthly transfers, ensuring on-time rent without manual intervention.

- Real-Time Payment Tracking: Instantly updates rent status, providing landlords with clear visibility over outstanding balances.

- Secure Online Platforms: Minimize risks associated with cash or check payments and improve record accuracy.

Popular solutions such as Buildium, Rentec Direct, and AppFolio integrate these features, helping landlords stay organized across multiple properties.

Handling Late Payments and Minimizing Impact

Despite best efforts, late payments occasionally occur. When this happens:

- Communicate Promptly and Professionally: Reach out immediately after a missed payment with a polite reminder or notice to address the issue before it escalates.

- Enforce Lease Terms Consistently: Apply late fees and consequences as stated in the lease to maintain fairness and deter future delays.

- Offer Solutions Where Appropriate: In cases of temporary hardship, consider flexible payment arrangements or partial payments to retain good tenants while protecting your cash flow.

- Document All Communications: Maintain detailed records of late payment notices and any agreed-upon accommodations for legal protection.

Maintaining Accurate Financial Records for Tax and Performance Tracking

Accurate bookkeeping is critical for managing rental property finances, preparing for taxes, and evaluating investment performance over time. Best practices include:

- Record Rent Payments and Expenses Promptly: Track all incoming rent payments, repair costs, property taxes, insurance, and management fees.

- Separate Accounts: Use dedicated bank accounts for rental income and expenses to simplify accounting.

- Use Property Management Software with Financial Modules: Automate income and expense tracking, generate financial reports, and store important documents securely.

- Regular Reconciliation and Review: Review financial statements monthly or quarterly to catch errors, monitor profitability, and support tax preparation.

By combining clear rent collection policies, leveraging technology, proactive management of late payments, and rigorous financial tracking, landlords can significantly reduce income disruptions and administrative burdens. These strategies not only preserve your rental cash flow but also enhance your ability to build lasting wealth through real estate investments.

Image courtesy of weCare Media

Proactive Maintenance and Property Inspections: Preserving Value and Preventing Costly Repairs

One of the most effective strategies for safeguarding your rental property’s value and minimizing unexpected expenses is implementing a proactive maintenance schedule combined with regular property inspections. Waiting until something breaks or a tenant reports a problem often leads to more extensive damage and costly repairs that could have been prevented through timely intervention. By establishing clear maintenance routines and promptly addressing repair requests, landlords protect their investment and enhance tenant satisfaction—two key drivers of long-term rental success.

Building a Routine Maintenance Schedule

Creating and adhering to a detailed maintenance calendar is essential for both residential and commercial properties. Schedule periodic tasks such as:

- HVAC system servicing at least twice a year to ensure efficient heating and cooling.

- Roof inspections and gutter cleaning annually to prevent water damage.

- Plumbing checks for leaks, fixture integrity, and water pressure.

- Smoke detector and safety equipment testing to comply with legal requirements.

- Exterior upkeep, including landscaping, paint touch-ups, and pest control.

Regular maintenance not only prevents costly emergency repairs but also extends the lifespan of critical building components, preserving your property’s market value.

Handling Repair Requests Promptly and Professionally

Tenants expect timely resolution of maintenance issues, and delays can cause dissatisfaction and even legal liability. Best practices include:

- Establishing a clear, accessible repair request process, ideally integrated with property management software that tracks requests and completion status.

- Prioritizing urgent repairs—such as heating failures, water leaks, or electrical hazards—to mitigate safety risks.

- Communicating transparently with tenants about timelines and progress to maintain trust.

- Documenting all repairs and expenses meticulously for financial tracking and future planning.

Conducting Periodic Property Inspections

In addition to tenant-reported issues, scheduled property inspections are invaluable to detect problems early and enforce lease compliance. Consider:

- Performing move-in and move-out inspections to assess property condition and secure security deposits.

- Scheduling quarterly or biannual inspections to identify maintenance needs, ensure tenant adherence to lease terms, and prevent damage escalation.

- Using detailed inspection checklists covering structural elements, appliances, safety devices, and cleanliness.

Regular inspections help catch minor issues before they worsen, reducing vacancy downtime and expensive restorations. They also encourage tenants to maintain the property responsibly, further protecting your investment’s value.

By prioritizing proactive maintenance and consistent inspections, landlords maintain safer, more attractive rental properties, reduce operational disruptions, and ultimately enhance ROI. Integrating these habits into your property management routine is a cornerstone of building sustainable long-term wealth in rental real estate.

