Rental Property Insurance Essentials for Savvy Investors

Category: Real Estate Investing

Master Rental Property Insurance to Protect Your Investment

As a real estate investor focused on building long-term wealth through residential and commercial rental properties, you already understand that protecting your assets is crucial to your success. But navigating the complex world of rental property insurance can feel overwhelming—especially when you’re aiming to optimize coverage while managing costs effectively. If you've found yourself wondering "Which insurance policies do I truly need?" or "How can I safeguard my rental income against unforeseen risks?" you're in the right place. This guide breaks down the essentials of rental property insurance tailored specifically for investors like you. We cut through the jargon to provide clear, actionable insights on the types of policies that matter, how to assess coverage needs based on your property type, and ways to save money without jeopardizing protection. Unlike generic insurance advice, this article is crafted with real estate investors in mind, combining practical strategies with industry knowledge to help you confidently secure your investment portfolio. Keep reading to master rental property insurance essentials that will protect your properties, minimize risk, and safeguard your rental income streams.

- Master Rental Property Insurance to Protect Your Investment

- Understanding Rental Property Insurance: Definition and Importance for Investors

- Types of Rental Property Insurance Policies: Landlord, Commercial, Vacancy, and More

- Key Coverage Components: Property Damage, Liability, Loss of Income, and Additional Riders

- Assessing Your Insurance Needs Based on Property Type: Residential vs. Commercial Rentals

- Common Exclusions and Limitations in Rental Property Insurance to Watch For

- Factors That Affect Premium Costs and How to Get the Best Rates

- How to File a Rental Property Insurance Claim: Step-by-Step Process Tailored for Investors

- Step 1: Assess and Document the Damage Immediately

- Step 2: Notify Your Insurance Company Promptly

- Step 3: Review Your Policy Coverage and Deductibles

- Step 4: Complete and Submit the Claim Form

- Step 5: Coordinate with the Insurance Adjuster

- Step 6: Review the Settlement Offer and Negotiate if Necessary

- Step 7: Approve Repairs and Receive Payment

- Step 8: Follow Up and Close the Claim

- Legal Requirements and Local Regulations Impacting Rental Property Insurance

- Risk Management Strategies Complementing Your Insurance Coverage

- Tips for Choosing the Right Insurance Provider and Policy for Your Investment Goals

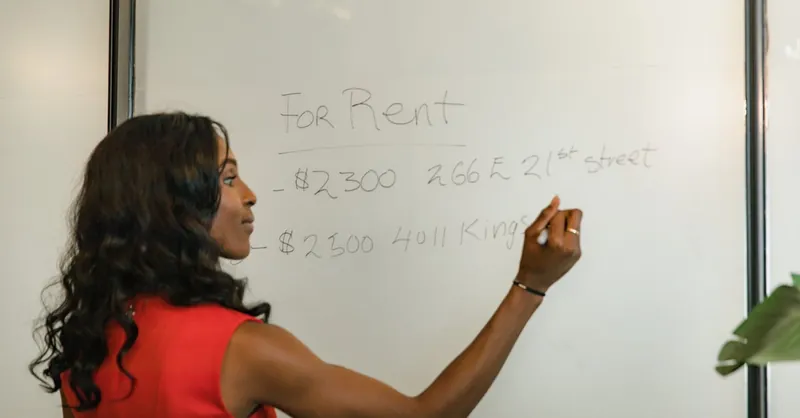

Understanding Rental Property Insurance: Definition and Importance for Investors

Rental property insurance is a specialized type of insurance policy designed to protect real estate investors against financial losses related to their rental properties. Unlike standard homeowners insurance, rental property insurance covers the unique risks associated with leasing residential or commercial real estate to tenants. This coverage extends beyond structural damage to include protection against liability claims, loss of rental income, and tenant-related damages, making it a critical component of a successful investment strategy.

For investors focused on building long-term wealth, understanding the importance of rental property insurance is essential. Property damage from fire, storms, vandalism, or tenant negligence can lead to costly repairs and loss of income during vacancy periods. Liability claims—such as injuries occurring on your rental property—can expose investors to lawsuits with significant financial repercussions. Furthermore, without appropriate insurance, unexpected events can severely impact your cash flow and overall return on investment (ROI). By securing comprehensive rental property insurance, investors not only protect their physical assets but also ensure business continuity, safeguard rental income streams, and maintain portfolio stability, which are all crucial steps toward sustainable wealth accumulation in real estate.

