Long-Term vs Short-Term Rental Strategies for Investors

Category: Real Estate Investing

Understanding Long-Term vs Short-Term Rental Strategies

For savvy real estate investors, choosing between long-term and short-term rental strategies can be a game-changer in building sustainable wealth. Whether you're a novice investor just starting out or a seasoned property owner looking to optimize your portfolio, understanding the distinct benefits and challenges of each rental model is critical. You’ve likely scoured countless resources seeking clear, actionable advice without the fluff—this post cuts through the noise to help you decide which strategy aligns with your financial goals, risk tolerance, and management capacity. We’ll break down key factors such as cash flow, market volatility, maintenance demands, and tax implications, providing you practical insights tailored for both residential and commercial properties. This detailed comparison isn’t just theoretical; it’s designed to equip you with decision-making clarity so you can maximize returns while minimizing headaches. Read on to learn which rental strategy could be your most powerful tool for long-term wealth accumulation.

- Understanding Long-Term vs Short-Term Rental Strategies

- Definitions and Key Differences: Long-Term vs Short-Term Rentals

- Financial Overview: Long-Term vs Short-Term Rental Income and Stability

- Market Dynamics and Demand Trends: Influencing Success in Rental Strategies

- Management Complexity and Operational Requirements: Evaluating Effort, Costs, Tenant Turnover, and Maintenance for Both Strategies

- Regulatory and Legal Considerations: Navigating Laws, Zoning, Licensing, and Tax Implications

- Risk Factors and Mitigation Strategies: Vacancy, Damage, Income Fluctuations, and Economic Cycles

- Tax Benefits and Implications: Navigating Deductions, Depreciation, and Reporting Differences

- Investment Time Horizon and Scalability: Aligning Rental Strategies with Portfolio Growth

- Technology and Platforms Impact: Revolutionizing Short-Term Rentals vs. Traditional Leasing

- Case Studies and Decision Framework: Real-World Successes and How to Choose Your Optimal Rental Strategy

Definitions and Key Differences: Long-Term vs Short-Term Rentals

When diving into rental property investing, it’s essential to clearly understand what sets long-term rentals apart from short-term rentals, especially as these distinctions impact income predictability, management intensity, and legal considerations.

Long-term rentals are leases that typically span six months to a year or more, involving tenants who commit to residing in the property on a continuous basis. This strategy is common for residential properties such as single-family homes, apartment units, and condominiums, as well as certain commercial spaces leased to businesses on extended contracts. For example, a family renting a three-bedroom home for a year or a retailer leasing a storefront with a five-year agreement represents typical long-term rental scenarios. The emphasis here is on stable, predictable occupancy and steady cash flow.

In contrast, short-term rentals involve leasing properties for brief periods, often days to weeks, catering primarily to vacationers, business travelers, or temporary occupants. Residential examples include Airbnb or vacation rental apartments, while commercial short-term rentals can include event spaces or temporary office hubs. These rentals demand active management and rapidly changing occupancy but benefit from potentially higher per-night rates and flexibility in adjusting pricing according to market demand.

| Aspect | Long-Term Rentals | Short-Term Rentals |

|---|---|---|

| Lease Duration | 6+ months | Days to weeks |

| Tenant Type | Stable residents/businesses | Tourists, transient workers, event attendees |

| Property Examples | Single-family homes, apartments, retail storefronts | Vacation homes, short-term office spaces |

| Income Stability | Predictable monthly rent | Variable, seasonal or event-driven income |

| Management Intensity | Lower, periodic upkeep | Higher, frequent cleaning and guest communication |

By grasping these fundamental distinctions, investors can better match rental strategies to their portfolio goals—whether seeking the consistent cash flow of long-term tenants or the dynamic earnings potential and flexibility of short-term rentals.

Image courtesy of Louie Alma

Financial Overview: Long-Term vs Short-Term Rental Income and Stability

When evaluating long-term versus short-term rental strategies, a thorough financial overview is key to understanding how each impacts your portfolio’s income stability, cash flow predictability, average rental yields, and occupancy rates. These metrics directly influence your investment’s resilience and growth potential in both residential and commercial real estate markets.

