Long-Term vs Short-Term Rental Strategies: Which Builds Wealth Best?

Category: Real Estate Investing

Mastering Long-Term vs Short-Term Rental Strategies for Real Estate Wealth

If you're an aspiring or current real estate investor striving to build lasting wealth through rental properties, you’ve likely grappled with the pivotal decision: should you focus on long-term or short-term rental strategies? Whether you’re investing in residential homes, commercial buildings, or mixed-use properties, this choice shapes your cash flow, management style, and ultimately your returns. Perhaps you’ve scoured countless articles, forums, and YouTube videos, yet still feel overwhelmed by conflicting advice or unclear evaluations of risks and benefits. This post is crafted precisely for investors like you who need clear, actionable insights - cutting through the noise to compare long-term and short-term rentals side-by-side.

We’ll dive into key topics like income stability, occupancy rates, operational demands, market trends, and tax implications. Moreover, this guide uniquely blends practical considerations for both residential and commercial properties, helping you tailor strategies to your investment goals and personal tolerance for management intensity. By the end, you’ll confidently understand which rental approach aligns with your wealth-building objectives, enabling you to make smarter, more profitable real estate decisions. Ready to demystify these rental models and amplify your portfolio’s growth? Let’s get started.

- Mastering Long-Term vs Short-Term Rental Strategies for Real Estate Wealth

- Understanding Rental Property Investing: Defining Long-Term vs Short-Term Rentals

- Income Stability and Cash Flow Comparison

- Operational and Management Considerations: Long-Term vs Short-Term Rentals

- Market and Location Suitability: Urban vs Rural, Tourism Appeal, and Commercial Hubs

- Legal and Regulatory Frameworks Influencing Long-Term and Short-Term Rental Strategies

- Financial Metrics and ROI Analysis: Comparing Long-Term vs Short-Term Rental Strategies

- Tax Implications and Benefits: Long-Term vs Short-Term Rental Strategies

- Risk Management and Exit Strategies: Safeguarding Your Investment and Flexibility in Rental Approaches

- Case Studies: Success Stories and Pitfalls in Long-Term and Short-Term Rental Investing

- Choosing the Right Strategy for Your Investment Goals

Understanding Rental Property Investing: Defining Long-Term vs Short-Term Rentals

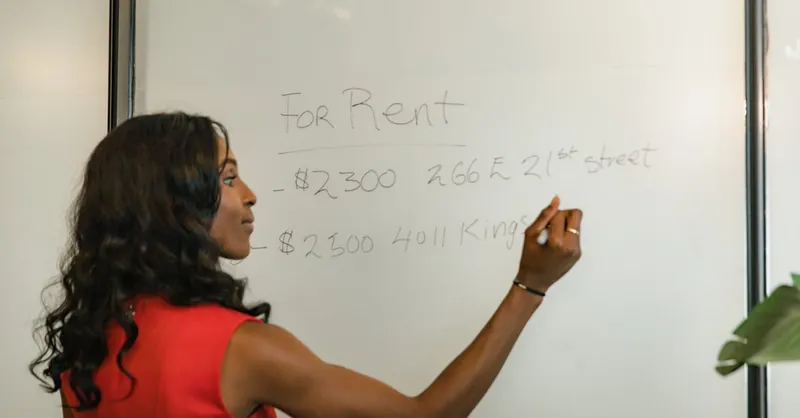

When navigating the rental property market, grasping the fundamental differences between long-term and short-term rental strategies is critical for aligning your investment approach with your financial goals. Long-term rentals typically involve leases lasting six months to one year or more, offering tenants stability and landlords a more predictable income stream. Examples in the residential market include single-family homes or apartment units leased to families or professionals under annual agreements. In commercial real estate, long-term leases often span several years and are common for office spaces, retail storefronts, or industrial units, where tenants seek extended occupancy to support business operations.

Conversely, short-term rentals operate on stays from a few days up to several weeks, catering mainly to travelers, temporary workers, or those seeking flexible housing solutions. This model gained prominence through platforms like Airbnb and VRBO, transforming residential properties in vacation hotspots or urban centers into lucrative short-term rentals. In commercial sectors, short-term leasing can include coworking spaces or pop-up retail units rented on a daily or weekly basis, appealing to entrepreneurs and seasonal businesses. Understanding these timeframes and use cases is essential because the duration of tenancy influences cash flow stability, maintenance demands, and tenant turnover, all of which impact your return on investment and property management intensity.

