Top Commercial Real Estate Financing Options for Investors

Category: Real Estate Investing

Unlock the Best Commercial Real Estate Financing Options for Your Investment Success

Navigating the world of commercial real estate financing can feel overwhelming, especially for investors striving to build long-term wealth through rental properties. You’ve likely researched different lending options but still face questions like: Which financing path aligns best with my investment goals? How do I balance costs, risks, and growth potential? This post is crafted specifically for aspiring and current real estate investors who want clear, actionable guidance tailored to both commercial and residential rental property investing. We understand your pain points—complex loan types, tough qualification requirements, and the pressure of making the right financing choice for sustainable success. Unlike generic overviews, this guide breaks down key commercial financing options, compares their benefits and drawbacks, and offers practical tips to help you make confident investment decisions. Whether you’re securing your first commercial loan or scaling your portfolio, this post delivers precise, easy-to-understand insights that get straight to what matters most: identifying the ideal financing solution to fuel your rental property dreams. Read on to master commercial real estate financing and take your investment journey to the next level.

- Unlock the Best Commercial Real Estate Financing Options for Your Investment Success

- Understanding Commercial Real Estate Financing

- Traditional Commercial Loans: Bank and Credit Union Financing Explained

- SBA Loans for Commercial Properties: Exploring SBA 7(a) and CDC/504 Loan Programs

- Commercial Bridge Loans: Short-Term Financing for Dynamic Investment Needs

- CMBS Loans (Commercial Mortgage-Backed Securities): Unlocking Capital with Structured Financing

- Private Money and Hard Money Loans: Flexible Financing from Private Lenders

- Seller Financing and Lease Options: Creative Alternatives to Traditional Lending

- Key Factors to Consider When Choosing Financing

- Tips for Improving Loan Approval Chances: Preparing, Demonstrating, and Building Relationships

- Emerging Financing Trends: Crowdfunding Platforms and Fintech Lenders Revolutionizing Commercial Real Estate Finance

Understanding Commercial Real Estate Financing

Before diving into specific loan types, it's essential to grasp what commercial real estate financing entails and why it plays a critical role in your investment strategy. Simply put, commercial real estate financing refers to the process of securing funds to purchase, refinance, or develop income-producing properties such as office buildings, retail centers, warehouses, and multifamily apartment complexes. Unlike residential financing, which typically involves loans for single-family homes or small-scale properties primarily intended for personal use, commercial financing is tailored to business properties focused on generating revenue.

Why Commercial Financing Matters for Investors

Securing the right commercial loan impacts your cash flow, investment returns, and long-term wealth-building potential. These loans often come with higher loan amounts, varied repayment structures, and stricter underwriting criteria compared to residential loans, reflecting the larger scale and complexity of commercial ventures. Understanding these distinctions enables investors to better navigate lender expectations, optimize financing costs, and select loan products that balance risk and growth aligned with their investment goals.

Key Differences Between Commercial and Residential Financing

| Aspect | Commercial Real Estate Financing | Residential Real Estate Financing |

|---|---|---|

| Loan Purpose | Income-producing business properties | Personal housing or smaller investment properties |

| Loan-to-Value (LTV) Ratios | Typically lower (65%-80%) to reduce lender risk | Often higher (80%-97%), depending on loan type |

| Underwriting Focus | Property cash flow, business financials, and borrower’s credit | Borrower’s personal creditworthiness and income |

| Loan Terms | Usually 5-20 years with balloon payments | Commonly 15-30 years with fully amortizing payments |

| Interest Rates | Generally higher than residential rates due to increased risk | Typically lower, reflecting market stability |

| Qualification Criteria | Strong emphasis on property income, business performance, and down payment size | Focus on personal credit score, income verification, and debt-to-income ratio |

By appreciating these fundamental differences, investors can avoid common pitfalls and strategically approach commercial financing with informed confidence, setting a solid foundation for their rental property empire.