Income Stability and Cash Flow Predictability

Long-term rentals typically provide steady and predictable monthly income due to fixed lease agreements ranging from six months to multiple years. This income stability reduces the risk of sudden vacancy losses and allows for easier financial planning. With long-term tenants, rent is generally paid monthly, creating a reliable cash flow stream that supports consistent mortgage payments and operational expenses. This makes long-term rentals especially attractive for investors prioritizing low-risk cash flow management over maximizing short-term profits.

In contrast, short-term rentals exhibit variable and often seasonal income patterns, influenced by demand fluctuations, location popularity, and event-driven market spikes. While nightly rates can be substantially higher than monthly equivalents, short-term rentals experience more frequent vacancies and unbooked days. Consequently, cash flow can be less predictable, requiring investors to maintain higher cash reserves to cover off-peak periods, maintenance, and marketing costs. The upside is the ability to dynamically adjust pricing based on market trends, potentially increasing yields when managed effectively.

Average Rental Yields and Occupancy Rates

Rental yields generally differ between strategies:

| Metric | Long-Term Rentals | Short-Term Rentals |

|---|---|---|

| Average Rental Yield | Typically 4-8% annually, stable | Higher potential, often 8-12%+ |

| Occupancy Rates | Relatively high, ~90-95% | Variable, 60-80% depending on season and location |

Long-term rentals benefit from high occupancy rates due to longer lease terms and less tenant turnover. This results in minimal income interruptions but usually caps rental yield growth due to market rent ceiling constraints. Conversely, short-term rentals can command premium nightly rates that increase yields dramatically in high-demand areas, but their income reliability depends heavily on maintaining strong occupancy through marketing, competitive pricing, and excellent guest experiences.

Key Financial Considerations

- Reserve Requirements: Short-term rental owners should budget for higher reserves to cover vacancy risks, cleaning, and frequent repairs.

- Operational Costs: Short-term rentals incur more expenses in property management, utilities, furnishing, and platform fees.

- Market Sensitivity: Short-term income is more sensitive to external factors such as travel restrictions, local regulations, and seasonal tourism trends.

- Financing and Valuation: Long-term rentals often qualify for traditional financing with predictable income considered a favorable factor during underwriting, while short-term rentals may face stricter loan scrutiny due to income variability.

Understanding these financial nuances helps investors tailor their rental strategy to align with risk tolerance and cash flow expectations, whether prioritizing stable monthly income through long-term leases or maximizing return potential via short-term rental flexibility.

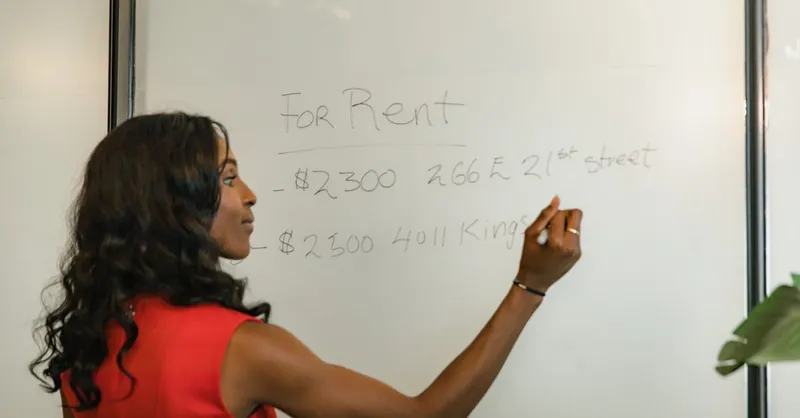

Image courtesy of Jakub Zerdzicki

Market Dynamics and Demand Trends: Influencing Success in Rental Strategies

Successful rental property investing hinges not only on selecting a long-term or short-term rental model, but also on understanding the market dynamics and demand trends that significantly impact each strategy's profitability. Factors such as tourist demand, local regulations, and demographic shifts shape occupancy rates, rental pricing, and operational feasibility, making market analysis indispensable for maximizing returns.

Tourist Demand and Seasonal Trends

Short-term rentals thrive in locations with strong tourism appeal and high visitor turnover—beaches, urban centers, and entertainment hubs, for example. These properties benefit from seasonal peaks when demand surges due to holidays, festivals, or conventions, allowing investors to charge premium nightly rates. However, off-peak seasons can lead to reduced occupancy and inconsistent cash flow. Conversely, long-term rentals experience less pronounced seasonal fluctuations because they target residents or businesses seeking year-round occupancy, offering consistent demand independent of tourism cycles.

