Top Investment Strategies in Commercial Real Estate

Category: Real Estate Investing

Mastering Investment Strategies in Commercial Real Estate

If you're an aspiring or current real estate investor aiming to build lasting wealth, understanding commercial real estate investment strategies is essential. You've likely explored residential properties, but commercial real estate offers unique opportunities and challenges that require a tailored approach. This post dives deep into actionable strategies tailored for investors at all experience levels—from those just starting out to seasoned pros—helping you navigate market complexities and capitalize on growth potential.

You might have arrived here seeking clarity on how to select the right commercial property types, evaluate risks, optimize financing, or maximize cash flow. This article cuts through the noise with practical insights that go beyond surface-level advice, addressing your real concerns like managing tenant relations, leveraging tax benefits, and choosing investment vehicles strategically. By the end, you'll gain confidence in crafting a robust strategy that aligns with your financial goals. Let's unlock the potential of commercial real estate investing to build your portfolio's resilience and long-term wealth.

- Mastering Investment Strategies in Commercial Real Estate

- Understanding Different Types of Commercial Real Estate: Office, Industrial, Retail, Multifamily, and Specialty Properties

- Evaluating Market Trends and Economic Indicators Critical to Commercial Real Estate Investment Decisions

- Assessing Property Value and Risk: Due Diligence, Location Analysis, and Financial Metrics

- Financing Strategies: Choosing Between Traditional Mortgages, Syndications, REITs, and Private Equity

- Leasing Structures and Tenant Management: Triple Net Leases, Gross Leases, and Commercial Tenant Relations

- Maximizing Cash Flow: Rent Optimization, Expense Management, and Property Upgrades

- Tax Advantages and Legal Considerations in Commercial Property Investment

- Diversifying Your Portfolio: Balancing Residential and Commercial Assets for Long-Term Wealth

- Exit Strategies: Selling, Refinancing, and 1031 Exchanges to Optimize Returns

- Technology and Tools to Streamline Commercial Real Estate Investment and Property Management

Understanding Different Types of Commercial Real Estate: Office, Industrial, Retail, Multifamily, and Specialty Properties

To build a successful commercial real estate portfolio, it’s crucial to understand the distinct property types and how each aligns with your investment goals. Commercial real estate broadly categorizes into five primary types, each offering unique cash flow patterns, risk profiles, and management requirements.

-

Office Properties

Office buildings range from skyscrapers in urban centers to suburban business parks. These investments tend to attract long-term tenants under net leases, providing stable income but requiring attention to market fluctuations driven by local employment trends and economic health. Investment strategies here focus on location quality, tenant creditworthiness, and building amenities that drive retention. -

Industrial Properties

Industrial spaces include warehouses, distribution centers, and manufacturing facilities. The explosive growth of e-commerce has boosted demand for logistic-oriented properties, making industrial real estate appealing for investors targeting long-term leases with corporate tenants. Key metrics to monitor include lease length, proximity to transport hubs, and the building’s adaptability to evolving supply chain needs. -

Retail Properties

Retail real estate encompasses everything from single storefronts to shopping centers and malls. This sector is heavily influenced by consumer behavior trends and the rise of online shopping, requiring savvy investors to focus on property locations with strong foot traffic and tenants with diverse, stable tenant mixes. Triple-net leases are common, shifting many operational costs to tenants and increasing net income predictability. -

Multifamily Properties

Multifamily properties are residential buildings with five or more units, blurring the line between residential and commercial investing. They offer consistent cash flow driven by rental income and often demonstrate resilience during economic downturns. Multifamily investments demand active property management and tenant relations but provide scalable growth and multiple financing options. -

Specialty Properties

This category includes niche investments such as healthcare facilities, self-storage units, hotels, and recreational centers. Specialty properties require in-depth industry knowledge but can yield high returns due to limited competition and specialized tenant needs.

By understanding the characteristics, advantages, and risks associated with each property type, you can tailor your commercial real estate investment strategy to maximize cash flow, minimize vacancies, and build sustainable wealth. Aligning property selection with your risk tolerance, investment timeline, and management capacity sets the foundation for long-term success in mastering commercial real estate investing.