Image courtesy of Laura Tancredi

Traditional Commercial Loans: Bank and Credit Union Financing Explained

When it comes to financing commercial real estate investments, traditional commercial loans from banks and credit unions remain one of the most common and reliable options. These lenders offer structured loan programs designed to support the acquisition, refinancing, or renovation of income-producing properties such as office buildings, retail centers, and multifamily complexes.

Key Features of Traditional Commercial Loans

Traditional commercial loans typically feature:

- Loan Amounts: Ranging from $100,000 to several million dollars, depending on property type and borrower qualifications.

- Loan-to-Value (LTV): Generally capped between 65% and 80%, requiring a substantial down payment or equity contribution.

- Interest Rates: Typically fixed or variable rates that reflect market conditions and borrower creditworthiness, often higher than residential loan rates.

- Loan Terms: Usually span from 5 to 20 years, with many loans structured with a balloon payment at maturity requiring refinancing or payoff.

- Repayment Structure: May involve fully amortizing payments or interest-only periods, depending on the lender’s underwriting policies.

Application Process and Eligibility Criteria

Obtaining a traditional commercial loan involves a thorough and well-documented application process, including the following key steps:

- Financial Documentation: Prepare detailed personal and business financial statements, tax returns, and credit reports. Banks heavily scrutinize borrower creditworthiness and financial stability.

- Property Analysis: Provide comprehensive information about the property’s income, expense reports, occupancy rates, leases, and appraisals to demonstrate cash flow sufficiency.

- Business Plan or Investment Strategy: Outline the purpose of the loan and how the property fits into your overall investment portfolio and long-term wealth-building goals.

- Down Payment: Have liquid capital available to cover the loan’s required down payment, often ranging from 20% to 35% of the property’s purchase price or value.

- Personal and Business Guarantees: Be prepared to offer personal guarantees or collateral, which is common in commercial lending to mitigate lender risk.

Eligibility Criteria Overview

Most banks and credit unions require:

- Strong personal credit scores (typically 680 or above).

- Demonstrated business income or a profitable rental history for existing investors.

- Stable and predictable property cash flow with loan debt service coverage ratio (DSCR) usually above 1.25x.

- Satisfactory property condition and location verified through professional appraisal.

- Solid borrower experience or relevant expertise in managing commercial rental properties, especially for larger or more complex deals.

Traditional commercial loans are an excellent starting point for serious investors seeking competitive interest rates, longer amortization schedules, and established lending relationships. However, the strict eligibility and documentation requirements mean that thorough preparation and a strong financial profile are essential to secure these loans and maximize your investment’s potential.

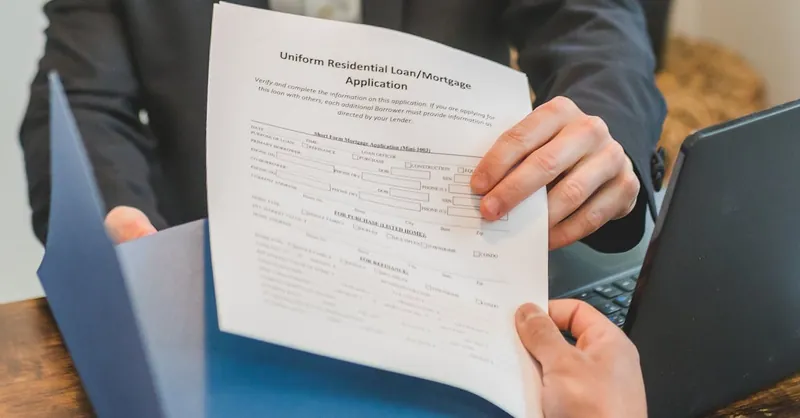

Image courtesy of Jakub Zerdzicki

SBA Loans for Commercial Properties: Exploring SBA 7(a) and CDC/504 Loan Programs

For real estate investors seeking flexible, government-backed financing options, Small Business Administration (SBA) loans offer an attractive alternative to traditional bank loans. SBA loan programs, especially the SBA 7(a) and CDC/504 loans, are designed to help small businesses—including real estate investors—access capital with favorable terms, lower down payments, and competitive interest rates. These loans are particularly suitable for purchasing, renovating, or refinancing commercial properties used for business purposes, such as office buildings, retail centers, or mixed-use developments.