Local Regulations and Compliance

Local laws and zoning regulations profoundly affect the viability of short-term rentals. Many cities impose restrictions such as license requirements, limits on rental duration, or outright bans to address concerns about housing affordability and neighborhood disruption. These regulations can increase operational complexity and risk, sometimes making long-term rentals a safer, more compliant option. Meanwhile, long-term rentals generally face fewer regulatory hurdles but must still comply with landlord-tenant laws, fair housing regulations, and possibly commercial leasing statutes depending on property type.

Demographic and Economic Shifts

Changes in population demographics and economic conditions shape rental demand across both strategies. For instance, areas experiencing job growth and population influx typically see rising demand and rental prices in both long-term and short-term markets. Millennials and remote workers have driven increased demand for flexible, furnished rentals, often favoring short-term stays. Conversely, aging populations or regions with declining employment might see more stable demand for affordable long-term housing rather than short-term units. Investors should track local employment trends, migration patterns, and urban development plans to anticipate shifts influencing tenant profiles and rental preferences.

Key Market Factors at a Glance

| Market Factor | Impact on Long-Term Rentals | Impact on Short-Term Rentals |

|---|---|---|

| Tourist & Event Demand | Minimal direct impact | Critical for high occupancy and premium rates |

| Regulatory Environment | Stable but subject to landlord-tenant laws | Often highly restrictive and evolving |

| Demographic Trends | Drives steady demand for residential/commercial leases | Influences demand for flexible, short-term accommodations |

| Economic Fluctuations | Moderate influence on tenant retention | High sensitivity impacting booking volumes |

For investors, aligning rental strategies with these market realities is essential. Targeting the right geographic locations and demographic segments, monitoring evolving regulations, and capitalizing on demand cycles can significantly enhance the long-term success of either rental model. A proactive approach to analyzing market dynamics and demand trends will position your rental portfolio to adapt and thrive amid changing conditions in both residential and commercial real estate sectors.

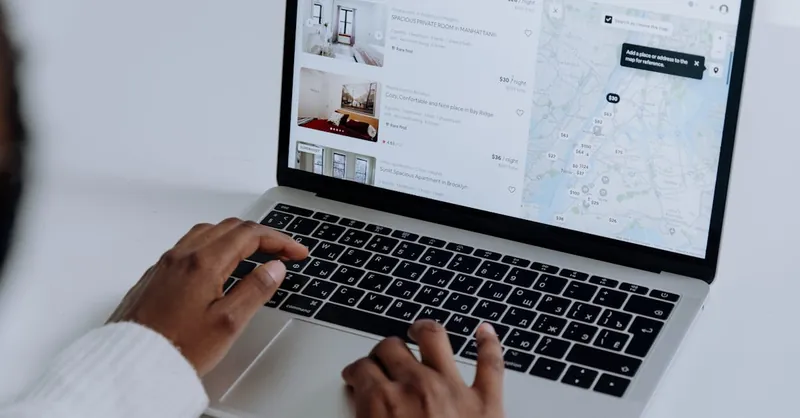

Image courtesy of La Ville Nouvelle

Management Complexity and Operational Requirements: Evaluating Effort, Costs, Tenant Turnover, and Maintenance for Both Strategies

When deciding between long-term and short-term rental strategies, understanding the differences in management complexity and operational demands is crucial for optimizing profitability and minimizing stress. Each approach carries distinct responsibilities that directly affect your time commitment, ongoing expenses, tenant turnover rates, and maintenance needs.

Long-Term Rentals: Lower Turnover but Steady Property Upkeep

Long-term rentals typically offer a more predictable management framework. With tenants occupying the property for six months or more, turnover is lower, reducing the frequency and associated costs of tenant screening, marketing, and unit preparation. This stability contributes to lower operational effort and more streamlined accounting, making it easier to manage multiple properties simultaneously.