Image courtesy of Erik Mclean

Evaluating Market Trends and Economic Indicators Critical to Commercial Real Estate Investment Decisions

Successful commercial real estate investing hinges not only on choosing the right property type but also on accurately interpreting market trends and key economic indicators that influence asset performance and value appreciation. Staying ahead of shifting market dynamics allows investors to make informed decisions, optimize entry and exit timing, and minimize risk exposure in volatile environments.

Key Market Trends to Monitor

-

Supply and Demand Dynamics

Understanding local and regional supply-demand balances is crucial. An oversupply of commercial space typically leads to increased vacancies and downward pressure on rental rates, whereas constrained supply amid rising demand can fuel rental growth and increase asset values. -

Vacancy Rates and Rental Growth

Tracking vacancy rates provides insight into market health and tenant demand. Consistently low vacancies coupled with steady rent increases indicate a strong market, ideal for investors focused on cash flow stability and property appreciation. -

Capitalization Rates (Cap Rates)

Cap rates reflect investor expectations about return relative to risk and property values. Declining cap rates often signal rising property prices and intense competition, while rising cap rates may indicate investor caution or market corrections.

Critical Economic Indicators Affecting Commercial Real Estate

-

Gross Domestic Product (GDP) Growth: Strong GDP growth correlates with increased business activity, driving demand for office and industrial spaces. Monitoring GDP trends helps forecast future leasing activity.

-

Employment Rates and Job Growth: Commercial real estate demand, particularly in office and retail sectors, closely ties to employment levels. Job growth in key industries signals expanding tenant pools, enhancing leasing prospects.

-

Interest Rates and Monetary Policy: Changes in interest rates directly impact borrowing costs and capitalization rates, influencing property affordability and investor returns. Lower rates typically stimulate investment and refinancing activity.

-

Inflation Rates: Moderate inflation can increase rental income over time, enhancing real returns. However, rapid inflation may compress capitalization rates and elevate operational costs, requiring careful lease structuring.

-

Consumer Spending Patterns: Particularly relevant for retail and multifamily sectors, shifts in consumer confidence and spending influence tenant stability and demand for commercial spaces.

By integrating these market trends and economic indicators into your investment analysis, you develop a comprehensive understanding of the commercial real estate landscape. This approach not only improves risk assessment accuracy but also uncovers opportunities that align with your wealth-building objectives. A data-driven strategy rooted in current, relevant market intelligence is indispensable for mastering commercial real estate investing.

Image courtesy of Antoni Shkraba Studio

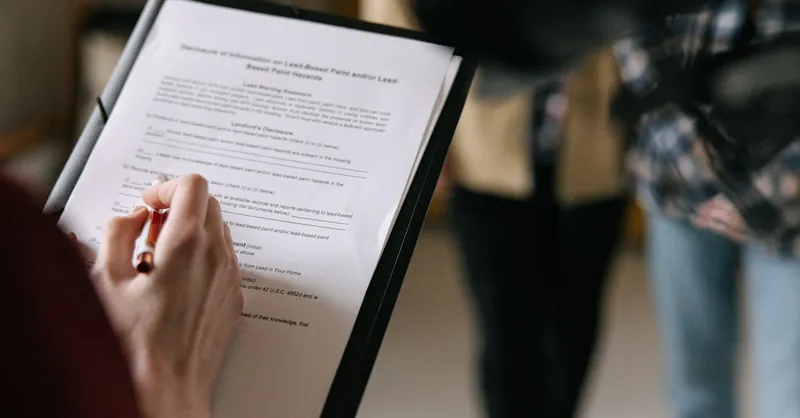

Assessing Property Value and Risk: Due Diligence, Location Analysis, and Financial Metrics

Before committing capital to a commercial real estate investment, conducting thorough due diligence is critical to accurately assess the property’s value and inherent risks. This comprehensive evaluation goes beyond surface-level inspections, focusing on legal documentation, physical condition, tenant leases, and market comparables to confirm that the asset aligns with your investment criteria and risk tolerance.

Due Diligence Essentials

-

Title and Legal Review

Verify clear title ownership and review any liens, encumbrances, zoning restrictions, or pending litigation that could adversely impact the property’s use or transferability. -

Physical Inspection

Engage qualified professionals to inspect structural integrity, building systems, environmental conditions, and compliance with safety codes. Identifying costly repairs or environmental hazards upfront prevents unexpected capital expenditures. -

Lease and Tenant Analysis

Evaluate existing leases for tenant creditworthiness, lease terms, rent escalations, renewal options, and vacancy history. Reliable tenants and long-term leases reduce income volatility and enhance property value.