Image courtesy of RDNE Stock project

Leveraging Property Management Software and Tools

In today’s competitive real estate market, leveraging property management software and digital tools is a game-changer for landlords seeking to streamline operations and maximize rental income. These technologies automate routine tasks such as tenant communication, rent collection, maintenance tracking, and document storage, reducing manual workload and minimizing human error. By integrating the right proptech solutions, landlords can enhance efficiency, improve tenant satisfaction, and maintain better control over their residential and commercial rental portfolios.

Top Tools to Automate Communication, Payments, and Maintenance Requests

Modern property management platforms offer comprehensive features designed to automate crucial landlord responsibilities, including:

- Automated Tenant Communication: Tools like Buildium, AppFolio, and TenantCloud enable landlords to send rent reminders, notices, or updates via email and SMS automatically, ensuring consistent and professional tenant interactions.

- Online Rent Payment Systems: Platforms such as Rentec Direct and Avail provide secure portals for tenants to pay rent electronically using credit cards, bank transfers, or mobile wallets—accelerating payment receipt and reducing late fees.

- Maintenance Request Management: Software solutions often include tenant-facing portals to submit repair requests, track progress, and schedule vendor visits, allowing landlords to prioritize and document maintenance efficiently.

- Document Storage and Lease Management: Centralized cloud storage for lease agreements, inspection reports, and financial records enhances organization and quick retrieval, helping landlords stay compliant and prepared for audits or legal disputes.

Benefits of Integrating Property Management Software

Utilizing these digital tools translates directly into time and cost savings by:

- Reducing Administrative Burden: Automation cuts down on repetitive manual work, freeing landlords to focus on strategic decision-making and portfolio growth.

- Improving Tenant Experience and Retention: Prompt communication and hassle-free payment options improve tenant satisfaction, which correlates with longer lease terms.

- Enhancing Financial Transparency: Real-time dashboards and reporting features help landlords monitor cash flow, track expenses, and optimize profitability.

- Ensuring Legal Compliance and Documentation: Comprehensive digital records simplify compliance with landlord-tenant laws and facilitate easier dispute resolution.

For landlords serious about building long-term wealth through scalable, professional property management, investing in the right software solutions is no longer optional. These tools not only improve daily operational efficiency but also position your rental business for sustained growth and stability. Choosing a platform that aligns with your property type, portfolio size, and specific management needs is the next essential step toward mastering property management in the digital age.

Image courtesy of cottonbro studio

Setting Up a Reliable Vendor and Contractor Network

Building a trusted network of vendors and contractors is fundamental for landlords who want to maintain their properties cost-effectively while ensuring high-quality work. Reliable service providers—ranging from plumbers and electricians to landscapers and cleaning crews—help prevent costly delays, reduce repair expenses, and protect tenant satisfaction. Establishing these relationships proactively enables swift response to maintenance needs, emergency repairs, and routine inspections without compromising your property’s integrity or your investment returns.

Finding Trustworthy Service Providers

Start by sourcing vendors with strong reputations and verifiable credentials:

- Ask for Recommendations: Leverage referrals from other landlords, property managers, or local real estate investment groups to identify dependable contractors with proven track records.

- Check Licenses, Insurance, and Certifications: Verify that all contractors comply with local licensing and insurance requirements. This protects you from liability and ensures professionalism.

- Review Past Work and References: Request portfolios or examples of previous projects along with references to assess quality, punctuality, and communication.

- Evaluate Responsiveness and Communication: Prompt, clear communication is crucial—vendors who respond quickly and explain work thoroughly reduce misunderstandings and repair delays.

Negotiating Clear, Fair Contracts

Once you've identified potential vendors, negotiate contracts that protect your interests and establish clear expectations:

- Scope of Work: Define detailed services, timelines, and deliverables to avoid scope creep.

- Pricing and Payment Terms: Secure fixed or capped rates where possible and set payment milestones contingent on satisfactory completion.

- Service Level Agreements (SLAs): Include performance standards related to response times, workmanship, and dispute resolution.

- Warranty and Liability Clauses: Ensure contractors warrant their work for a reasonable period and carry sufficient liability coverage.

- Termination Clauses: Allow for contract termination in cases of consistent poor performance or breach without penalty.

A well-crafted contract minimizes cost overruns, encourages accountability, and fosters long-term vendor partnerships.

Enforcing Quality Standards and Cost-Effective Maintenance

Maintaining quality standards requires ongoing oversight and evaluation:

- Regular Performance Reviews: Periodically assess vendor work against agreed SLAs, tenant feedback, and property conditions.

- Integrated Maintenance Management: Use property management software to track work orders, schedule preventive maintenance, and store vendor information for transparency.

- Competitive Bidding: For larger projects, seek multiple bids to ensure competitive pricing while maintaining quality.