However, long-term rentals still require regular maintenance and upkeep to ensure tenant satisfaction and compliance with habitability standards. Common tasks include:

- Routine inspections and repairs

- Addressing tenant maintenance requests within a reasonable timeframe

- Managing lease renewals and rent collection

- Complying with local landlord-tenant regulations

While tenants generally handle daily upkeep, landlords must budget for periodic maintenance costs and potential vacancy periods, which, though less frequent, can be financially impactful if poorly managed.

Short-Term Rentals: High Management Intensity and Dynamic Operational Demands

In contrast, short-term rentals demand significantly more intensive management due to high tenant turnover, frequent bookings, and guest expectations for hotel-like experiences. Key operational challenges include:

- Coordinating cleaning and property turnover between guests, often on tight schedules

- Handling guest communication and booking inquiries 24/7 to maximize occupancy and ratings

- Managing dynamic pricing strategies to respond to demand fluctuations and events

- Investing in durable furnishings and frequent repairs due to heavier wear and tear

- Complying with additional licensing, tax collection, and safety regulations unique to short-term rentals

These factors elevate both time and monetary costs associated with short-term rentals, making them more labor- and service-intensive. Many successful investors mitigate this complexity by outsourcing to professional property management companies or leveraging automated tools for booking, guest messaging, and cleaning coordination.

Tips for Efficient Rental Property Management

Regardless of your chosen strategy, these best practices can improve operational efficiency and reduce costs:

- Leverage technology: Use property management software tailored to your rental type for automating rent collection, booking management, and maintenance tracking.

- Set clear tenant/guest expectations: Detailed lease agreements and house rules minimize misunderstandings and reduce conflicts.

- Conduct thorough screening: For long-term rentals, robust tenant vetting decreases late payments and evictions; for short-term, verifying guest identities and reviews boosts security.

- Schedule regular maintenance: Proactive upkeep prevents costly emergency repairs and maintains property value.

- Consider professional management: Outsourcing management can enhance guest experiences for short-term rentals and streamline operations for larger long-term rental portfolios.

By realistically assessing management complexity, operational requirements, and associated costs, you can better align your rental strategy with your capacity and investment goals. While long-term rentals offer more predictable and lower-effort management, short-term rentals promise higher income but require hands-on, dynamic operational skills or reliance on expert managers for optimal results.

Image courtesy of Kindel Media

Regulatory and Legal Considerations: Navigating Laws, Zoning, Licensing, and Tax Implications

When choosing between long-term and short-term rental strategies, a clear understanding of the regulatory and legal landscape is essential to ensure compliance and protect your investment. The viability and profitability of each rental model are heavily influenced by local laws, zoning restrictions, licensing requirements, and differing tax treatments. Ignoring these factors can result in hefty fines, forced vacancy, or costly legal disputes.

Common Legal Frameworks Impacting Rental Properties

Both long-term and short-term rentals operate under distinct legal frameworks:

-

Landlord-Tenant Laws: These govern rights and responsibilities in long-term leases, including eviction procedures, security deposit rules, rent control, and habitability standards. Long-term rentals generally benefit from well-established regulations that provide a measure of predictability, though they vary significantly by state and municipality.

-

Zoning and Use Restrictions: Many jurisdictions regulate property use through zoning laws that can restrict or prohibit short-term rentals in residential neighborhoods. Short-term rentals may require specific zoning approval or be limited to certain districts, especially in urban or historic areas.

-

Licensing and Permits: Short-term rentals often require special business licenses, registration with local authorities, or adherence to occupancy limits and safety inspections. Conversely, long-term rentals usually do not require additional licensing beyond standard property registration.

-

Tax Treatment Differences: Tax implications for rental income differ by rental type. Long-term rentals typically classify income as passive rental income, subject to standard deductions for expenses and depreciation. Short-term rentals may be treated more like a business, especially if frequent services are provided (cleaning, concierge), which can have implications for self-employment taxes, sales tax collection, and allowable deductions.