SBA 7(a) Loan Program: Versatile Financing with Flexible Use

The SBA 7(a) loan is the most common SBA-backed financing option for commercial real estate investors. Key benefits include:

- Loan Amounts: Up to $5 million, accommodating a broad range of investment sizes.

- Down Payment: Typically as low as 10%, making it more accessible for investors with limited capital.

- Loan Terms: Up to 25 years for real estate, enabling manageable monthly payments and better cash flow.

- Interest Rates: Generally pegged to Prime rate plus a lender spread; SBA caps limit excessive rates.

- Use of Funds: Allows purchase, refinancing, construction, or renovation of eligible commercial properties.

However, the SBA 7(a) program requires borrowers to demonstrate a viable business plan and the ability to repay from property income or related business revenues. Since the SBA partially guarantees the loan, lenders have more confidence offering competitive terms, but borrowers must meet credit, collateral, and business experience requirements.

CDC/504 Loan Program: Long-Term Fixed Financing for Fixed Assets

The CDC/504 loan program focuses specifically on long-term, fixed-asset financing like commercial real estate and equipment. It pairs a loan from a Certified Development Company (CDC), backed by the SBA, with a conventional lender loan, providing:

- Loan-to-Value (LTV): Up to 90% total financing—50% from the bank, 40% from the CDC/SBA portion, and a low 10% borrower down payment.

- Loan Terms: 10, 20, or 25 years, with fixed interest rates on the CDC portion for predictable budgeting.

- Purpose: Ideal for purchasing or improving owner-occupied commercial properties, with 51% or more of the property used by the borrower’s business.

- Lower Down Payments: Reduce upfront capital requirements compared to conventional financing.

- Eligibility: Small businesses with tangible assets needing long-term financing and solid credit history.

Who Should Consider SBA Loans for Commercial Real Estate?

SBA loans are especially suitable for investors who:

- Need lower down payments to preserve capital.

- Believe in their business strategy and property’s ability to generate sustainable cash flow.

- Own or plan to occupy a portion of the property for business operations (especially for CDC/504 loans).

- Desire longer loan terms and predictable, fixed-rate financing to support steady growth.

- May find it challenging to meet stricter conventional loan underwriting but have solid business fundamentals.

While SBA loans may involve a more involved application process and additional documentation, their benefits—such as attractive leverage, government backing, and flexible use—make them a powerful tool in commercial real estate financing. For investors looking to maximize purchasing power and secure competitive financing options, exploring SBA 7(a) and CDC/504 loan programs can unlock significant advantages for building long-term wealth through commercial rental property investments.

Image courtesy of Erik Mclean

Commercial Bridge Loans: Short-Term Financing for Dynamic Investment Needs

When you need quick, flexible financing to seize timely commercial real estate opportunities or address temporary cash flow gaps, commercial bridge loans can be an essential tool in your lending arsenal. These short-term loans function as a "bridge" between transactions, providing immediate capital to acquire, renovate, or reposition commercial properties before securing longer-term financing.

Characteristics of Commercial Bridge Loans

Bridge loans typically have distinct features that differentiate them from traditional commercial loans:

- Short Loan Terms: Usually span from 6 months up to 3 years, designed for interim financing rather than long-term holding.

- Higher Interest Rates: Reflect the increased risk and convenience, often ranging from 7% to 12%, significantly above conventional loan rates.

- Loan Amounts and LTV: Loan-to-value ratios are generally around 65% to 75%, depending on the property and borrower profile.