- Build Long-Term Relationships: Reward dependable vendors with repeat business to encourage priority service and negotiated discounts.

By thoughtfully assembling and managing your vendor network, you create an efficient, cost-effective maintenance ecosystem that safeguards your properties from decline, enhances tenant retention, and strengthens your real estate investment’s profitability. This strategic approach is a vital component of mastering rental property management and securing sustained long-term wealth through residential and commercial real estate.

Image courtesy of Tima Miroshnichenko

Handling Tenant Communication and Conflict Resolution

Effective tenant communication and swift conflict resolution are cornerstones of successful property management that directly impact tenant satisfaction, retention, and the smooth operation of your rental business. Clear, consistent communication helps manage tenant expectations, reduces misunderstandings, and prevents disputes that can escalate into costly legal challenges or vacancies. As a landlord, mastering these interpersonal skills ensures a positive landlord-tenant relationship that supports long-term investment growth.

Tips for Clear and Proactive Tenant Communication

- Establish Multiple Communication Channels: Offer tenants various ways to reach you—phone, email, tenant portals, or messaging apps—to encourage timely reporting of issues and inquiries.

- Set Expectations Early: From move-in, clarify communication protocols including response times, emergency contacts, and maintenance request procedures outlined in your lease and tenant welcome packets.

- Regular Updates and Reminders: Send periodic notices about rent due dates, seasonal maintenance, policy changes, or community news to keep tenants informed and engaged.

- Be Professional and Empathetic: Approach all interactions with respect and understanding, listening actively to tenant concerns and validating their experiences to build trust.

Managing Tenant Expectations to Prevent Conflicts

Conflicts often arise when tenants’ expectations exceed what landlords can reasonably provide. Prevent this by:

- Clearly defining responsibilities for repairs, utilities, and property usage in lease agreements and tenant handbooks.

- Explaining any limitations upfront, such as maintenance response times or rules about alterations.

- Being transparent about fees, penalties, and consequences related to lease violations or late payments.

Resolving Disputes Quickly and Effectively

When conflicts do occur, timely resolution protects tenant relationships and minimizes financial and reputational damage. Approach disputes with these strategies:

- Address Issues Promptly: Acknowledge complaints quickly and investigate thoroughly to prevent escalation.

- Communicate Openly: Maintain open dialogue, sharing facts and listening to tenant viewpoints while setting clear boundaries.

- Seek Win-Win Solutions: Whenever possible, find compromises that satisfy both parties without sacrificing your property’s standards or profitability.

- Use Mediation or Arbitration: Incorporate alternative dispute resolution clauses in leases to handle disagreements professionally without resorting to costly litigation.

- Document Everything: Keep detailed records of communications, agreements, and actions taken to protect yourself legally.

By prioritizing transparent, respectful communication and proactive conflict management, landlords cultivate positive tenant relationships that promote long-term occupancy and stable rental income. This skillful approach to tenant interaction not only reduces turnover costs but also strengthens your reputation and supports sustained wealth-building in your real estate portfolio.

Image courtesy of Alena Darmel

Optimizing Marketing and Vacancy Management

Effective marketing and strategic vacancy management are vital to minimizing vacancy periods and attracting high-quality tenants who contribute to the stability and profitability of your rental portfolio. Leveraging modern marketing techniques and digital platforms not only expands your reach but also streamlines tenant acquisition, reducing downtime between leases and accelerating your return on investment.

Techniques to Market Your Property Effectively

To stand out in a competitive rental market, implement a multi-channel marketing approach that highlights your property’s unique features and appeals directly to your target tenant profile. Key strategies include:

- Professional Photography and Virtual Tours: High-quality images and video walkthroughs significantly increase engagement by showcasing the property’s condition and amenities, helping prospective tenants visualize living or working there.

- Compelling Property Descriptions: Use clear, concise, and keyword-rich descriptions that emphasize benefits such as location advantages, recent upgrades, nearby amenities, and unique features. Incorporate terms tenants commonly search for, like “pet-friendly,” “near public transit,” or “off-street parking.”

- Utilize Multiple Listing Platforms: Post your listings on popular rental websites like Zillow, Apartments.com, Realtor.com, and niche sites for commercial or specialized residential properties. Expanding your digital footprint increases exposure to a broader tenant pool.

- Leverage Social Media Marketing: Harness platforms like Facebook Marketplace, Instagram, and LinkedIn to reach local audiences. Engage with community groups, post regular updates, and encourage tenant referrals through incentives.

- Optimize for Local SEO: Create Google My Business listings for your properties or property management business to appear in local search results. Use localized keywords such as neighborhood names, city, and nearby landmarks within your online ads and website content.