Key Regulatory and Tax Considerations

| Factor | Long-Term Rentals | Short-Term Rentals |

|---|---|---|

| Zoning Restrictions | Usually allowed in residential and commercial zones | Frequently restricted or banned in certain zones |

| Licensing Requirements | Minimal or none beyond standard property registration | Often requires short-term rental permits or licenses |

| Landlord-Tenant Protections | Strong tenant protections impacting eviction and rent control | Varies; some jurisdictions apply fewer protections to short-term guests |

| Tax Reporting & Compliance | Rental income reported on Schedule E, deductible expenses allowed | May require collecting and remitting transient occupancy taxes; potential business tax filings |

| Legal Risks | Eviction delays and tenant disputes common, but process is standardized | Risks include fines for unlicensed renting, zoning violations, liability claims for short-term guests |

Practical Tips for Regulatory Compliance

To safeguard your rental investment and optimize operational efficiency, consider these best practices:

- Research Local Ordinances: Check city and county regulations before choosing your rental strategy, focusing on zoning laws, rental caps, and licensing rules.

- Obtain Necessary Permits: Secure all required licenses or permits upfront for short-term rentals to avoid penalties.

- Maintain Proper Documentation: Keep meticulous records of leases, licenses, tax filings, and communications with local authorities.

- Consult Professionals: Engage real estate attorneys and tax advisors to navigate complex legal and tax issues unique to your rental type.

Understanding and adapting to the regulatory environment and tax treatment differences between long-term and short-term rentals not only prevents costly non-compliance but also supports sustainable wealth building through rental property investing. Smart investors integrate these legal considerations early in their strategy to align investment decisions with evolving laws and maximize long-term profitability.

Image courtesy of Artful Homes

Risk Factors and Mitigation Strategies: Vacancy, Damage, Income Fluctuations, and Economic Cycles

Investing in rental properties inherently involves various risk factors that can impact profitability and long-term wealth accumulation, whether you pursue long-term or short-term rental strategies. A clear understanding of these risks and proactive mitigation steps is essential to protect your investment and maintain steady cash flow.

Key Risk Factors

- Vacancy Risk:

- Long-term rentals face potential vacancy periods primarily between tenant leases, which may last weeks to months depending on market competitiveness and tenant turnover.

-

Short-term rentals experience higher vacancy risk due to fluctuating demand, seasonal trends, and event-driven occupancy, often resulting in unpredictable gaps between bookings.

-

Property Damage and Maintenance:

- Long-term tenants typically cause less frequent wear and tear but damages can accumulate over prolonged stays if not addressed timely.

-

Short-term rentals encounter accelerated wear and tear due to high guest turnover, increasing maintenance frequency and repair costs.

-

Income Fluctuations:

- Income from long-term rentals tends to be stable but can be affected by tenant delinquency or lease non-renewals.

-

Short-term rental income is more volatile due to seasonal demand, local events, or external shocks such as travel restrictions.

-

Economic Cycles and Market Volatility:

- Economic downturns can reduce tenant affordability in long-term rentals, leading to higher vacancy or rent concessions.

- Short-term rentals may suffer from decreases in tourism and business travel during recessions or public health crises, magnifying income instability.

Effective Mitigation Strategies

To safeguard your rental portfolio against these risks, consider the following best practices:

- Thorough Tenant and Guest Screening: Implement rigorous background checks for long-term tenants and use reputable short-term booking platforms with guest reviews and identity verification to reduce damage and default risks.

- Adequate Insurance Coverage: Carry comprehensive property and liability insurance tailored to your rental type, including coverage for short-term guests or commercial use as applicable.

- Maintain a Financial Reserve: Set aside cash reserves to cover vacancy periods, emergency repairs, and seasonal income slumps—typically 3-6 months of operating expenses for long-term rentals and a larger buffer for short-term rentals.

- Regular Property Inspections and Preventive Maintenance: Schedule routine inspections to detect issues early and invest in durable furnishings or upgrades that reduce long-term maintenance costs, especially important for short-term rental properties.

- Dynamic Pricing and Marketing Strategies: For short-term rentals, leverage automated pricing tools and targeted marketing to optimize occupancy and maximize revenue during low-demand periods. For long-term rentals, competitive pricing aligned with market trends can minimize vacancy durations.

- Diversify Your Rental Portfolio: Spread investment across different property types, locations, or rental strategies to reduce exposure to localized economic downturns or regulatory changes that affect a single market segment.

By identifying these risk factors upfront and implementing comprehensive mitigation strategies, investors can stabilize rental income streams and preserve property value, ensuring a resilient approach to both long-term and short-term rental investing. This risk-aware mindset is fundamental for achieving consistent wealth growth through residential and commercial real estate.