Image courtesy of Louie Alma

Income Stability and Cash Flow Comparison

When evaluating long-term vs short-term rental strategies, a crucial factor for investors is how each affects income stability and cash flow. Long-term rentals often provide a steady, predictable monthly income with lower vacancy risks, thanks to leases that typically span six months to multiple years. This consistency makes long-term rentals attractive for those prioritizing reliable cash flow and easier financial planning. Additionally, long-term tenants tend to generate fewer turnovers, reducing the costs and downtime associated with vacancy and property turnover, which can further stabilize your revenue stream.

On the other hand, short-term rentals can offer significantly higher rental yields per unit by charging premium nightly or weekly rates, especially in high-demand urban, vacation, or commercial hub locations. However, this potential for increased income comes with greater exposure to vacancy fluctuations and seasonality factors, including periods of low tourism or business travel, which can cause irregular cash flow. Furthermore, short-term rentals often require more hands-on management to maintain high occupancy rates and clean, attractive spaces for frequent guest turnover. This variability in income and operational demands means short-term rental investors must carefully analyze local market trends, competition, and seasonal demand cycles to optimize cash flow and minimize vacancy gaps.

To summarize the key differences:

| Aspect | Long-Term Rentals | Short-Term Rentals |

|---|---|---|

| Income Stability | High – steady, predictable monthly income | Variable – income fluctuates with bookings and seasonality |

| Vacancy Risk | Lower – longer lease terms reduce turnover | Higher – frequent vacancy between bookings |

| Seasonal Impact | Minimal – stable occupancy throughout year | Significant – demand often peaks and dips seasonally |

| Cash Flow Potential | Moderate – consistent but often lower yields | Higher – premium pricing can boost returns |

| Management Intensity | Lower – fewer tenant turnovers and maintenance | Higher – frequent cleaning and guest communication |

By weighing these factors, investors can better align their rental strategy with their risk tolerance and income goals, whether seeking reliable cash flow or aiming for maximized returns with flexibility.

Image courtesy of Jakub Zerdzicki

Operational and Management Considerations: Long-Term vs Short-Term Rentals

When comparing long-term and short-term rental strategies, understanding the operational and management differences is key to choosing an approach that fits your lifestyle and investment objectives. Each model presents distinct challenges and responsibilities for landlords, especially in tenant screening, turnover rates, maintenance demands, and property management involvement.

Landlord Responsibilities and Tenant Screening

In long-term rentals, landlords typically have more extensive responsibilities regarding tenant vetting and lease enforcement. Screening involves background checks, credit history, employment verification, and references to ensure tenants are reliable and likely to honor a lease lasting six months to multiple years. This rigorous process reduces risks of late payments or property damage. Once tenants are secured, the landlord's role often shifts toward regular but less frequent interactions focused on rent collection and property upkeep.

Conversely, short-term rentals attract a high volume of transient tenants, requiring landlords or property managers to be vigilant about guest screening primarily through platform reviews and identity verification rather than traditional credit checks. The turnover rate is much higher, with guests staying from a few days to weeks, necessitating constant marketing efforts, rapid communication, and handling bookings efficiently to maintain occupancy.

Turnover Rates and Maintenance Demands

Turnover rates in short-term rentals can be dozens or even hundreds of times greater annually compared to long-term leases, which usually have one tenant per year or multiple years. This high turnover translates to frequent cleaning, inspections, key exchanges, property inspections, and repairs between stays, dramatically increasing operational workload and costs. Additionally, wear and tear accumulate faster due to a variety of guests using the property in diverse ways.

In contrast, long-term rentals experience lower turnover, reducing the frequency and expense of cleaning and maintenance turnover. However, landlords should budget for occasional repairs and routine maintenance to keep properties tenant-ready and compliant with safety standards.