Image courtesy of Mikhail Nilov

Types of Rental Property Insurance Policies: Landlord, Commercial, Vacancy, and More

When it comes to protecting your rental portfolio, understanding the different types of rental property insurance policies available is key to selecting the right coverage for your specific investment needs. Each policy type is designed to address unique risks associated with various rental property scenarios, whether you own a single-family home, a multi-unit residential building, or commercial real estate.

1. Landlord Insurance

Also known as dwelling fire insurance, landlord insurance is the most common policy for residential rental properties. It covers the structure itself, protects against losses from fire, storms, vandalism, and often includes liability coverage if tenants or visitors are injured on the property. Importantly, landlord policies can also include loss of rental income insurance, which compensates for lost rent during periods when the property is uninhabitable due to covered perils.

2. Commercial Property Insurance

For investors with commercial rental properties—such as office buildings, retail spaces, or industrial facilities—commercial property insurance offers broader protection. It covers physical damages from a wide range of risks including fire, theft, and natural disasters, and typically incorporates more extensive liability protection due to the higher risk exposures in commercial settings. Coverage limits and policy terms can be customized based on the size, use, and location of the property.

3. Vacancy Insurance

Many standard landlord or commercial policies exclude coverage if your rental property remains vacant for an extended period, usually 30 to 60 days. That’s where vacancy insurance becomes critical. This specialized policy or endorsement ensures your property is still protected from vandalism, fire, and other damages even when no tenants are occupying it. Vacancy insurance is particularly important when you’re renovating a property, repositioning it in the market, or experiencing longer tenant turnover periods.

4. Additional and Specialized Policies

Depending on your portfolio and risk profile, you may also consider:

- Umbrella Insurance: Adds an extra layer of liability protection beyond your primary policy limits.

- Rent Guarantee Insurance: Covers lost rental income in case tenants fail to pay.

- Equipment Breakdown Insurance: Protects against mechanical failures in HVAC, plumbing, or electrical systems.

- Flood and Earthquake Insurance: Necessary in areas prone to these natural disasters, often excluded from standard policies.

By familiarizing yourself with these insurance types, you can more effectively tailor your coverage to protect the physical assets, income streams, and liability exposures inherent in your rental property investments. Evaluating your property types, tenant situations, and local risks will guide you toward a robust insurance strategy that secures your portfolio for long-term wealth building.

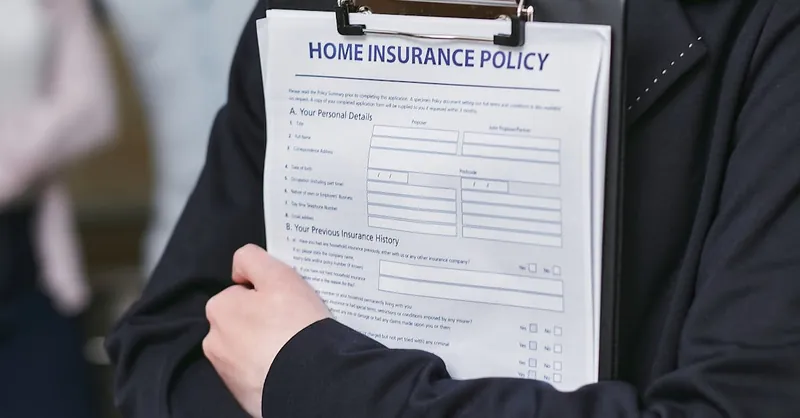

Image courtesy of RDNE Stock project

Key Coverage Components: Property Damage, Liability, Loss of Income, and Additional Riders

When securing rental property insurance, understanding the key coverage components is essential to ensure comprehensive protection for your investment. These components address the spectrum of risks rental properties face, helping investors avoid costly surprises and safeguard long-term rental income.

1. Property Damage Coverage

At the core of any rental property insurance policy is property damage coverage. This protects the physical structure of your rental property from perils such as fire, windstorms, hail, vandalism, and certain natural disasters. Coverage typically includes the building itself, permanent fixtures, and sometimes detached structures like garages or sheds. For landlords, it’s vital to verify that your policy covers repairs or rebuilding costs to restore your property to its pre-loss condition without excessive out-of-pocket expenses.