Image courtesy of RDNE Stock project

Tax Benefits and Implications: Navigating Deductions, Depreciation, and Reporting Differences

Understanding the tax advantages and implications of long-term versus short-term rental strategies is crucial for maximizing your after-tax returns and building sustainable wealth in real estate investing. Both models offer valuable tax deductions and depreciation opportunities, but they differ significantly in how income is reported and what expenses are deductible, influencing overall profitability and tax planning.

Tax Advantages Shared by Both Rental Types

Whether managing long-term or short-term rentals, investors can generally benefit from:

- Depreciation Deductions: You can depreciate the value of the building (excluding land) over 27.5 years for residential properties or 39 years for commercial properties, reducing taxable income by spreading out the cost basis.

- Operating Expense Deductions: Expenses directly related to the rental property, such as mortgage interest, property taxes, insurance, repairs, utilities, and property management fees, are deductible against rental income.

- Passive Activity Losses: For most investors, rental activities are considered passive, allowing some losses to offset other passive income or be carried forward to future tax years.

Key Tax Differences Between Long-Term and Short-Term Rentals

| Tax Aspect | Long-Term Rentals | Short-Term Rentals |

|---|---|---|

| Income Reporting | Reported as rental income on IRS Schedule E | May be reported on Schedule E or Schedule C if services rendered are substantial |

| Self-Employment Tax | Generally not subject to self-employment tax | If short-term rentals provide significant services (e.g., cleaning, concierge), income may be subject to self-employment tax |

| Depreciation | Fully applicable, straightforward | Same as long-term, but property use allocation may matter if partial personal use occurs |

| Deductible Expenses | Standard operating expenses and depreciation | Similar expenses allowed; additional costs for frequent cleaning and guest services are deductible |

| Occupancy Threshold | No minimum occupancy requirement affecting tax treatment | If rented fewer than 15 days annually, rental income may be tax-free; over 14 days, normal rental rules apply |

Practical Tax Considerations for Investors

-

Short-Term Rental Business Classification:

If your short-term rental operation involves considerable services or frequent tenant turnover, the IRS may classify it as a business rather than passive rental activity. This reclassification impacts tax reporting and could expose income to self-employment taxes but also potentially allows for broader business expense deductions. -

Record-Keeping and Expense Allocation:

Accurate and detailed record-keeping is critical, especially for short-term rentals, to separate deductible business expenses from personal use. For mixed-use properties, allocate expenses proportionally based on rental days versus personal occupancy. -

Transient Occupancy Taxes (TOT):

Many municipalities require short-term rental owners to collect and remit transient occupancy or lodging taxes. Though not a direct federal tax benefit, compliance avoids penalties and adds a layer of tax-related responsibility unique to short-term rentals. -

Depreciation Recapture:

When you sell your rental property, accumulated depreciation deductions can trigger recapture tax, taxed at a maximum rate of 25%. Proper tax planning can help mitigate this impact through strategies such as 1031 exchanges.

Optimizing your rental property’s tax position requires a thorough understanding of how tax laws apply differently to long-term and short-term rentals. Engaging with a qualified tax professional familiar with real estate investing is highly recommended to tailor deductions, depreciation schedules, and reporting methods that best suit your rental strategy, ultimately enhancing your wealth-building outcomes.

Image courtesy of Ivan Samkov

Investment Time Horizon and Scalability: Aligning Rental Strategies with Portfolio Growth

Selecting the right rental strategy depends heavily on your investment time horizon and your goals for scaling your real estate portfolio over the short, medium, and long term. Both long-term and short-term rentals offer distinct advantages and challenges when viewed through the lenses of time commitment, passive income generation, and business expansion—especially across residential and commercial real estate sectors.

Short-Term Horizons and Initial Scalability

For investors aiming at quick cash flow and rapid portfolio expansion, short-term rentals can deliver higher immediate returns due to premium nightly rates and dynamic pricing capabilities. This strategy fits well within a short- to medium-term investment horizon, where investors seek to capitalize on strong tourist or business travel demand to accelerate cash flow generation. Residential short-term rentals, such as Airbnb units in high-traffic urban or vacation destinations, often allow for fast scalability by purchasing multiple smaller, easily manageable properties or leveraging turnkey furnished units.