- Fast Approval and Funding: Fewer underwriting requirements and accelerated processing enable borrowers to act swiftly on deals.

- Repayment Flexibility: Many bridge loans feature interest-only payments or deferred principal, reducing initial cash flow pressure.

When to Use Commercial Bridge Loans

Bridge loans offer powerful strategic advantages in several scenarios:

- Property Acquisition: Secure a competitive purchase quickly while arranging permanent financing.

- Renovation and Value-Add Projects: Fund improvements or repositioning efforts that increase property value before refinancing.

- Refinancing Delays or Credit Gaps: Overcome temporary credit challenges or underwriting delays that prevent immediate conventional loan approval.

- Portfolio Expansion: Accelerate growth by leveraging short-term funding to close multiple deals rapidly.

- Auction or Off-Market Deals: Act decisively in time-sensitive transactions requiring upfront cash.

Pros and Cons of Commercial Bridge Loans

| Pros | Cons |

|---|---|

| Quick access to capital enables rapid closings | Higher interest rates increase borrowing cost |

| Flexible underwriting for varied credit profiles | Short terms necessitate refinancing or exit strategy |

| Interest-only payments preserve cash flow | Not ideal for long-term holding due to costs |

| Bridges funding gaps between transactions | Potentially higher upfront fees and penalties |

How Bridge Loans Support Short-Term Financing Solutions

Commercial bridge loans provide a critical solution for investors needing immediate liquidity without the lengthy processes of conventional loans. By bridging the timing and funding gap, these loans empower you to capitalize on market opportunities, stabilize or renovate properties, and position your investment for stronger long-term financing options. Understanding when and how to deploy bridge financing strategically can accelerate your portfolio’s growth and protect your competitive advantage in dynamic commercial real estate markets.

Image courtesy of Jakub Zerdzicki

CMBS Loans (Commercial Mortgage-Backed Securities): Unlocking Capital with Structured Financing

Commercial Mortgage-Backed Securities (CMBS) loans are an increasingly popular financing option for investors seeking access to large-scale capital through a securitized loan product. Unlike traditional bank loans, CMBS loans pool multiple commercial mortgages into a single security sold to investors on the bond market. This structure gives lenders liquidity and enables investors to tap into competitive, non-recourse financing for stabilized commercial properties such as office buildings, shopping centers, and multifamily complexes.

Benefits of CMBS Loans for Commercial Investors

CMBS loans offer several advantages that appeal to seasoned investors focused on long-term wealth building:

- Non-Recourse Structure: CMBS loans typically do not require personal guarantees, limiting borrower liability to the collateral property alone.

- Competitive Interest Rates: Due to the broad investor base and securitization, CMBS loans often feature lower fixed interest rates compared to other non-bank lending options.

- Longer Terms: Loan terms generally range from 5 to 10 years, with predictable amortization schedules and clear maturity dates.

- Larger Loan Amounts: These loans can finance properties valued in the tens of millions, ideal for institutional or large portfolio investments.

- Streamlined Approval: Once underwriting criteria are met, CMBS loans can provide efficient closing timelines without the extensive ongoing lender oversight typical of bank loans.

Risks and Investor Flexibility Considerations

Despite their advantages, CMBS loans come with unique risks and constraints that affect investor flexibility:

- Strict Servicing and Modification Guidelines: CMBS loans are serviced by third parties bound by rigid pooling and servicing agreements, making loan modifications or restructurings difficult if financial trouble arises.

- Prepayment Penalties: Borrowers face significant prepayment penalties or defeasance requirements, which can limit the ability to refinance or sell the property before maturity without incurring substantial costs.

- Less Personalized Underwriting: Because loan profiles are standardized for packaging into securities, CMBS underwriting is less tailored to individual borrower circumstances, which may be a deterrent for complex or transitional properties.