2. Liability Coverage

Liability insurance shields you from financial loss if someone is injured on your property or if you’re held legally responsible for damages caused by your rental operations. This can include tenant injuries due to unsafe conditions, third-party property damage caused by your tenants, or lawsuits arising from your management practices. Strong liability coverage is a must-have protection, helping you cover legal fees, medical costs, and settlements, thereby protecting your personal assets and investment portfolio from potential lawsuits.

3. Loss of Income Coverage

Also called rental income protection or business interruption insurance, this coverage reimburses lost rental income if your property becomes uninhabitable due to a covered event, like fire or severe storm damage. Since rental income often funds mortgage payments and other expenses, loss of income insurance is critical for maintaining cash flow and avoiding financial strain during repairs. Investors should confirm the length of coverage and any waiting periods to ensure it aligns with their financial resilience.

4. Additional Riders and Endorsements

To tailor your insurance policy to the specific risks of your rental properties, consider adding riders or endorsements. These optional coverages expand protection beyond standard limits, such as:

- Vandalism and Theft Rider: Offers enhanced coverage for intentional damage or stolen property.

- Equipment Breakdown Coverage: Protects costly systems like HVAC, electrical, or plumbing from mechanical failure.

- Legal Expense Coverage: Helps with the costs associated with eviction proceedings or tenant disputes.

- Flood and Earthquake Endorsements: Essential in high-risk geographic areas where natural disaster coverage is excluded from standard policies.

By strategically combining these key components—property damage, liability, loss of income, and additional riders—you create a robust insurance shield that minimizes risks and maximizes the security of your rental property investment. This comprehensive approach empowers real estate investors to focus on growing their portfolios with confidence, knowing their assets and income streams are well protected.

Image courtesy of Mikhail Nilov

Assessing Your Insurance Needs Based on Property Type: Residential vs. Commercial Rentals

When it comes to rental property insurance, the type of property you own—residential or commercial—significantly influences the coverage requirements and risk exposures you must address. Understanding these differences is crucial for customizing your insurance strategy to adequately protect your investment and optimize premiums.

Residential Rentals: Single-Family Homes to Multi-Unit Properties

For residential rental properties, including single-family homes, duplexes, and small multi-unit buildings, landlord insurance policies are typically sufficient when properly tailored. These policies focus on:

- Structural protection against common perils such as fire, wind, and vandalism

- Liability coverage for tenant or visitor injuries on-site

- Loss of rental income if the property becomes temporarily uninhabitable

- Coverage for detached structures like garages or fences

Because residential tenants generally create lower risk profiles compared to commercial tenants, liability limits on residential policies tend to be lower. However, investors should still evaluate neighborhood crime rates, vacancy durations, and property conditions to determine if enhanced coverage or endorsements—such as vandalism protection or legal expense riders—are necessary.

Commercial Rentals: Office, Retail, and Industrial Spaces

By contrast, commercial rental properties require a more comprehensive insurance approach due to their distinct liability exposures, usage, and tenant operations. Factors that necessitate specialized commercial property insurance include:

- Higher potential for property damage caused by varied tenant activities (e.g., heavy machinery, public foot traffic)

- Increased liability risks from customers, employees, and contractors present on-site

- Potential need for business interruption insurance tailored to longer or more complex repair periods

- Customizable coverage limits reflecting the value and use of commercial real estate

Commercial policies often come with broader definitions of covered perils and higher coverage limits but also involve stricter underwriting standards. Assessing tenant operational risks, location-specific hazards, and property value is key to selecting the right coverage.

Tailoring Insurance Based on Your Property Portfolio Mix

Investors who hold a mixed portfolio benefit from segmenting insurance policies based on property type rather than applying a one-size-fits-all approach. Key tips include:

- Conduct a property-by-property risk assessment: Evaluate physical condition, tenant profile, and vacancy risk.

- Consult with insurers specializing in your property types: Residential-focused insurers versus commercial insurance brokers.

- Review policy exclusions carefully: Commercial and residential policies differ in what they exclude (e.g., vacancy clauses can vary).

- Consider standalone endorsements or umbrella policies: To address unique risks without overpaying for blanket coverage.