However, scaling short-term rentals often requires a significant operational infrastructure—whether via technology platforms, outsourced property management, or on-the-ground teams—to maintain high occupancy and service quality. In the commercial real estate realm, short-term leases like flexible office spaces or event venues can scale through partnerships and co-working concepts but demand tailored marketing and robust customer engagement.

Long-Term Investment and Sustainable Growth

Conversely, long-term rentals align more naturally with medium- to long-term portfolio strategies aimed at stable wealth accumulation through predictable cash flow and property appreciation. Residential long-term rental properties, including single-family homes and multifamily buildings, provide consistent income streams, facilitating easier financing and reinvestment. This steady cash flow and lower management intensity enable investors to scale gradually, adding properties strategically over time with less operational complexity.

In commercial real estate, long-term leases—often spanning multiple years—offer durable tenant relationships and income security that appeal to investors focused on building a recession-resilient portfolio. While scaling typically requires larger capital commitments and more extensive due diligence, the long-term model supports portfolio diversification into various commercial asset classes such as retail, industrial, and office spaces.

Scalability Considerations Across Residential vs. Commercial Real Estate

| Aspect | Residential Short-Term Rentals | Residential Long-Term Rentals | Commercial Short-Term Rentals | Commercial Long-Term Rentals |

|---|---|---|---|---|

| Typical Investment Horizon | Short to medium-term | Medium to long-term | Short to medium-term | Long-term |

| Operational Complexity | High (frequent turnover, guest services) | Moderate (tenant relationships, maintenance) | High (client turnover, event coordination) | Moderate to low (long-term tenant management) |

| Scaling Potential | Rapid scaling via multiple units, tech-enabled | Gradual expansion with stable cash flow | Niche opportunities, dependent on location | Larger capital needed, stable portfolio growth |

| Management Intensity | Intensive; often requires outsourcing | Lower; manageable in-house or with minimal help | Intensive; requires specialized management | Lower; can be streamlined through property managers |

Investors should carefully assess their available resources, tolerance for operational demands, and investment timeframe when choosing between these strategies. While short-term rentals can fast-track income and portfolio size, the long-term rental model delivers scalability rooted in stability and predictability, often translating into less volatile growth and stronger financing options.

By aligning your rental strategy with your investment time horizon and scalability objectives, you position your residential or commercial real estate portfolio for sustainable growth tailored to your wealth-building goals.

Image courtesy of Jakub Zerdzicki

Technology and Platforms Impact: Revolutionizing Short-Term Rentals vs. Traditional Leasing

Advancements in technology and digital platforms have fundamentally reshaped the landscape of rental property investing, particularly influencing the feasibility and attractiveness of short-term rental strategies compared to traditional long-term leasing. Sophisticated rental marketplaces, property management software, and automation tools now enable investors to manage operations more efficiently, increase occupancy rates, and optimize rental income with unprecedented precision.

Rental Marketplaces: Expanding Reach and Booking Efficiency

The rise of platforms like Airbnb, Vrbo, and Booking.com has democratized short-term rentals by connecting property owners instantly with global travelers. These marketplaces provide powerful tools to showcase listings with professional photos, detailed descriptions, and dynamic pricing algorithms that adjust nightly rates based on demand, seasonality, and local events. This visibility and flexibility allow investors to maximize revenue potential, outperforming static pricing models common in long-term rentals.

Additionally, these platforms offer built-in payment processing, guest vetting, and review systems, which reduce risk and facilitate trust between hosts and guests. In contrast, traditional long-term rentals typically rely on local advertising, broker listings, or property management firms for tenant sourcing, which can limit reach and prolong vacancy periods.

Property Management Software and Automation Tools: Streamlining Operations

Managing short-term rentals once demanded intensive, hands-on effort, but emerging property management systems (PMS) and automation tools have significantly lowered the barrier to entry. Solutions like Guesty, Hostaway, and Lodgify integrate channel management, calendar synchronization, guest communication, and financial reporting into centralized dashboards. This automation helps investors:

- Coordinate cleaning and maintenance schedules automatically between bookings

- Send timely check-in instructions and responsive guest messaging

- Implement dynamic pricing strategies with data-driven insights

- Track and manage multiple listings across platforms without double-booking

For long-term rentals, software such as Buildium, AppFolio, or Rentec Direct simplify processes like online rent collection, lease management, maintenance requests, and tenant screening but generally do not support the rapid turnover and service demands inherent in short-term rentals.