Location Analysis: The Cornerstone of Value

The importance of location in commercial real estate cannot be overstated—it directly influences tenant demand, rental rates, and property appreciation potential. When analyzing location, consider:

- Accessibility and Visibility: Proximity to major highways, public transportation, and customer foot traffic improves desirability.

- Local Economic Drivers: Employment centers, population growth, and economic diversification create sustainable demand.

- Competitive Supply Levels: An oversaturated market can limit rental growth and increase vacancies.

- Neighborhood Trends: Urban renewal, infrastructure projects, and demographic shifts can signal future appreciation or decline.

Financial Metrics to Quantify Investment Potential

Applying objective financial metrics helps quantify risk and forecast returns, enabling informed decision-making:

| Financial Metric | What It Measures | Why It Matters |

|---|---|---|

| Net Operating Income (NOI) | Revenue minus operating expenses | Indicator of property's income-generating ability |

| Capitalization Rate (Cap Rate) | NOI divided by property purchase price | Reflects expected rate of return and market risk |

| Cash-on-Cash Return | Annual pre-tax cash flow divided by cash invested | Assesses annual cash yield relative to investment |

| Debt Service Coverage Ratio (DSCR) | NOI divided by annual debt payments | Gauges ability to cover debt obligations |

| Internal Rate of Return (IRR) | Total return over the investment holding period | Projects profitability factoring cash flow timing |

Combining diligent property inspections, strategic location evaluation, and rigorous financial analysis positions you to identify undervalued opportunities while mitigating risks. This integrated approach empowers you to build a resilient commercial portfolio capable of generating reliable cash flow and long-term wealth growth.

Image courtesy of RDNE Stock project

Financing Strategies: Choosing Between Traditional Mortgages, Syndications, REITs, and Private Equity

Securing the right financing is a cornerstone of successful commercial real estate investing, directly impacting your cash flow, risk exposure, and overall returns. Understanding the nuances of traditional mortgages, real estate syndications, Real Estate Investment Trusts (REITs), and private equity funds empowers investors to align capital sources with their investment goals, experience level, and financial capacity.

Traditional Mortgages

Traditional commercial mortgages remain the most common financing option for individual investors and entities acquiring commercial properties. These loans typically require:

- A substantial down payment (often 20-30% of the property value)

- Strong creditworthiness and financial documentation

- Fixed or variable interest rates with amortization schedules ranging from 5 to 25 years

Advantages include retention of full ownership control, potential tax-deductible interest, and the ability to leverage debt for higher cash-on-cash returns. However, buyers must carefully consider debt service obligations, potential refinancing risks, and the impact of interest rate fluctuations on long-term profitability.

Real Estate Syndications

Syndications pool capital from multiple investors to acquire larger commercial assets than most individuals could purchase alone. In this model:

- A syndicator or sponsor manages the asset and operations

- Passive investors contribute equity and share proportional returns

- Investments may be structured as limited partnerships or LLCs

This approach offers access to higher-quality properties with shared risk, professional management, and often preferred return structures. Syndications suit investors seeking portfolio diversification without direct management responsibilities but require thorough sponsor vetting and understanding of deal terms.

Real Estate Investment Trusts (REITs)

REITs provide a publicly or privately traded vehicle to invest in commercial real estate portfolios with liquidity akin to stocks. Key benefits include:

- Diversification across property types and geographies

- Professional management with transparency through regulatory filings

- Lower minimum investment thresholds compared to direct property ownership

While REITs offer ease of entry and dividend income, investors typically sacrifice direct property control and may face market volatility unrelated to real estate fundamentals.

Private Equity Funds

Private equity real estate funds pool substantial capital from accredited investors to pursue value-add or opportunistic commercial property investments. These funds emphasize:

- Strategic asset repositioning, development, or redevelopment

- Active management to enhance property value and investor returns

- Longer investment horizons (5-10+ years) with capital lock-up periods

Such funds are ideal for investors with higher risk tolerance and capital seeking superior returns through aggressive growth strategies but require due diligence regarding fund track records, fee structures, and exit plans.