By accurately assessing your insurance needs through the lens of residential versus commercial rental property characteristics, you can craft an optimized protection plan that balances cost against comprehensive risk mitigation—helping you preserve and grow your wealth in real estate investing.

Image courtesy of Jakub Zerdzicki

Common Exclusions and Limitations in Rental Property Insurance to Watch For

While rental property insurance provides essential protection, understanding common exclusions and limitations is critical to avoid unexpected gaps in your coverage. Insurance policies often include specific scenarios, property conditions, or risks that are not covered by default. As a real estate investor, being aware of these exclusions ensures you can proactively seek additional endorsements or alternative coverage to fully safeguard your rental properties.

Typical Exclusions in Rental Property Insurance

-

Wear and Tear or Maintenance Issues

Standard policies generally exclude damage caused by normal wear and tear, neglect, or lack of regular maintenance. This means issues like roof deterioration, plumbing leaks due to aging pipes, or gradual mold growth are the landlord’s responsibility to repair. Regular upkeep is essential to prevent costly out-of-pocket expenses and potential coverage denials. -

Flood and Earthquake Damage

Most rental property insurance policies exclude flood and earthquake damage unless purchased as separate endorsements or standalone policies. If your property is located in a floodplain or seismic zone, obtaining specialized flood or earthquake insurance is vital to protect against these high-risk natural disasters. -

Vacancy Periods Beyond Policy Limits

Many landlord and commercial policies restrict coverage if a property remains vacant for more than 30 to 60 days. During extended vacancy, the risk of vandalism, theft, or unnoticed damage increases, yet claims for such damages may be denied unless you have vacancy insurance specifically designed to cover these periods. -

Intentional Damage and Illegal Activities

Damage resulting from intentional acts by tenants or illegal activities occurring on the property may be excluded. This limitation underscores the importance of thorough tenant screening and clear lease agreements to minimize risks that could lead to denied claims. -

Certain High-Value Personal Property and Tenant Belongings

Rental property insurance typically covers only the structure and landlord-owned property, not tenants’ personal belongings. Additionally, high-value items owned by the landlord—such as appliances or furnishings in furnished rentals—may require separate scheduled personal property endorsements to ensure adequate protection.

Limitations to Coverage Amounts and Conditions

-

Coverage Limits and Sub-limits: Policies have maximum payout limits per claim and per coverage category. Review these limits carefully to confirm they align with your property’s replacement cost and liability exposure, and consider umbrella insurance to expand liability coverage beyond standard limits.

-

Deductibles and Waiting Periods: Understand your policy’s deductibles—the out-of-pocket amount you must pay before coverage kicks in—as well as any waiting periods, especially for loss of income claims. Higher deductibles lower premiums but can increase your immediate costs after a claim event.

-

Excluded Perils and Conditions: Beyond flood and earthquake, some policies exclude risks such as landslides, war, nuclear events, or mold unless specifically endorsed. Clarify these with your insurer to avoid surprises when filing claims.

By carefully reviewing common exclusions and limitations in rental property insurance, you can identify coverage gaps that might expose you to significant financial risks. Proactively addressing these through targeted endorsements, additional policies, or improved property management practices will enhance your overall insurance strategy—ensuring your rental investments remain protected under a wide array of potential scenarios. This vigilance ultimately contributes to more stable, predictable returns as you build long-term wealth in real estate.

Image courtesy of Helena Jankovičová Kováčová

Factors That Affect Premium Costs and How to Get the Best Rates

Understanding the factors that influence rental property insurance premiums is essential for real estate investors aiming to strike a balance between comprehensive coverage and cost efficiency. Insurance companies evaluate various risk elements to determine your policy’s price, so becoming familiar with these can help you make strategic decisions to lower premiums without compromising protection.