Property Management Involvement

Many investors prefer hiring professional property management for both rental types but for different reasons and extents. In long-term rentals, property managers handle tenant placement, rent collection, lease enforcement, and periodic inspections, streamlining operations especially for out-of-area investors.

For short-term rentals, property management often entails a more hands-on role including guest communications, dynamic pricing optimization, cleaning coordination, and marketing across multiple platforms. Some specialists focus exclusively on short-term rentals to navigate ever-changing platform policies and local regulations effectively.

In summary, long-term rentals typically demand less intensive day-to-day management but require diligent tenant screening and lease oversight, fostering steady operations with fewer turnovers. Short-term rentals offer potentially higher returns but come with heightened operational complexity, requiring active management, frequent maintenance, and agile tenant relations to maximize occupancy and profitability. Understanding these operational and management considerations helps investors allocate time, resources, and capital efficiently to build sustainable rental property wealth.

Image courtesy of Ivan Samkov

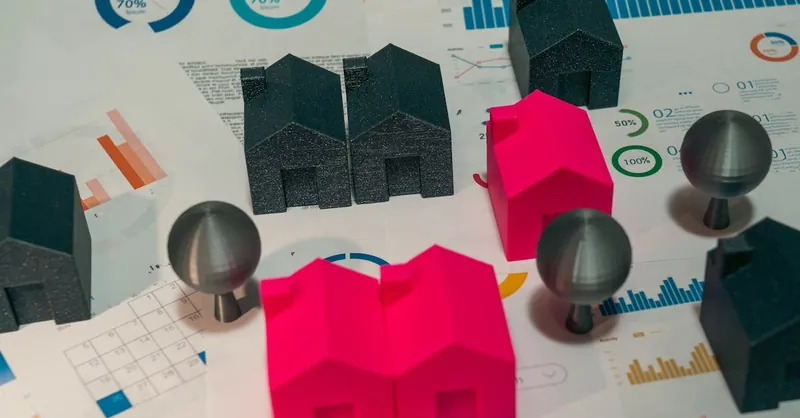

Market and Location Suitability: Urban vs Rural, Tourism Appeal, and Commercial Hubs

Selecting the right market and location is pivotal when determining whether a long-term or short-term rental strategy will yield optimal profitability and sustainability. Different location characteristics dramatically influence demand patterns, rental rates, occupancy, and guest or tenant profiles, making this analysis indispensable for savvy investors.

Urban vs. Rural Settings

-

Urban locations typically favor short-term rentals due to higher tourist influx, business travel, and event-driven stays. Cities host diverse attractions, corporate headquarters, and transportation hubs that generate consistent demand for flexible, short-duration lodging. Additionally, urban centers often have robust infrastructure and amenities appealing to short-term guests willing to pay premium nightly rates. However, urban markets may also face stricter municipal regulations on short-term rentals and higher competition among hosts.

-

In contrast, rural or suburban areas often align better with long-term rentals, primarily serving residents seeking affordable, stable housing away from city centers. These locations appeal to families and remote workers looking for community-focused living with lower rent costs. Short-term rentals in rural areas can succeed in niche markets like vacation cabins or seasonal retreats, but they tend to be highly seasonal and demand careful timing to maximize occupancy.

Impact of Tourism Appeal

Areas with strong tourism appeal—such as beach towns, ski resorts, or cultural hotspots—present excellent opportunities for short-term rental strategies. These markets attract visitors year-round or seasonally who prefer flexible stays close to attractions. High seasonal demand allows investors to capitalize on peak pricing and achieve strong cash flow during busy periods. However, off-season vacancies can be a setback without diversified rental approaches or sound financial buffers.

Conversely, locations with limited tourism but stable local economies and employment centers usually support long-term rentals better, as the tenant pool consists mainly of residents needing extended housing solutions rather than transient visitors.

Commercial Hubs and Mixed-Use Districts

In commercial real estate, proximity to business districts and commercial hubs influences lease terms and tenant types significantly. Properties in these zones tend to attract long-term commercial tenants such as corporate offices, retail stores, or healthcare providers who require predictable spaces for extended periods, often secured by multi-year leases offering landlords consistent rental income.