Impact on Feasibility and Investment Strategy

The technological ecosystem supporting short-term rentals reduces operational complexity and labor costs, enabling even smaller investors to scale short-term rental portfolios efficiently. This has expanded the viability of short-term rentals beyond traditional vacation hotspots into urban and suburban markets where demand for flexible accommodations is rising. However, these advantages also come with increased scrutiny from regulators and more dynamic competition.

Conversely, long-term rentals benefit from technology that optimizes tenant management and expense tracking, but their business model remains more passive and less dependent on rapid technological innovation. Investors prioritizing stable cash flow and lower management intensity may find long-term rentals more suitable, while those seeking high-yield, flexible income streams can leverage technology to unlock the full potential of short-term rentals.

In summary, leveraging cutting-edge rental marketplaces and property management software is increasingly essential for investors aiming to thrive in the evolving rental property market. Understanding how technology influences occupancy rates, income optimization, and operational efficiency empowers investors to make data-driven decisions tailored to their chosen rental strategy, whether long-term or short-term.

Image courtesy of cottonbro studio

Case Studies and Decision Framework: Real-World Successes and How to Choose Your Optimal Rental Strategy

Understanding how investors successfully deploy long-term and short-term rental strategies in real-world scenarios provides invaluable insights for shaping your own approach to rental property investing. Equally important is a practical decision framework that helps you evaluate which strategy aligns best with your unique financial goals, risk tolerance, and operational capacity.

Real-World Case Studies: Success Stories from Both Strategies

-

Long-Term Rental Success: The Stable Cash Flow Builder

Jane, a residential real estate investor in a growing metropolitan area, built a portfolio of single-family homes leased to long-term tenants. By focusing on properties near quality schools and employment centers, she secured tenants who signed multi-year leases, minimizing turnover and vacancy. Jane’s portfolio generated steady monthly income that allowed her to comfortably service debt, reinvest in additional properties, and benefit from property appreciation over time. This long-term strategy suited her risk-averse profile and preference for hands-off management, demonstrating how stability and predictability can lead to consistent wealth accumulation. -

Short-Term Rental Triumph: Maximizing Revenue Through Market Cycles

Mike ventured into short-term rentals by acquiring vacation properties in a popular tourist destination. Leveraging dynamic pricing models and professional property management services, he capitalized on peak travel seasons and special events to achieve nightly rates far exceeding equivalent long-term rents. Although higher operational intensity was required, Mike’s active management and savvy use of technology platforms allowed him to maintain high occupancy rates year-round. His approach unlocked accelerated cash flow and positioned his portfolio for rapid scalability, showcasing how flexibility and market timing can amplify returns in short-term rentals.

Practical Decision Framework: Choosing Your Best Rental Strategy

To determine whether a long-term or short-term rental strategy best fits your investing style and goals, apply this decision framework:

| Criteria | Consider Long-Term Rentals If... | Consider Short-Term Rentals If... |

|---|---|---|

| Goal | You prioritize stable, predictable income over high volatility | You aim for higher yields and faster cash flow growth |

| Risk Tolerance | You prefer lower risk with consistent occupancy | You can manage income fluctuations and operational complexity |

| Management Capacity | You want lower hands-on involvement or minimal management | You are willing to invest time or outsource active management |

| Market Characteristics | Your location supports strong, stable rental demand | Your market has robust tourism, events, or transient demand |

| Regulatory Environment | Long-term rentals face fewer zoning or licensing restrictions | You can navigate or comply with short-term rental regulations |

| Investment Horizon | You have a medium to long-term outlook for asset growth | You seek short to medium-term cash flow and portfolio scalability |

Applying this framework alongside a thorough analysis of your local real estate market, financing options, and personal circumstances empowers you to select the rental strategy that delivers the best balance of profitability, stability, and scalability.

By studying proven investor successes and using a structured decision-making approach, you can confidently tailor your rental property investments to harness the distinct advantages of either long-term or short-term strategies, enhancing your path to building long-term wealth in residential and commercial real estate.

Image courtesy of Jakub Zerdzicki