Minimizing Vacancy Times with Proactive Vacancy Management

Vacancies directly impact your cash flow, so swift turnover is essential. Best practices for minimizing vacancy include:

- Pre-Marketing Before Lease Expiry: Start advertising the property several weeks before the current lease ends to line up prospective tenants in advance.

- Flexible Showing Schedules: Offer convenient, even virtual, showing options to accommodate busy tenant schedules and maintain strong interest.

- Competitive Pricing Strategies: Regularly review market rent rates and adjust competitively to attract tenants quickly without undervaluing your property.

- Streamlined Application and Screening: Simplify your tenant application process with digital forms and prompt screening to reduce delays in lease signing.

- Tenant Retention Focus: Maintain good relationships with existing tenants and offer lease renewal incentives to reduce turnover frequency.

Using Digital Platforms to Attract Quality Tenants

Harnessing digital tools not only accelerates marketing but also helps identify creditworthy and responsible tenants through integrated screening services. Platforms such as Cozy, Avail, and TurboTenant enable you to:

- Collect online applications and securely gather tenant information.

- Automate background and credit checks for faster decision-making.

- Communicate efficiently with applicants through built-in messaging systems.

- Manage lease documents digitally to expedite signing processes.

By combining professional marketing with savvy vacancy management and digital tenant acquisition tools, landlords can significantly reduce online vacancy rates and consistently attract reliable tenants who enhance your long-term rental income and property value. This focused approach ensures your rental properties stay leased, profitable, and competitive in evolving real estate markets.

Image courtesy of Thirdman

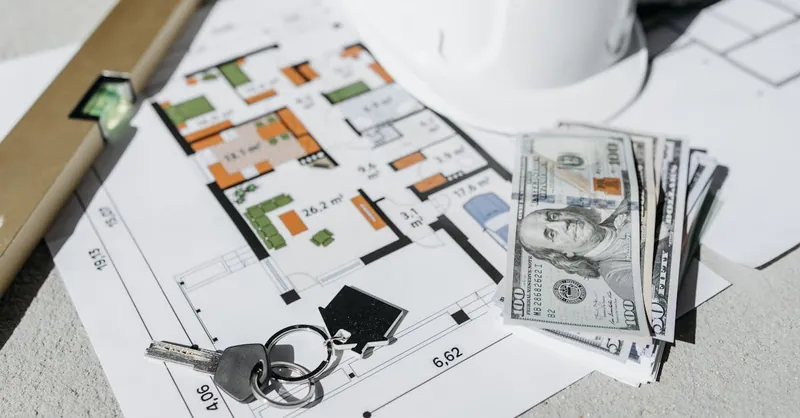

Planning for Long-Term Financial Success: Monitoring Cash Flow, Capital Expenditures, Tax Strategies, and Portfolio Diversification

Achieving long-term financial success in rental property investing requires more than just securing tenants and maintaining properties—it demands diligent financial oversight and strategic planning. A critical component is monitoring cash flow closely to ensure your rental income consistently exceeds operating expenses, debt service, and reserves. Regularly tracking income and expenses allows you to identify trends, adjust rent or cost structures proactively, and maintain positive monthly returns that build sustainable wealth over time.

Equally important is planning for capital expenditures (CapEx)—the larger, less frequent investments necessary to keep your properties competitive and maintain or increase their value. Budgeting ahead for items like roof replacement, HVAC upgrades, and major renovations prevents unexpected financial strain and helps preserve your property's long-term profitability. Establish a CapEx reserve fund based on detailed property condition assessments and realistic timelines to ensure funds are available when needed.

In addition to operational planning, implementing effective tax strategies can substantially improve your investment’s after-tax returns. Take full advantage of deductions for mortgage interest, depreciation, repairs, and management expenses while exploring benefits like 1031 exchanges to defer capital gains taxes on property sales. Collaborating with a knowledgeable real estate accountant or tax advisor empowers you to navigate complex tax codes, optimize your tax position, and reinvest savings into portfolio growth.

Finally, diversifying your rental property portfolio across different property types (residential, commercial), locations, and tenant industries helps mitigate risks associated with market fluctuations, tenant turnover, or economic downturns. A balanced portfolio reduces income volatility and opens multiple avenues for appreciation and cash flow, reinforcing your financial resilience.

By integrating consistent cash flow monitoring, proactive capital expenditure planning, savvy tax management, and strategic portfolio diversification, landlords position themselves to not only preserve but steadily grow their real estate wealth—transforming rental property management from a day-to-day operational task into a powerful vehicle for building long-term financial independence.

Image courtesy of Pavel Danilyuk