By carefully evaluating these financing strategies against your investment timeline, risk profile, and desired level of involvement, you can craft an optimized capital structure that enhances portfolio growth, cash flow stability, and wealth accumulation in commercial real estate investing.

Image courtesy of Jakub Zerdzicki

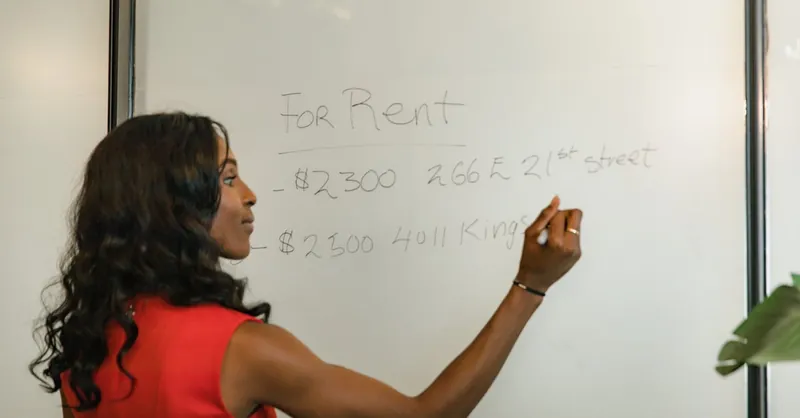

Leasing Structures and Tenant Management: Triple Net Leases, Gross Leases, and Commercial Tenant Relations

A fundamental component of successful commercial real estate investing lies in mastering leasing structures and tenant management, which directly impact cash flow stability, risk allocation, and property value. Understanding the differences between triple net leases (NNN), gross leases, and how to cultivate strong commercial tenant relations equips investors to optimize income predictability while minimizing operational burdens.

Triple Net Leases (NNN)

In a triple net lease, tenants agree to pay not only base rent but also all—or most—operating expenses related to the property, including property taxes, insurance, and maintenance costs. This lease type is highly favored in commercial sectors like retail and industrial because it transfers many variable expenses to the tenant, providing landlords with:

- Predictable net income streams by reducing exposure to unexpected property operating costs

- Lower property management responsibilities, enhancing passive income potential

- Typically, long-term lease terms that increase investment stability

However, investors should carefully assess tenant creditworthiness since the tenant absorbs most expenses and is directly responsible for property upkeep, which can affect property condition and long-term value.

Gross Leases

Gross leases simplify the landlord's role by bundling all operating expenses into one fixed rent payment from the tenant. This arrangement is common in multi-tenant office buildings and some multifamily commercial properties, offering:

- Easier budgeting for tenants, improving demand in competitive markets

- Greater landlord control over building maintenance and services

- Increased exposure to fluctuations in operating costs, which can compress landlord net income if expenses rise unexpectedly

Gross leases demand proactive expense management by landlords and strategic rent setting to preserve profitability. Hybrid leasing forms, such as modified gross leases, blend features from both NNN and gross leases to tailor expense responsibilities.

Commercial Tenant Relations and Management

Effective tenant management extends beyond lease terms into fostering strong, mutually beneficial relationships. For commercial properties, this means:

- Maintaining clear and consistent communication to address tenant needs and concerns promptly

- Ensuring timely maintenance and responsive property management to uphold property standards and tenant satisfaction

- Facilitating lease renewals and minimizing vacancies through tenant engagement and negotiation flexibility

- Understanding tenant industries and business cycles to anticipate potential challenges and provide support that encourages long-term occupancy

By combining appropriate leasing structures with diligent tenant management, investors can reduce vacancy risks, enhance property cash flow, and preserve asset quality. Balancing risk between landlord and tenant, along with fostering strong tenant relationships, is essential for building resilient commercial real estate portfolios that generate sustained long-term wealth.

Image courtesy of Artful Homes

Maximizing Cash Flow: Rent Optimization, Expense Management, and Property Upgrades

Maximizing cash flow is a cornerstone of successful commercial real estate investing and directly influences your portfolio’s long-term wealth-building potential. To achieve robust, sustainable income, focus on three critical areas: rent optimization, expense management, and strategic property upgrades.

Rent Optimization

Effective rent optimization balances competitive market rates with tenant retention strategies. Conduct regular market rent analyses to ensure your rents align with prevailing local and submarket trends without undercutting potential income. Consider implementing tiered rent increases tied to lease renewals or CPI adjustments to maintain pace with inflation. Additionally:

- Segment tenants strategically—different tenant industries and lease types may bear varied rent levels.