However, in urban mixed-use districts, short-term leasing models like coworking spaces, pop-up shops, or event venues are gaining traction. These shorter lease periods cater to emerging business trends demanding flexibility and scalability. Investors contemplating short-term commercial rentals must meticulously assess local demand drivers and regulatory environments to avoid pitfalls.

Assessing market and location suitability based on these characteristics ensures that investors choose rental strategies optimized for local dynamics—balancing income potential with operational feasibility for both residential and commercial properties. Understanding these nuances helps maximize occupancy, rental rates, and long-term wealth building in real estate investing.

Image courtesy of RDNE Stock project

Legal and Regulatory Frameworks Influencing Long-Term and Short-Term Rental Strategies

Navigating the legal and regulatory landscape is a critical step for investors deciding between long-term and short-term rental strategies. Both approaches are subject to various laws, zoning restrictions, licensing requirements, and tax regulations that can significantly impact profitability and operational feasibility.

Laws and Zoning Restrictions

Zoning laws differ widely across municipalities and directly dictate where short-term and long-term rentals are permitted. Many cities impose restrictions or outright bans on short-term rentals in residential zones to address concerns such as noise, neighborhood disruption, and housing availability. For example, some locations require properties to be located in commercial or mixed-use zones to qualify for short-term rental approval. Conversely, long-term rentals generally face fewer zoning hurdles since they align with traditional residential use, but investors must ensure compliance with occupancy limits and building codes to avoid legal issues.

Licensing and Permit Requirements

Operating a short-term rental often requires securing special permits or licenses, such as transient occupancy permits or business licenses tailored to short-term hospitality services. These permits may entail inspections, fees, and compliance with health and safety regulations, increasing setup and ongoing costs. Long-term rentals typically involve landlord registration with local authorities or housing departments but usually lack the extensive licensing demands placed on short-term operators.

Tax Obligations and Compliance

Tax regulations present another vital consideration. Short-term rental income may be subject to transient occupancy taxes, hotel taxes, or other local levies in addition to standard income tax obligations. Investors must stay updated on filing requirements to avoid penalties and factor these taxes into net income projections. Long-term rental income is usually classified as passive rental income and taxed accordingly, with landlords able to deduct expenses like depreciation, maintenance, and mortgage interest.

Additionally, changes in tax laws affecting depreciation schedules, capital gains, or 1031 exchanges can influence the attractiveness of either rental strategy. Staying informed on evolving tax codes and consulting with real estate tax professionals is crucial to optimize after-tax returns.

Understanding and proactively managing these legal and regulatory factors empowers investors to avoid costly compliance pitfalls while tailoring their rental strategy to local market realities. Whether focusing on long-term or short-term rentals, thorough due diligence on jurisdiction-specific requirements forms the foundation of a legally sound and profitable real estate investment portfolio.

Image courtesy of RDNE Stock project

Financial Metrics and ROI Analysis: Comparing Long-Term vs Short-Term Rental Strategies

A critical piece in mastering rental property investing is understanding and comparing key financial metrics such as cap rates, gross rental yields, appreciation potential, and the impact of financing structure on both long-term and short-term rental strategies. These metrics provide a quantifiable basis for evaluating expected returns, risk levels, and cash flow sustainability, empowering investors to make informed decisions tailored to their wealth-building goals.

Cap Rates and Gross Rental Yields

Capitalization rate (cap rate), calculated as the ratio of net operating income to property purchase price, is often lower for short-term rentals due to higher operating expenses like frequent maintenance, cleaning, and property management fees. However, the gross rental yield—the annual rental income divided by property value—can be substantially higher in short-term rentals because of premium nightly rates and potential for dynamic pricing during peak seasons. Conversely, long-term rentals typically exhibit steadier but comparatively modest yields, benefitting from lower vacancy rates and operating costs.

| Financial Metric | Long-Term Rentals | Short-Term Rentals |

|---|---|---|

| Cap Rate | Moderate (5%-8%) | Often lower due to higher expenses (3%-6%) |

| Gross Rental Yield | Stable 6%-10% | Higher potential (8%-15%+) but variable |

| Operating Expenses | Lower, predictable | Higher, includes cleaning, utilities, marketing |

| Vacancy Impact | Minimal impact due to longer leases | Higher vacancy risk lowers effective yield |

Appreciation Potential and Market Dynamics

Both long-term and short-term rental properties can benefit from property appreciation, yet their market dynamics differ. Long-term rentals in stable or growing neighborhoods often experience consistent property value increases driven by demand for steady housing. Short-term rental markets, frequently located in tourist or commercial hubs, may see accelerated appreciation in booming travel regions but can also be more susceptible to regulatory shifts or tourism downturns. Therefore, assessing local market appreciation trends is essential when choosing between strategies.