Key Factors Affecting Rental Property Insurance Premiums

-

Property Location

Insurance premiums heavily depend on your property’s geographic location. Properties in areas prone to natural disasters (floods, hurricanes, earthquakes), high crime rates, or with limited access to fire services typically incur higher insurance costs. Additionally, urban versus rural settings may affect premiums due to differences in risk exposure. -

Property Type and Construction

The type of rental property—residential or commercial—and its construction materials impact risk and pricing. For example, brick or concrete buildings often attract lower premiums due to increased durability compared to wood-frame structures. Older properties with dated wiring or plumbing may raise risk assessments, leading to higher costs. -

Coverage Limits and Deductibles

Higher coverage limits and lower deductibles increase premium prices, as the insurer’s potential payout rises. Conversely, opting for higher deductibles can reduce your premium but means larger out-of-pocket expenses when claims occur. Balancing these options based on your financial capacity is key. -

Claims History and Tenant Profile

Properties with a history of frequent claims or those leased to tenants with poor rental backgrounds can face elevated premiums. Insurers consider prior damages, losses, or tenant-caused incidents to assess risk. Implementing thorough tenant screening and maintaining the property well can positively influence your premium rates. -

Security and Risk Mitigation Measures

Installing security systems such as alarms, smoke detectors, fire sprinklers, deadbolt locks, or surveillance cameras demonstrates proactive risk management and often leads to premium discounts. Similarly, maintaining a low vacancy rate and regularly updating property condition signals reduced risk to insurers.

Tips to Secure the Best Rental Property Insurance Rates

-

Compare Multiple Quotes: Shop around and request quotes from various insurers specializing in rental property insurance to find competitive pricing aligned with your coverage needs.

-

Bundle Policies: If you own multiple rental properties or have other insurance needs (e.g., personal home, auto), bundling policies with one insurer can lead to significant discounts.

-

Maintain a Claims-Free History: Avoid minor claims when possible by handling small repairs out-of-pocket to keep your claims history clean and premiums favorable.

-

Enhance Property Security: Invest in approved security and fire protection systems that qualify you for insurer discounts.

-

Review and Update Coverage Annually: Periodically reassess your insurance policies to adjust limits, remove unnecessary riders, or add new coverage reflecting changes in your portfolio or market conditions.

By carefully managing these factors and adopting a proactive insurance strategy, rental property investors can effectively reduce premium costs while maintaining optimal protection for their residential and commercial assets. This disciplined approach to insurance expense management supports stronger cash flow and contributes to building sustainable long-term wealth through real estate investing.

Image courtesy of Mikhail Nilov

How to File a Rental Property Insurance Claim: Step-by-Step Process Tailored for Investors

Filing an insurance claim for your rental property can seem daunting, but understanding the step-by-step process will help you navigate it efficiently and maximize your chances of a successful payout. As a real estate investor, timely and accurate claims handling is critical to minimizing financial disruption and protecting your rental income stream. Here’s a clear, practical guide tailored specifically to rental property insurance claims:

Step 1: Assess and Document the Damage Immediately

- Ensure safety first — Make sure the property is safe before entering or allowing any repairs, especially after fire, flood, or structural damage.

- Document every detail — Take comprehensive photos and videos of the damage from multiple angles, including structural issues, property contents, and any tenant belongings affected (if applicable).

- Create an itemized list of damaged items, repairs needed, and estimated costs. This documentation is crucial evidence when filing your claim.

Step 2: Notify Your Insurance Company Promptly

- Contact your insurance provider as soon as possible after discovering the damage. Timely notification is usually required under policy terms.

- Provide initial details about the incident, date, cause (if known), and extent of damage. Request specific instructions for the claim process from your insurer.

Step 3: Review Your Policy Coverage and Deductibles

- Before proceeding, confirm the covered perils and limits relevant to your claim (e.g., fire, vandalism, theft) to set realistic expectations.

- Know your deductible amount that you’ll be responsible for paying before insurance benefits apply.

Step 4: Complete and Submit the Claim Form

- Fill out the insurance claim form carefully and thoroughly, including all requested documentation such as photos, repair estimates, police reports (if applicable), and tenant communications related to the claim.

- Keep copies of every submission for your records.

Step 5: Coordinate with the Insurance Adjuster

- An insurance adjuster will likely be assigned to inspect the property physically or virtually. Be available to guide them through the damage, answer questions, and provide your documentation.

- The adjuster’s report heavily influences the claim settlement, so clear communication and detailed evidence are essential.

Step 6: Review the Settlement Offer and Negotiate if Necessary

- Upon receiving your insurer’s settlement offer, review it carefully to ensure it aligns with your documented damages and policy terms.

- If the offer is lower than expected, you have the right to negotiate. Provide additional evidence or seek professional damage assessments to support your case.

Step 7: Approve Repairs and Receive Payment

- Once satisfied with the settlement, approve the repair work. Payments are usually disbursed based on estimated repair costs, sometimes in installments as work progresses.