- Encourage longer lease terms for creditworthy tenants in exchange for moderate rent escalations that guarantee steady cash flow.

- Use data-driven rental benchmarking tools to identify underperforming units or spaces that can command higher rents after minor improvements or marketing efforts.

Expense Management

Maintaining tight control over operational expenses is essential for maximizing your net operating income (NOI). Analyze expense categories such as property management fees, maintenance costs, utilities, and insurance premiums to identify savings without compromising property quality. Techniques include:

- Negotiating bulk contracts for services and supplies

- Investing in energy-efficient systems to cut utility costs

- Regularly auditing vendor agreements to ensure competitive pricing

- Implementing preventative maintenance to avoid costly emergency repairs

Effective expense management not only improves your bottom line but also enhances tenant satisfaction by maintaining property standards proactively.

Strategic Property Upgrades

Investing in thoughtful property upgrades can justify rent increases, attract higher-quality tenants, and reduce vacancy periods. Focus on high-impact improvements such as:

- Modernizing building exteriors and common areas to elevate curb appeal

- Upgrading HVAC, lighting, and plumbing systems for efficiency and tenant comfort

- Adding amenities aligned with tenant needs, such as secure parking, high-speed internet infrastructure, or flexible workspaces

By prioritizing upgrades that enhance tenant experience and operational efficiency, you increase property value and create a competitive advantage in the market. When combined, these rent optimization tactics, disciplined expense management, and targeted property improvements form a triad for maximizing cash flow and accelerating long-term wealth accumulation through commercial real estate investing.

Image courtesy of Khwanchai Phanthong

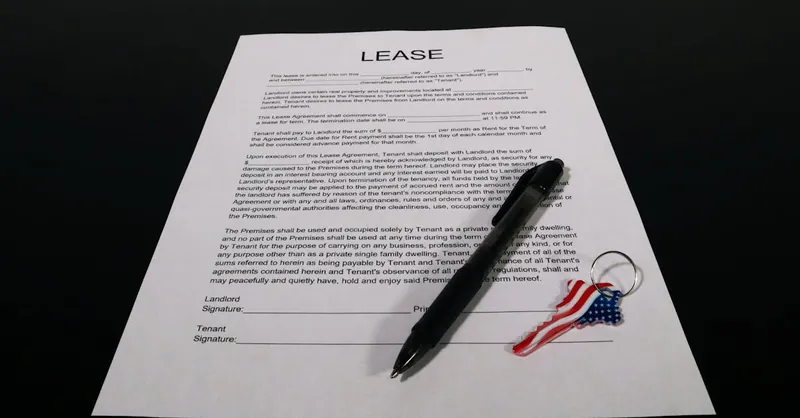

Tax Advantages and Legal Considerations in Commercial Property Investment

Navigating the tax advantages and legal considerations of commercial real estate investment is critical for maximizing returns and protecting your assets. Commercial properties offer a variety of tax benefits that can significantly enhance cash flow and long-term wealth accumulation while requiring compliance with complex legal frameworks to minimize risks.

Key Tax Benefits in Commercial Real Estate

-

Depreciation Deductions

One of the most powerful tools investors leverage is depreciation, which allows you to deduct the building’s cost (excluding land) over a set recovery period—typically 39 years for commercial properties. This non-cash expense offsets taxable income, thereby reducing your income tax liability without impacting cash flow. -

Interest Expense Deductions

Mortgage interest on loans used to acquire or improve commercial properties is generally tax-deductible, providing further shelter from taxable income. Strategic financing can therefore improve tax efficiency alongside leveraging cash flow. -

1031 Like-Kind Exchanges

The IRS's 1031 exchange provision permits deferral of capital gains taxes when you reinvest proceeds from a sold commercial property into another qualifying property. This powerful strategy enables portfolio growth by deferring tax liabilities and compounding wealth. -

Operating Expense Deductions

Routine expenses such as property management fees, maintenance, insurance, and property taxes are deductible against rental income. Careful documentation and expense tracking are essential to maximize these deductions. -

Cost Segregation Studies

Conducting a cost segregation analysis separates personal property components from the building structure, accelerating depreciation schedules for certain assets and increasing upfront tax deductions, boosting early cash flow.