Impact of Financing Structure on ROI

Financing plays a pivotal role in shaping rental investment returns. Long-term rentals often qualify for conventional residential or commercial mortgages with favorable interest rates and terms, facilitating higher leverage and steady debt service coverage ratios. Short-term rentals, classified sometimes as commercial or hospitality properties by lenders, may face stricter financing criteria, higher down payments, and increased interest rates, which can erode cash flow benefits despite higher gross income. Investors should factor in the cost of capital, loan-to-value ratios, and debt coverage ratios when projecting ROI across rental models.

By meticulously analyzing these financial metrics, investors can contrast the relative profitability and risk profiles of long-term versus short-term rentals. This quantitative perspective, combined with operational and market considerations, refines strategy selection focused on maximizing return on investment and achieving sustainable real estate wealth.

Image courtesy of Jakub Zerdzicki

Tax Implications and Benefits: Long-Term vs Short-Term Rental Strategies

When structuring your rental property investments for long-term wealth, understanding the tax implications and benefits of long-term versus short-term rental strategies is paramount. Both rental types offer opportunities to optimize your tax situation through deductible expenses, depreciation, and strategic income reporting, but they differ substantially in how taxable income is treated and the scope of allowable deductions.

Tax Advantages and Deductible Expenses

Regardless of rental type, landlords can deduct several critical expenses that reduce taxable income, including:

- Mortgage interest

- Property taxes

- Insurance premiums

- Repairs and maintenance costs

- Property management fees

- Utilities (especially in short-term rentals where landlords often cover these)

- Marketing and advertising expenses

However, short-term rentals tend to incur higher operational expenses related to frequent turnover, cleaning, and guest services, which can lead to increased deductions in these categories. In contrast, long-term rentals usually have steadier, more predictable expenses focused on routine maintenance and tenant management.

Depreciation Benefits

Both rental strategies benefit significantly from depreciation deductions, allowing investors to recover the cost of the property (excluding land) over time, typically across 27.5 years for residential and 39 years for commercial properties. Depreciation is a non-cash deduction that improves cash flow by lowering taxable income without decreasing actual cash in hand, making it a powerful tax advantage in real estate.

Investors should note that certain short-term rental properties, especially if they provide substantial services similar to hotels (e.g., daily cleaning, concierge), might be classified differently and subject to alternative depreciation schedules or even considered self-employment income, affecting how depreciation and expenses apply.

Differential Treatment of Income

Long-term rental income is generally classified as passive rental income, which may be offset by passive losses and subject to favorable tax treatment under IRS rules. This income is reported on Schedule E, and many investors benefit from the ability to deduct losses against other passive income, potentially sheltering additional earnings from taxes.

In contrast, short-term rental income can be treated differently depending on your rental days and personal use:

- If you rent the property for fewer than 15 days per year, the income may be tax-free.

- If your short-term rental activity rises to a substantial level of services (akin to a hospitality business), IRS rules might categorize it as non-passive or even self-employment income, subjecting you to higher tax rates and self-employment taxes.

- Active management and provision of services may allow you to qualify as a real estate professional, unlocking additional tax benefits like unlimited deductibility of losses, which long-term rental landlords may not easily access.

Strategic Tax Planning

To maximize tax efficiency:

- Keep meticulous records of all expenses and categorize them properly.

- Consult a tax professional experienced in both long-term and short-term rental tax codes to structure your holdings advantageously.

- Consider how depreciation recapture and capital gains taxes apply when selling the property, as short-term rentals with more active use may face different tax consequences.

- Leverage 1031 exchanges where possible to defer capital gains taxes and recycle investment gains into larger portfolios.