- Use licensed contractors and keep receipts, as your insurer may request proof of repair expenses.

Step 8: Follow Up and Close the Claim

- Maintain communication with your insurer until all repairs are fully covered and the claim is officially closed.

- Keep all records related to the claim for future reference and tax purposes.

By following this step-by-step claim process tailored for rental property investors, you ensure claims are handled professionally and promptly, minimizing downtime and financial impact. Proper documentation, timely filing, and clear communication with your insurer are your strongest tools for a smooth claims experience, helping preserve your rental income and protect your long-term real estate investment success.

Image courtesy of Jakub Zerdzicki

Legal Requirements and Local Regulations Impacting Rental Property Insurance

Navigating the legal requirements and local regulations surrounding rental property insurance is vital for real estate investors to ensure compliance while adequately protecting their assets. Insurance mandates can vary significantly depending on your jurisdiction, influencing the types and amounts of coverage you are legally required to maintain. Understanding these legal frameworks not only helps avoid penalties and fines but also aligns your insurance strategy with local market norms and risk exposures.

State and Local Insurance Mandates

Many states and municipalities impose minimum insurance coverage requirements for landlords and commercial property owners. These may include:

- Mandatory liability coverage limits to protect tenants and visitors from injuries on the property.

- Requirements for property damage insurance to guarantee that buildings can be repaired or rebuilt in case of disasters.

- Specific directives around rent loss or business interruption insurance, especially in commercial real estate sectors.

Failing to meet these minimum requirements can result in legal penalties, financial liability for uncovered damages, or complications when trying to enforce lease agreements.

Building Codes and Safety Regulations Affecting Insurance

Local building codes and safety regulations directly impact insurance underwriting and coverage conditions. For example:

- Up-to-date adherence to fire safety codes, electrical standards, and accessibility laws can reduce insurance premiums and eliminate coverage exclusions.

- Properties lacking required safety features such as smoke detectors, fire extinguishers, or secure exits may face limited liability protection or higher deductibles in claims.

- Some jurisdictions mandate specific disaster resilience standards (e.g., hurricane-resistant windows or seismic retrofitting) that insurers consider in risk assessments.

Ensuring your rental properties comply with current codes mitigates risk and aligns your insurance policies with local legal frameworks, ultimately protecting your investment.

Licensing and Registration Requirements

In several regions, landlords must register rental properties or obtain licenses which can include proof of appropriate insurance coverage. This administrative step often requires:

- Verification of active insurance policies covering both property damage and liability.

- Periodic renewal and documentation submission to local housing authorities or regulatory bodies.

- Compliance with tenant protection laws, which can influence the scope of mandated insurance, including coverage for habitability and tenant safety.

Meeting these stipulations protects you from administrative fines and legal disputes, while signaling responsible ownership that can positively impact tenant relations and insurer evaluations.

Navigating HOA and Commercial Lease Insurance Obligations

If your rental property falls within a Homeowners Association (HOA) or tenant-governed commercial complex, additional insurance responsibilities typically arise:

- HOAs may require landlords to carry certain minimum coverages and provide proof to the association each year.

- Commercial leases often stipulate specific insurance conditions that tenants must comply with or carry complementary insurance to protect shared risks.

Properly reviewing and fulfilling these contractual and regulatory insurance obligations prevents conflicts, protects your liability exposure, and ensures smooth operational relationships.

By thoroughly understanding and adhering to local legal requirements and regulations impacting rental property insurance, investors can optimize coverage choices, maintain compliance, and safeguard their real estate portfolios from preventable risks and liabilities. This legal awareness complements your broader insurance strategy, reinforcing the protection needed to build and sustain long-term wealth in residential and commercial rental property investing.

Image courtesy of Mikhail Nilov

Risk Management Strategies Complementing Your Insurance Coverage

While comprehensive rental property insurance forms the backbone of protecting your real estate investments, integrating proactive risk management strategies significantly enhances your overall defense against financial losses. Effective risk management not only reduces the likelihood of insurance claims but also helps maintain lower premiums, preserves property value, and stabilizes rental income—key factors for building sustainable long-term wealth.