Essential Legal Considerations

-

Entity Structuring

Choosing the right legal entity—such as an LLC, partnership, or corporation—is foundational for liability protection, tax treatment, and estate planning. Most commercial investors prefer LLCs for their flexibility and pass-through taxation benefits, but professional consultation is advised to optimize structure based on individual goals. -

Zoning and Land Use Compliance

Verify zoning classifications, permitted uses, and any land use restrictions before acquisition. Non-compliance can result in costly modifications or operational limitations that degrade investment value. -

Environmental and Building Regulations

Commercial properties often face stringent environmental regulations (e.g., asbestos, soil contamination) and safety codes. Ensuring compliance mitigates legal risks and potential fines. -

Lease Agreement Enforcement and Tenant Rights

Robust lease agreements are legally binding documents critical for defining tenant responsibilities, rent payment terms, and dispute resolution mechanisms. Understanding landlord-tenant laws in your jurisdiction helps enforce leases effectively and avoid litigation.

Integrating these tax advantages and legal safeguards into your commercial real estate investment strategy not only amplifies profitability but also fortifies your portfolio against regulatory and financial risks. Proactive planning and staying informed about evolving tax laws and legal standards empower investors to confidently optimize returns and build long-term wealth in commercial real estate.

Image courtesy of Ivan Samkov

Diversifying Your Portfolio: Balancing Residential and Commercial Assets for Long-Term Wealth

A well-diversified real estate portfolio that includes both residential and commercial properties is a proven strategy for building long-term wealth while mitigating risk. Residential rental properties, such as single-family homes and multifamily units, offer consistent cash flow and often require less upfront capital, making them accessible to many investors. In contrast, commercial properties—ranging from office spaces to industrial warehouses—tend to provide higher income potential, longer lease terms, and opportunities for value creation through active management or repositioning.

By balancing residential and commercial assets, investors can:

-

Enhance income stability — Residential leases typically have shorter terms, increasing turnover risk but offering flexibility and frequent rent adjustments. Commercial leases are generally longer and more structured, providing reliable, predictable cash flow over extended periods.

-

Capitalize on market cycles — Residential and commercial real estate often respond differently to economic shifts. During economic downturns, multifamily rentals may maintain occupancy better, while certain commercial sectors, like industrial or essential retail, can outperform.

-

Optimize risk-adjusted returns — Diversification across property types reduces dependence on a single market segment or tenant base, dampening the impact of sector-specific downturns and vacancy fluctuations.

-

Maximize tax advantages — Combining residential depreciation schedules with commercial property deductions and strategies like cost segregation or 1031 exchanges allows for strategic tax planning to improve after-tax cash flow.

To effectively implement portfolio diversification, consider your investment goals, risk tolerance, and management bandwidth. Residential investments generally require more hands-on involvement, whereas commercial properties, especially with triple net leases, can operate with a more passive management style. Moreover, diversifying across different geographic locations and property classes further strengthens your portfolio’s resilience.

Ultimately, integrating both residential and commercial real estate investments creates a complementary framework that leverages the strengths of each asset class. This balanced approach not only improves overall portfolio performance but also positions you for sustainable wealth accumulation and flexibility in navigating evolving market conditions.

Image courtesy of Charles Parker

Exit Strategies: Selling, Refinancing, and 1031 Exchanges to Optimize Returns

Developing effective exit strategies is a vital component of any successful commercial real estate investment plan. Knowing when and how to sell, refinance, or utilize a 1031 exchange enables investors to optimize returns, manage tax liabilities, and preserve capital for future opportunities. Exit strategies should align with your overall financial goals, investment horizon, and market conditions to maximize profitability and portfolio growth.

Selling: Timing and Market Positioning

Selling a commercial property at the right time can unlock substantial capital gains and enable reinvestment into higher-yielding assets. Key to a successful sale is:

- Market Timing – Monitor local economic indicators, cap rate trends, and asset class performance to choose an optimal window when demand and pricing peak.

- Property Positioning – Enhance property appeal through strategic upgrades, lease renewals, and tenant credit improvements to attract competitive offers.

- Tax Planning – Anticipate capital gains tax consequences and explore options to defer or reduce tax burdens through sophisticated exit techniques.