- Market Sensitivity: CMBS loan availability and terms depend on broader credit markets; economic downturns or tightening investor appetite can affect loan pricing or accessibility.

How CMBS Loans Impact Your Investment Strategy

CMBS loans are best suited for investors targeting stabilized, income-producing commercial properties with a strong operating history and predictable cash flow. Their non-recourse nature and competitive interest rates can improve portfolio risk management and enhance long-term returns. However, the trade-off comes in the form of reduced flexibility due to prepayment restrictions and servicing rules, making CMBS loans less attractive for value-add strategies or assets expected to undergo significant operational changes.

Understanding these nuances helps you determine when a CMBS loan aligns with your commercial financing goals, especially if you seek large, fixed-rate, and non-recourse financing for long-term hold in your rental property portfolio. By incorporating CMBS loans strategically, you can diversify your funding sources and optimize capital structure as you scale your commercial real estate investments.

Image courtesy of mingche lee

Private Money and Hard Money Loans: Flexible Financing from Private Lenders

When traditional loans aren’t a fit due to tight qualification requirements, slow approvals, or urgent funding needs, many commercial real estate investors turn to private money and hard money loans. These financing options originate from private individuals or companies rather than conventional banks or government programs. Understanding how private lenders operate, their typical interest rates, loan terms, and when to consider these loans can significantly expand your financing toolkit for rental property investing.

What Are Private Money and Hard Money Loans?

-

Private Money Loans are loans from individual investors or private groups who lend their own capital, often secured by a lien against the commercial property. Terms and costs can vary widely depending on the lender’s appetite and relationship with the borrower.

-

Hard Money Loans are a specialized subset of private money loans provided by professional hard money lenders. These loans are typically more structured, emphasizing the property’s value rather than borrower creditworthiness, and are used primarily for short-term financing needs or properties requiring rehab or repositioning.

Interest Rates and Loan Terms

-

Interest Rates: Private and hard money loans generally come with higher interest rates to compensate for increased risk and quicker access to funds, often ranging from 8% to 15% or more. Unlike traditional loans, rates are rarely subsidized and often include points or upfront fees.

-

Loan Terms: These loans are usually short-term, spanning from 6 months to 3 years. They often require interest-only payments with the principal due in a balloon payment or at the end of the term.

-

Loan-to-Value (LTV): LTV ratios tend to be more conservative, commonly 50% to 70%, reflecting the lender’s reliance on property collateral rather than borrower credit.

When Do Private and Hard Money Loans Make Sense?

Private money and hard money loans best serve investors who:

- Need Fast Funding: Deals requiring rapid closings or competitive bids benefit from private lenders’ streamlined approval processes.

- Have Credit or Income Challenges: Borrowers with less-than-perfect credit or complicated financials can still secure capital when property value is strong.

- Plan Short-Term Holds or Fix-and-Flip Projects: These loans facilitate property renovations, repositioning, or quick resales before refinancing with conventional financing.

- Bridge Financing Gaps: Investors waiting to qualify for traditional loans or sell other assets can bridge liquidity needs with private loans.

- Value Flexible Underwriting: Private lenders often customize terms and are less encumbered by standard bank regulations, allowing creative deal structuring.

Key Considerations for Investors

While private and hard money loans offer flexibility and speed, investors should carefully assess:

- Higher Costs: Elevated interest rates and fees can compress cash flow and reduce returns if held long-term.

- Short Durations: The necessity to refinance or exit quickly demands proactive planning and exit strategies.

- Lender Reliability: Working with reputable private lenders mitigates risks associated with predatory terms or unclear conditions.

- Loan Covenants: Understand all loan restrictions, including prepayment penalties, default triggers, and collateral requirements.

By strategically leveraging private money and hard money loans, commercial real estate investors can unlock opportunities that traditional financing cannot reliably serve—especially in fast-paced markets or for value-add projects. These options provide a critical alternative for building and scaling a rental property portfolio when speed, flexibility, and access to capital outweigh cost concerns.