By thoroughly understanding these tax implications, investors can not only enhance after-tax cash flow but also tailor their rental strategy to align with long-term wealth-building objectives, optimizing returns whether they choose the stability of long-term leases or the higher income potential of short-term rentals.

Image courtesy of Jakub Zerdzicki

Risk Management and Exit Strategies: Safeguarding Your Investment and Flexibility in Rental Approaches

Effective risk management is crucial for both long-term and short-term rental property investors aiming to protect their assets and ensure sustainable income streams amid market fluctuations and operational uncertainties. Key risks include market volatility, tenant defaults, property damage, and evolving regulatory landscapes, each demanding proactive strategies tailored to your chosen rental model.

Managing Market Fluctuations and Vacancy Risks

Both rental strategies face exposure to economic cycles and local market dynamics. Long-term rentals benefit from lease agreements that lock in rental income, providing some buffer against short-term market dips. However, prolonged economic downturns can lead to increased tenant defaults or vacancy periods. Investors should maintain conservative underwriting assumptions and build cash reserves to cover unexpected vacancies or reduced rental payments.

Short-term rentals, while offering higher income potential, are more sensitive to seasonality, tourism trends, and economic shocks—such as travel restrictions or downturns—that can rapidly diminish occupancy rates. Employing dynamic pricing tools, diversifying marketing platforms, and targeting varied guest demographics can help mitigate these risks. Additionally, continuously monitoring local regulations that may impact short-term rental operations is vital to avoiding sudden legal restrictions.

Tenant Defaults and Property Damage Prevention

Tenant reliability is a common concern in both rental models but manifests differently:

-

Long-Term Rentals: Rigorous tenant screening using credit checks, employment verification, and references is essential to minimize default risk and property neglect over multi-year leases. Robust lease agreements with clear clauses on maintenance responsibilities and penalties for breach help protect landlords.

-

Short-Term Rentals: While guest stays are short, frequent turnover can increase the likelihood of property damage or rule violations. Leveraging platform safeguards such as security deposits, guest reviews, and insurance coverage designed for short-term rentals is critical. Investing in smart home technology (e.g., noise detectors, security cameras) and clearly communicating house rules reduce potential damages and neighborhood complaints.

Flexible Exit and Strategy Switching Approaches

A major advantage of rental property investing is the ability to adapt your rental strategy over time to align with changing market conditions or personal goals. Building flexibility into your business plan can include:

- Converting a property from short-term to long-term rental during off-peak seasons or regulatory constraints.

- Using hybrid models, such as renting portions of commercial or multi-family properties short-term while securing long-term tenants for other units.

- Incorporating an exit strategy that accounts for market timing, allowing you to sell or refinance when property appreciation or cash flow targets are met.

Preparing for exit scenarios through clear financial planning, maintaining property condition, and understanding local resale markets empowers you to maximize asset value and pivot rental approaches without distress.

By adopting comprehensive risk management practices and maintaining versatile exit and strategy-switching plans, investors can safeguard their portfolios against uncertainties and capitalize on evolving real estate opportunities. This strategic agility ultimately supports resilient, long-term wealth creation in both residential and commercial rental property investing.

Image courtesy of Jakub Zerdzicki

Case Studies: Success Stories and Pitfalls in Long-Term and Short-Term Rental Investing

Real-world examples provide invaluable insights into how investors have navigated the challenges and leveraged the advantages of long-term and short-term rental strategies to build substantial wealth. Examining these case studies highlights practical lessons that can inform your investment decisions.

Long-Term Rental Success Story: Stability Through Strategic Tenant Selection

An investor in a mid-sized city purchased a 10-unit multifamily residential building primarily catering to working professionals and families. By implementing rigorous tenant screening and maintaining competitive but fair rental rates, the investor achieved near 100% occupancy over five years. This consistent cash flow allowed steady loan repayments while building equity through property appreciation. Crucially, the investor reinvested a portion of rental income into proactive maintenance and property upgrades, which attracted high-quality tenants and reduced turnover costs.

Lessons learned:

- Prioritize thorough tenant vetting to reduce vacancies and defaults.

- Maintain property quality to enhance tenant retention.