Key Risk Management Practices for Rental Property Investors

-

Thorough Tenant Screening

Selecting reliable tenants with solid credit histories, stable incomes, and positive rental references is essential. Conduct background checks, verify employment, and assess rental histories to minimize risks related to non-payment, property damage, or legal disputes. Strong tenant screening reduces costly evictions and claims arising from tenant negligence or misconduct. -

Regular Property Maintenance and Inspections

Proactively maintaining your rental properties prevents deterioration and mitigates hazards that could lead to damage or liability claims. Schedule routine inspections to identify issues like faulty wiring, plumbing leaks, mold growth, or structural weaknesses before they escalate. Well-maintained properties enhance tenant satisfaction, reduce vacancy rates, and demonstrate responsible ownership to insurers. -

Implementing Safety and Security Measures

Installing smoke detectors, carbon monoxide alarms, secure locks, external lighting, and even security cameras helps prevent accidents, theft, and vandalism. These safety measures not only protect tenants and property but often qualify you for insurance discounts. Clear safety protocols and tenant education further reduce incidents that could trigger liability claims. -

Clear Lease Agreements and Legal Compliance

Well-drafted leases that clearly define tenant responsibilities, permissible uses, and maintenance obligations limit disputes and potential liabilities. Ensure compliance with local landlord-tenant laws, safety codes, and HOA rules to avoid regulatory penalties or insurance coverage issues. Consult legal professionals to keep agreements up-to-date with evolving regulations.

By systematically integrating these risk management strategies alongside your tailored insurance policies, you create a powerful synergy that mitigates exposure to losses and enhances your ability to weather unforeseen events. This holistic approach to risk reduction and insurance coverage is crucial for safeguarding your rental property investments, sustaining steady rental income, and ultimately accelerating your journey toward long-term wealth in residential and commercial real estate.

Image courtesy of RDNE Stock project

Tips for Choosing the Right Insurance Provider and Policy for Your Investment Goals

Selecting the right insurance provider and rental property insurance policy is a critical step in protecting your real estate investments and aligning coverage with your long-term wealth-building strategy. With numerous insurers, policy options, and coverage nuances in the market, making an informed choice requires a balance of thorough research, risk understanding, and cost considerations.

Evaluate Providers Based on Expertise and Reliability

- Choose insurers specializing in rental property and landlord insurance. Providers with real estate investment experience better understand the unique risks of both residential and commercial rental properties, offering tailored coverage options and claims support.

- Research financial strength and reputation. Opt for insurance companies with high ratings from agencies like A.M. Best, Standard & Poor’s, or Moody’s to ensure claim payments will be dependable when you need them most.

- Assess customer service and claims processing efficiency. Reading verified reviews and seeking referrals from fellow investors can reveal how responsive and fair an insurer is, especially in the potentially stressful claim aftermath.

Align Policy Features with Your Investment Risk Profile and Goals

- Match coverage types and limits to your property portfolio. If you own commercial properties with higher liability exposure, select policies offering substantial liability limits and comprehensive coverage, including specialized riders. For longer vacancy periods, ensure your policy includes or allows vacancy insurance endorsements.

- Prioritize loss of income coverage aligned with your cash flow needs. Rental income interruptions can quickly impact your financial stability; therefore, confirming terms, waiting periods, and benefit durations is essential to mitigate income loss effectively.

- Consider policy flexibility and scalability. As your portfolio grows or changes, working with a provider offering customizable policies and easy updates can save time and prevent insurance gaps.

Compare Quotes Beyond Premium Costs

- Investigate deductibles, exclusions, and coverage limits carefully. The cheapest premium may come with higher out-of-pocket costs or insufficient protection, which can be detrimental in significant loss events.

- Look for available discounts and bundling options. Many insurers offer reduced rates if you bundle multiple properties or combine landlord insurance with other policies like auto or personal homeowner’s insurance.

- Request detailed explanations of policy terms. Ensure you fully understand the fine print, including what claims might be excluded, as this knowledge empowers better decision-making.

By systematically evaluating insurance providers on their specialization, financial stability, customer service, and aligning policy features to your specific investment risk profile and goals, you can secure a comprehensive rental property insurance plan that protects assets, stabilizes cash flow, and supports your journey to sustained real estate wealth. This strategic approach not only optimizes your insurance investment but also mitigates risks that could otherwise derail your long-term rental property success.

Image courtesy of Mikhail Nilov