Image courtesy of Jakub Zerdzicki

Seller Financing and Lease Options: Creative Alternatives to Traditional Lending

When conventional financing sources pose challenges—whether due to credit issues, tight underwriting, or limited capital—seller financing and lease options emerge as powerful alternative tactics in commercial real estate investing. These creative financing strategies can help investors secure properties with flexible terms, reduced upfront costs, and often faster closings, unlocking opportunities that traditional lenders may not accommodate.

How Seller Financing Works and Its Benefits

Seller financing, also known as owner financing, involves the property seller acting as the lender. Instead of the buyer obtaining a commercial loan from a bank, the buyer makes payments directly to the seller based on mutually agreed-upon terms. This method avoids bank underwriting and can be structured to fit both parties’ financial needs.

Key advantages of seller financing include:

- Lower or No Bank Qualification Requirements: Since the seller controls terms, credit and income hurdles are often less strict.

- Flexible Down Payments and Interest Rates: Buyers and sellers negotiate terms tailored for affordability and investment goals.

- Faster Closing Process: Without bank delays, deals can close more quickly, helping investors move fast in competitive markets.

- Opportunity for Negotiating Creative Terms: Including balloon payments, graduated payment schedules, or reduced prepayment penalties.

- Potential Tax Benefits and Streamlined Transfers: Sellers may report installment sale gains, and buyers avoid typical bank fees.

Understanding Lease Options and Their Strategic Use

Lease options, where investors lease a property with an option to purchase it later, provide an alternative path to ownership without immediate financing. This strategy involves paying a lease premium upfront and negotiating the purchase price or terms for exercising the option within a specified timeframe.

Benefits of lease options include:

- Lower Initial Capital Outlay: Investors control a property without full purchase financing upfront.

- Time to Improve Credit or Secure Financing: Use the lease period to strengthen qualifications or attract lenders.

- Test Property Performance Before Commitment: Experience operational aspects and income potential before buying.

- Flexibility to Walk Away or Assign Rights: Allows pivoting strategies if circumstances change.

Negotiation Tips for Maximizing Seller Financing and Lease Options

Successfully structuring seller financing or lease options hinges on clear negotiation and due diligence. Consider these tips:

- Clarify Terms Upfront: Define interest rates, amortization schedules, payment due dates, and any balloon payments or option fees in writing.

- Assess Seller Motivation: Understand why the seller offers financing or lease options—motivations can provide leverage in negotiation.

- Include Protections and Contingencies: Protect yourself with clauses addressing default, property condition, and transferability.

- Consult Legal and Tax Professionals: Ensure contracts meet legal standards and optimize tax implications.

- Build a Win-Win Deal: Align incentives to keep sellers engaged while preserving your investment goals and cash flow.

By incorporating seller financing and lease options into your commercial real estate financing arsenal, you can unlock flexible pathways to property acquisition, especially when traditional loans are restrictive or unavailable. These tactics empower investors to creatively structure deals, conserve capital, and accelerate portfolio growth while maintaining prudent risk management.

Image courtesy of Ivan Samkov

Key Factors to Consider When Choosing Financing

Selecting the right commercial real estate financing option requires more than just comparing interest rates or loan terms. To align financing with your investment objectives and build sustainable, long-term wealth, you must evaluate several key factors that profoundly impact your cash flow, risk exposure, and exit flexibility. Understanding how these elements interplay helps you make strategic decisions tailored to your rental property portfolio’s growth.

Interest Rates and Their Impact on Costs and Returns

The interest rate directly influences your monthly debt service and the overall cost of borrowing. While lower rates are generally preferable, pay close attention to whether rates are fixed or variable, as variable rates may expose you to future payment volatility. Additionally, account for associated fees and points that affect your effective borrowing cost. Balancing interest rate considerations with your risk tolerance and investment horizon ensures manageable financing expenses that support positive cash flow and maximize returns.