- Long-term rentals demand patience but provide predictable income conducive to gradual wealth accumulation.

Short-Term Rental Success Story: Maximizing Revenue with Market Timing and Technology

A property owner in a popular tourist destination transformed a two-bedroom condo into a short-term rental listed on multiple platforms like Airbnb and VRBO. By using dynamic pricing tools to adjust nightly rates based on demand spikes during festivals and holidays, the investor tripled typical long-term rental income. Engaging a professional short-term rental property manager streamlined guest communications and housekeeping, maintaining a 90%+ annual occupancy rate. However, the investor remained agile, converting the unit to seasonal long-term leases during off-peak months to minimize vacancy risks.

Lessons learned:

- Employ technology and professional management to optimize occupancy and guest experience.

- Understand and leverage seasonal trends to maximize income.

- Flexibility to switch between short-term and longer leases can buffer against market downturns.

Pitfalls to Avoid: Regulatory Oversight and Operational Overextension

- Ignoring Local Regulations: One short-term rental investor faced hefty fines and forced listing removal due to non-compliance with city rules requiring registration and transient occupancy permits. This resulted in significant lost income and legal fees.

- Underestimating Management Demands: A long-term landlord underestimated the time required for tenant communications and maintenance, leading to neglected repairs, multiple expirations of leases without renewal, and increased turnover. This reduced cash flow and increased vacancy duration.

- Overleveraging Investments: Some investors leveraged up aggressively on short-term rentals, assuming continuous high occupancy. However, market shifts and travel disruptions led to sharp income drops and difficulties meeting mortgage obligations.

By studying these examples, investors can appreciate that success in both rental models relies on thorough market research, proactive management, legal compliance, and flexible strategies. Learning from both triumphs and failures reduces risk and accelerates your path toward building sustainable rental property wealth.

Image courtesy of Jakub Zerdzicki

Choosing the Right Strategy for Your Investment Goals

Selecting between long-term and short-term rental strategies ultimately hinges on your specific investment objectives, risk tolerance, and desired lifestyle integration. Employing a clear decision-making framework tailored to these goals can steer you toward the most profitable and manageable rental model. Consider these key investor priorities to align your strategy effectively:

1. Prioritizing Consistent Cash Flow and Stability

If your primary goal is stable, predictable income with minimal operational hassles, long-term rentals are generally the best fit. They offer:

- Reliable monthly rental payments secured by leases spanning six months to several years.

- Reduced tenant turnover translating to lower vacancy rates and operational interruptions.

- Easier property management with less frequent tenant screening and maintenance demands.

This strategy suits investors seeking to steadily build equity while benefiting from lower management intensity. It is particularly advantageous for those who prefer passive income streams or are balancing investing with other commitments.

2. Maximizing Capital Appreciation and Higher Returns

For investors aiming to maximize short-term income potential and capitalize on market cycles, short-term rentals can substantially boost cash flow thanks to premium nightly rates and dynamic pricing models. Key considerations include:

- Locations with high tourism, business travel, or event-driven demand to sustain occupancy.

- Willingness to engage in active property management or professional service coordination.

- Ability to navigate fluctuating income streams subject to seasonality and market trends.

Short-term rentals appeal to those eager to leverage market timing, use technology-driven pricing strategies, and optimize revenue in dynamic environments.

3. Integrating Lifestyle and Personal Use Flexibility

If you desire to combine personal use of your property with investment purposes, short-term rental models often provide superior flexibility:

- Renting on a nightly or weekly basis allows you to block off dates for your own stays.

- Mixed-use scheduling supports lifestyle goals like vacation home ownership while generating income when unused.

- Hybrid strategies, such as alternating between short-term and long-term leases seasonally, can tailor cash flow to your life rhythms.

Conversely, long-term rentals generally restrict personal use due to continuous tenant occupancy but promote more straightforward income modeling.

By assessing your priorities across these dimensions—cash flow stability, return maximization, and lifestyle integration—you can confidently determine which rental approach aligns with your long-term wealth-building plan. This targeted selection mitigates risks and enhances operational efficiency, setting a solid foundation for success in either residential or commercial real estate investing.

Image courtesy of Jakub Zerdzicki