Refinancing: Leveraging Equity for Growth

Refinancing commercial properties allows investors to tap into accumulated equity without selling, providing liquidity for new acquisitions, property improvements, or debt restructuring. Benefits of refinancing include:

- Lower interest rates that reduce debt service and increase cash flow

- Cash-out refinancing to extract equity for portfolio expansion

- Opportunity to extend loan terms and improve debt service coverage ratios

Careful assessment of current market rates, loan terms, and property performance metrics is crucial to ensure refinancing improves overall investment returns and aligns with your long-term strategy.

1031 Like-Kind Exchanges: Tax-Deferred Wealth Building

A 1031 exchange is a powerful tax deferral tool allowing investors to reinvest proceeds from the sale of a commercial property into a “like-kind” replacement property without immediately incurring capital gains taxes. Key considerations include:

- Strict IRS timelines requiring identification of replacement properties within 45 days and closing within 180 days

- Qualifying properties must be of similar nature and held for investment or business use

- Enables portfolio diversification, upgrading asset quality, or geographic repositioning while deferring tax liabilities and preserving capital

Integrating 1031 exchanges into your exit strategy magnifies compound growth potential by continually rolling gains into larger or more profitable commercial assets.

By strategically combining selling, refinancing, and 1031 exchanges, investors gain flexible tools to optimize cash flow, manage tax exposures, and accelerate portfolio growth in commercial real estate. Proactive exit planning ensures every phase of your investment lifecycle contributes meaningfully to your long-term wealth-building goals.

Image courtesy of Kampus Production

Technology and Tools to Streamline Commercial Real Estate Investment and Property Management

In today’s fast-evolving commercial real estate landscape, leveraging technology and digital tools is no longer optional but essential for maximizing efficiency, improving decision-making, and enhancing property management outcomes. Integrating innovative software solutions empowers investors and property managers to automate routine tasks, analyze market data with precision, and maintain seamless tenant relations—all of which contribute to stronger cash flow and long-term portfolio growth.

Investment Analysis and Market Research Tools

Access to real-time, accurate market intelligence can dramatically improve your ability to evaluate potential commercial properties and identify lucrative opportunities. Leading platforms now offer:

- Comprehensive property databases with detailed analytics on pricing trends, vacancy rates, cap rates, and comparable sales

- Financial modeling software that streamlines underwriting, helps calculate key metrics like NOI, IRR, and cash-on-cash return, and runs scenario analyses to stress-test investments

- Geospatial mapping and location analytics to assess demographics, traffic patterns, and local economic drivers affecting property value

- Integration with economic indicator dashboards to track interest rates, employment data, and consumer trends impacting market dynamics

These tools reduce guesswork and enable data-driven investment strategies that align closely with your financial goals and risk tolerance.

Property Management Solutions

Managing commercial rental properties efficiently demands robust technology to handle leasing, maintenance, and tenant communication. Key software features to optimize property operations include:

- Lease administration platforms that automate renewals, rent escalations, and document management

- Maintenance tracking systems with work order coordination, vendor scheduling, and cost monitoring to control expenses

- Tenant portals enabling online rent payments, service requests, and transparent communication, which boost tenant satisfaction and retention

- Financial dashboards offering real-time visibility into income, expenses, and performance metrics to support proactive decision-making

Many modern property management tools also incorporate mobile accessibility and cloud-based storage, allowing for on-the-go management and collaboration among property teams.

Automation and AI Applications

Emerging technologies such as Artificial Intelligence (AI) and machine learning are transforming commercial real estate by enabling:

- Predictive analytics that forecast market trends, rental pricing shifts, and tenant turnover risk

- Automated document processing to accelerate lease reviews and compliance checks

- Chatbots and virtual assistants for 24/7 tenant support and inquiry handling

- Enhanced investment screening algorithms that identify high-potential assets faster than traditional methods

By adopting these advanced technologies, investors can gain a competitive edge, reduce operational costs, and scale their commercial real estate portfolios more effectively.

Incorporating the right blend of technology and tools into your commercial real estate investment and property management workflows is pivotal for improving accuracy, streamlining operations, and ultimately maximizing your returns. Staying abreast of technological advancements ensures you remain agile and well-positioned to capture emerging opportunities in this dynamic market.

Image courtesy of MART PRODUCTION