Loan-to-Value (LTV) Ratios: Balancing Leverage and Risk

The loan-to-value (LTV) ratio determines how much financing you can obtain relative to the property’s appraised value or purchase price. Higher LTVs offer greater leverage, enabling you to preserve capital and potentially enhance returns. However, elevated LTVs increase lender risk and may result in higher interest rates, stricter covenants, or mortgage insurance requirements. Conservative LTV ratios, typically between 65% and 80% for commercial loans, often provide a safer equity cushion and better refinancing options in the future.

Amortization Schedules: Structuring Your Debt Repayment

The amortization schedule dictates how loan principal and interest payments are spread over the loan term. Fully amortizing loans reduce principal steadily, building equity and simplifying cash flow forecasting. In contrast, loans with balloon payments or interest-only periods lower initial payments but require a lump sum or refinancing at maturity, introducing potential refinancing risk. Selecting an amortization structure aligned with your investment timeline and exit strategy minimizes surprises and supports financial stability.

Loan Covenants: Understanding Restrictions and Obligations

Loan covenants are provisions imposed by lenders to manage risk and protect their investment. These may include financial performance requirements like minimum debt service coverage ratios (DSCR), restrictions on additional debt, limits on property improvements, or requirements for maintaining insurance and reserves. Failing to comply with covenants can trigger default or penalties, so thoroughly reviewing and negotiating these terms upfront ensures your operational flexibility and mitigates unexpected risks.

Exit Strategies: Planning for Loan Maturity and Property Disposition

A clear exit strategy is essential when choosing financing, as it influences loan term selection, prepayment options, and refinancing ability. Consider whether you plan to hold the property long-term for steady cash flow, renovate and sell it within a few years, or leverage it to acquire additional properties. Financing with prepayment penalties or short terms may limit your agility, while options with flexible payoffs facilitate portfolio scaling and tactical repositioning. Aligning your loan structure with your investment exit objectives safeguards your ability to execute timely sales or refinances without incurring excessive costs.

By meticulously evaluating interest rates, LTV ratios, amortization schedules, loan covenants, and your exit strategy, you position yourself to select commercial real estate financing that not only funds your acquisition but also strengthens your overall investment performance and wealth-building roadmap. This comprehensive approach ensures your financing choice optimally supports sustainable growth and maximizes long-term rental property returns.

Image courtesy of Jakub Zerdzicki

Tips for Improving Loan Approval Chances: Preparing, Demonstrating, and Building Relationships

Securing commercial real estate financing often hinges not just on the loan product but on how well you prepare your application, demonstrate strong financials, and build credibility with lenders. Maximizing your chances of loan approval requires proactive, strategic steps that showcase your investment’s viability and your capability as a borrower. Below are essential best practices to position yourself favorably in the eyes of commercial lenders.

1. Prepare Comprehensive and Organized Documentation

Lenders expect thorough financial and property information to accurately assess risk and loan eligibility. Key documents you should have ready include:

- Personal and business tax returns (typically 2-3 years) demonstrating consistent income and profitability.

- Financial statements, including balance sheets and profit and loss reports, to provide insight into your overall financial health.

- Credit reports showcasing strong credit scores and responsible debt management.

- Property operating statements, such as rent rolls, lease agreements, and expense reports, to prove reliable and stable cash flow.

- Appraisals and environmental reports verifying property value and condition.

- A clear business plan or investment strategy describing how the loan fits into your long-term wealth-building goals and how you intend to manage or improve the asset.

Organizing these documents neatly and providing updated, accurate information reduces lender friction during underwriting and enhances your professionalism.

2. Demonstrate Strong and Stable Cash Flow

One of the most critical underwriting criteria for commercial real estate loans is the property’s debt service coverage ratio (DSCR), a measure of the property’s net operating income relative to its debt obligations. Showing consistent positive cash flow, historically and projected, signals to lenders that you can comfortably meet loan payments without stressing operations.

To strengthen this case:

- Maintain and present detailed records of rental income, vacancy rates, and operating expenses.

- Highlight long-term lease agreements and tenant quality to demonstrate income stability.

- If applicable, include professional property management reports to reinforce operational competence.

- Optimize your DSCR by structuring deals with realistic income projections and conservative expense estimates.

3. Build and Maintain Strong Relationships with Lenders

Commercial real estate financing is as much about relationships as it is about numbers. Cultivating trusted connections with lenders can improve your access to capital, speed approvals, and occasionally enable more flexible terms. Consider these relationship-building tactics:

- Establish ongoing communication with loan officers and underwriters even before you need funding.

- Provide transparency and promptly respond to lender requests during the application process.

- Share your investment track record and future plans to build credibility and demonstrate professionalism.

- Work with lenders who specialize in your property type or investment niche to benefit from specialized expertise and tailored products.

- Consider sourcing referrals or leveraging existing professional networks to connect with reputable lenders.

By combining meticulous preparation, clear demonstration of cash flow strength, and genuine lender engagement, you greatly improve your likelihood of approval—unlocking better financing options to accelerate your commercial rental property success.

Image courtesy of RDNE Stock project

Emerging Financing Trends: Crowdfunding Platforms and Fintech Lenders Revolutionizing Commercial Real Estate Finance

In recent years, crowdfunding platforms and fintech lenders have dramatically transformed the landscape of commercial real estate financing, offering innovative alternatives to traditional lending pathways. These emerging financing trends democratize access to capital, streamline underwriting processes, and provide investors with more flexible and diverse funding options tailored to both small-scale and institutional commercial property projects.

Crowdfunding Platforms: Unlocking Capital Through Collective Investment

Real estate crowdfunding leverages digital platforms to pool funds from numerous individual investors, enabling participation in commercial property deals that were traditionally accessible only to large institutions or wealthy investors. Key advantages include:

- Lower Investment Minimums: Many platforms allow investors to commit relatively small amounts, opening doors to commercial real estate ownership for a broader audience.

- Diverse Deal Access: Investors can choose from a variety of property types and investment styles, including equity stakes, debt instruments, or hybrid models.

- Transparency and Ease of Use: Online dashboards offer streamlined access to deal information, performance tracking, and distribution management.

- Passive Investment Opportunities: Ideal for investors who prefer hands-off involvement while diversifying their commercial portfolio.

Popular crowdfunding platforms often conduct rigorous due diligence and work with experienced sponsors, ensuring project quality and risk management, which enhances investor confidence.

Fintech Lenders: Accelerating Financing with Technology-Driven Solutions

Fintech lenders harness advanced algorithms, big data analytics, and automated underwriting systems to provide fast, efficient commercial real estate loans with less paperwork and quicker turnaround times compared to traditional banks. Benefits of fintech financing include:

- Speed of Approval and Funding: Borrowers can receive credit decisions in days rather than weeks or months.

- Flexible Borrower Criteria: Fintech lenders often accommodate a wider range of credit profiles, including emerging investors and non-traditional borrowers.

- Customized Loan Products: Technology enables tailored financing options such as short-term loans, lines of credit, or hybrid structures.

- Improved User Experience: Fully digital application processes reduce friction and enhance transparency throughout the loan life cycle.

Integrating Emerging Financing into Your Investment Strategy

While crowdfunding and fintech lenders offer exciting new options, investors should weigh these sources alongside traditional loans by considering factors such as interest rates, fees, loan terms, and transparency. Combining these innovative financing solutions with conventional methods can optimize capital structure, accelerate portfolio growth, and increase access to deals that align with your long-term commercial real estate wealth-building goals. Staying informed about these trends ensures you remain competitive in an evolving market and leverage the full spectrum of commercial financing opportunities available today.

Image courtesy of lapography